Legal Trust Accounting Software

Tracking Made Easy

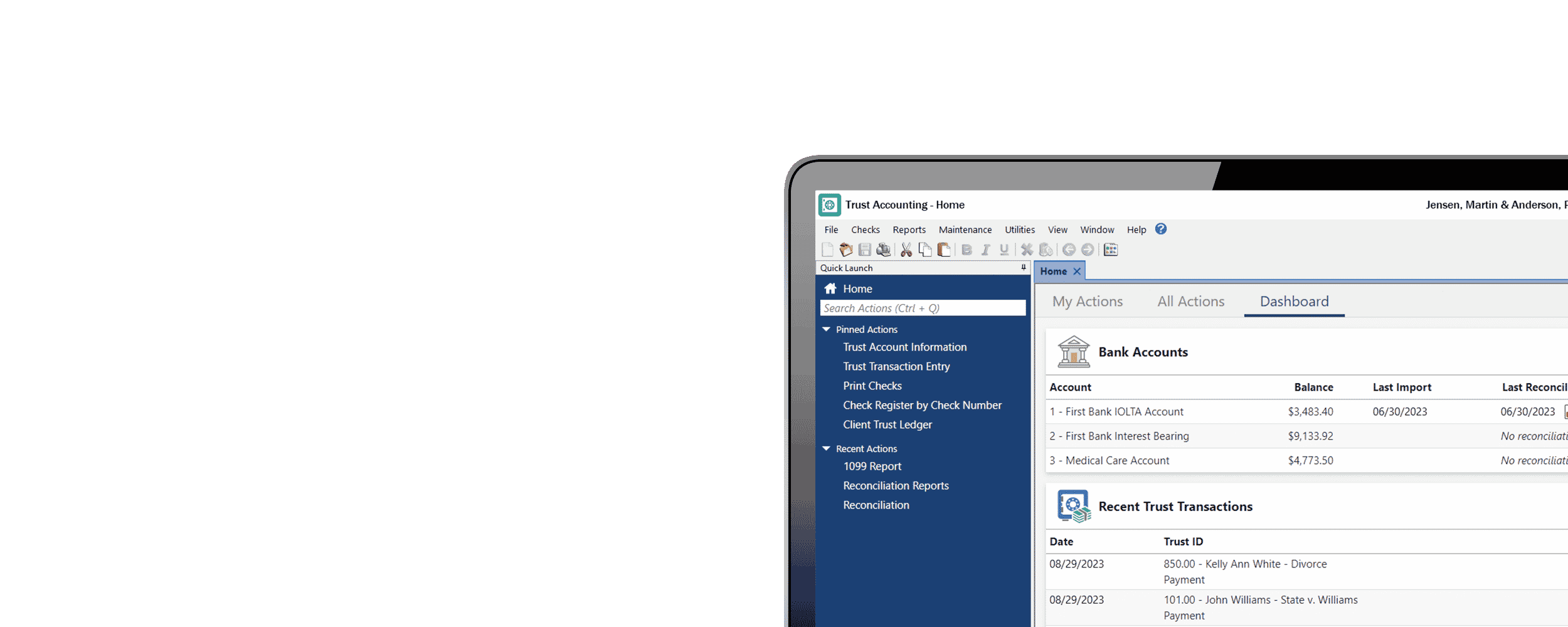

Using the Tabs3 Trust Accounting Dashboard, you can easily stay on top of your Trust Account bank balances and quickly monitor any recent activity at a glance.

3-Way Reconciliation and More

The 3-Way Reconciliation Report helps you stay compliant when balancing your accounts. Not only that, but Tabs3 Trust Accounting has a wide range of reports that can be customized to fit your needs.

Stay Secure with Positive Pay

Trust Accounting includes a Positive Pay Export program that allows you to export a list of all approved checks that can then be uploaded to your bank or financial institution’s fraud prevention program.

Accept Deposits Made by Credit Card

The best way to accept credit card deposits for your firm is with Tabs3Pay. Make deposits to trust accounts through a secure payment portal.

FAQ

What is Trust Accounting Software and how does it benefit law firms?

Law firms must comply with the rules for managing clients’ trust funds in their jurisdictions. Trust Accounting Software is one of the most effective ways to maintain this compliance. Tabs3’s Trust Accounting Software ensures that all financial transactions related to trust accounts are accurately recorded and monitored. By utilizing Trust Accounting Software, law firms can gain peace of mind knowing that they are maintaining compliance and providing clients with the utmost transparency and accuracy in managing their funds.

Does Tabs3 Trust Accounting Software provide me with 1099s for tax reporting?

Yes, 1099s can be prepared either by your Firm as a payer, or by the Trust Account holder as payer. When your firm is the payer, 1099 information can be combined with your accounts payable information to create a combined 1099 form or electronic file.

Read more: Prepping for Tax Season: Form 1099 Basics for Law Firms.

Can trust accounting activity appear on my Tabs3 client statement?

Yes. Statements can show just the Trust Account balance as of the statement date, all of the activity between the previous and current statement date, or no Trust Account information. You can also request a replenishment of trust Funds if the account drops below the recommended balance.

Can Tabs3 Trust Accounting tell me if I go below a minimum trust balance?

Yes. When creating a transaction in Tabs3 Trust Accounting, you will be notified if you fall below the minimum balance. Replenishment of Trust Account balances can also automatically show on clients’ statements.

Can I see a consolidated trust ledger for all of my firm’s trust accounts?

Tabs3 Trust Accounting can print ledgers showing the activity for each Trust Account, or print a combined ledger showing all activity for each bank account. Additionally, a Three-way report can be run after reconciling to demonstrate that the sum of the Trust Accounts matches the activity on the Bank Account plus any outstanding activity.

Is there a limit to the number of bank accounts I can use for my trust accounts?

Tabs3 Trust Accounting is limited to 99 Bank Accounts. Keep in mind that you can assign as many clients as necessary to each bank account so this should not pose a problem for most firms.

Is there a limit to the number of trust accounts I can track?

Tabs3 Trust Accounting does not limit the number of Trust Accounts you can track.

What are the benefits of a subscription plan?

Even the best legal billing software requires support and updates over time. A Subscription Plan provides you with free technical support, software updates, and substantial discounts on upgrading Tabs3 Software to allow more users or gain more features. A Subscription Plan is required to use Tabs3 Software.

Can I accept credit card payments for trust deposits?

Yes, the best way to accept credit cards for your firm is with Tabs3Pay. You will have the ability to authorize credit card and eCheck trust deposits directly in Trust Accounting.

Our bank provides the ability to download bank transactions. Can we import them into Trust?

Trust can import bank transactions in .OFX, .QFX, and .QBO file formats, which many banks support. Information about importing bank transactions can be found in KB Article R11504, “Importing Data into Trust.”

Our bank wants us to integrate with a check fraud program, like Positive Pay. Can Trust generate a list of approved checks for this purpose?

Positive Pay is available in Trust version 2020 and later. For information regarding Positive Pay, see KB Article R11833, “Exporting checks Using Positive Pay.”

Our Trust Bank Account accrues interest and incurs bank charges. Can I deposit or withdraw money from the bank account without affecting any of my Trust Accounts?

Yes. Simply set up a new Trust Account for each bank account and call it the “Administrative Account.” When you need to enter these types of transactions without affecting any of the other Trust Account balances, enter the transactions using the Administrative Trust Account for the bank account. These transactions can be created using the Interest and Service Charge fields in the Reconciliation Settings window.

Can I move money from one Trust Account to another without writing a check?

Yes, you can use Electronic Funds Transfer (EFT) transactions to move money between Trust Accounts. Simply enter an EFT for the amount you want to transfer using the account from which you want to transfer the money. You can then enter a negative EFT for the same amount using the account to which you want to transfer the money to add it to that account. Using a negative EFT instead of a deposit allows the total of the deposit transactions to match the total deposits on the bank statement.

Can Trust Accounting automatically apply a client's Trust balance to the amount due on their Tabs3 Billing statement?

Yes, Trust Accounting includes an Automatic Trust Payments feature that allows Tabs3 Billing to automatically generate a Payment to the Firm when generating final statements in Tabs3 Billing. Configuration settings at the firm level, the bank account level, and the trust account level allow for detailed customization of automatic payment settings. You can easily choose whether to pay current work only, accounts receivable only, or both. Payments can be made for specific transaction types or multiple transaction types.

If I am integrating Tabs3 Billing with Trust, do I have to add the client to Tabs3 Billing before I can make the initial deposit into Trust?

No. Trust Account information and the Tabs3 Billing client information is stored in a shared data file. When a client is added in Tabs3 Billing, the client information will automatically be available in the Trust Account Information window, and vice versa. A bank account must be associated with the Trust Account before Trust transactions can be entered.