When your invoicing system is working against you, every month is spooky season. Struggling with the billing function and the impact on profitability can be downright chilling. Too many firms are caught in a web of scary billing problems, but you can break free by avoiding these seven mistakes.

1. Late time entry

Why it is scary: Time capture is one of the legal industry’s biggest challenges. Legal professionals understand its importance, but every minute spent composing a fee entry is time away from client matters.

Being pulled in both directions takes a toll. Time gets lost because it is not entered contemporaneously. When the bills absolutely must go out, everyone scrambles to enter time and approve draft invoices. Bills may go out late as a result, extending the time it takes to get paid. Workflow and cash flow suffer.

Late time entry is usually caused by:

- Difficult and/or labor-intensive time entry process.

- Workflows and processes that do not support contemporaneous time tracking.

- Law firm culture relating to the importance of time entry.

How to vanquish it: Clear policies about time entry, with strong support from leadership, are crucial. Those policies should be backed up with easy-to-use, mobile-friendly time entry software, so that timekeepers can quickly enter time without interrupting their workflows.

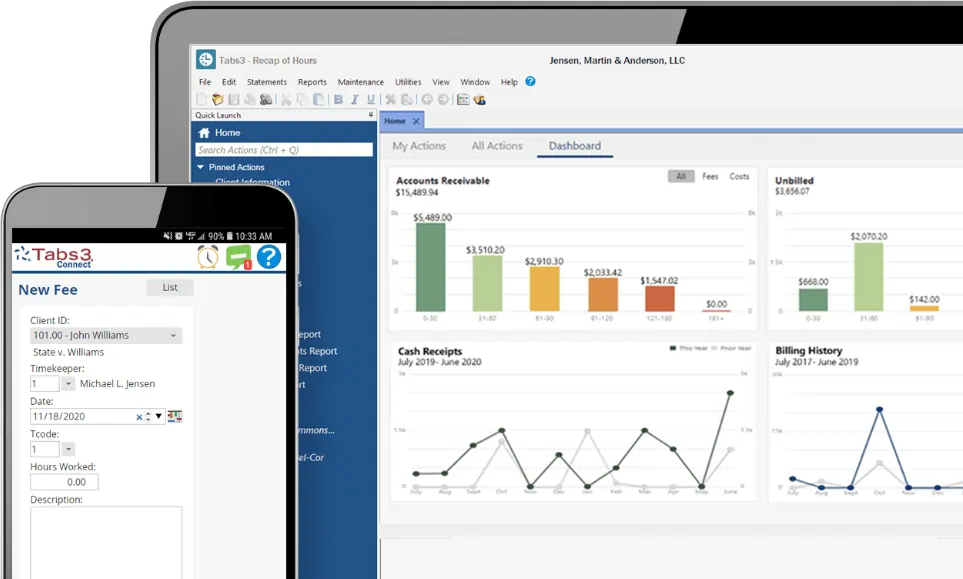

Tabs3 Cloud includes Tabs3 Billing, which allows timekeepers to securely record time in seconds from any browser: smartphone, tablet, laptop, or desktop.

2. Irregular billing cycles

Why it is scary: Ad hoc invoicing can seem like a time-saver, especially for matters with flat fees, retainers, and long timelines. But it creates more problems than it solves, like:

- More work collecting bills because clients are not accustomed to a regular billing cadence and the work you are billing for has faded in the client’s memory.

- More time managing clients because they are not getting regular reminders (in the form of invoices with descriptive fee narratives) about the work you are doing for them.

- More headaches with invoice approval because timekeepers’ memories are no longer fresh.

- Less efficiency in the billing function because of unpredictable spikes in billing and collections work.

- Irregular cash flow and potentially non-compliant trust accounting if client funds are not moved to the operating account timely.

How to vanquish it: The best practice is to invoice monthly. For alternative fee or retainer matters, your invoice is an opportunity to remind the client that you are working on their matter and that finances are settled monthly. For hourly work, monthly invoices keep clients’ financial obligations top of mind, keep cash flowing, and promote efficient billing.

Tabs3 Billing makes monthly invoicing easy. It can accommodate virtually any fee agreement and remembers your settings so invoices are automatically filled in with the correct information, including time entries. You can even complete your internal statement approval process (pre-billing) electronically.

Ready to transform your law firm’s billing process? Schedule a personalized demo and discover how Tabs3 Cloud can transform your firm in one complete practice management solution.

3. Vague or unclear fee narratives

Why it is scary: Ambiguous, fragmentary, or unclear fee entries make bills harder to collect and clients harder to manage. That is true even in flat fee cases where you do not provide a full hourly breakdown. Consider that:

- Many business clients will outright reject block billing or items with inadequate fee narratives.

- Individuals are less likely to pay promptly and remain engaged in their cases when they do not understand what is happening.

- Flat fee clients are more likely to question the reasonableness of your fee when they do not receive regular descriptions of the work you are doing on their behalf.

How to vanquish it: Firms should prohibit block billing and adopt general standards for fee narratives, as well as tracking any client- or matter-specific narrative requirements. Take advantage of any tools available in your software to reduce the time it takes to enter and revise narratives.

In Tabs3 Billing, you can set up macros to spell out common terms or phrases, so you can enter a fee with fewer keystrokes. And by handling pre-billing electronically, you can avoid mistakes caused by misinterpretation of handwritten narratives.

4. Leaving costs unbilled

Why it is scary: Too many firms absorb costs that should be billed to the client or integrated into rates. This cuts into profitability, especially in times where costs are rising. Costs include advanced costs like deposition costs, travel, medical records, and filing fees, as well as overhead expenses like making copies and legal research tool fees.

How to vanquish it: The way you approach this problem depends on your practice, your clients, and most importantly on your fee agreements. Options to consider include:

- Billing for every cost including the portion of overhead expenses. This approach requires careful recordkeeping, so it can increase timekeeper and accounting workloads. Some clients may perceive it as “nickel-and-diming.” Others expect itemized costs.

- Charging a flat monthly file maintenance fee. (Larger advanced costs would need to be billed separately.) This method might reduce recordkeeping burden, and some clients may appreciate knowing what the costs would be. Other clients may be sensitive to paying a set amount even in a month when costs are comparatively low.

- Including overhead costs in rates and billing for larger advanced costs. This works for hourly or flat rates, may reduce recordkeeping burden somewhat, and does not create a line item on the bill. It is still important, however, to track overhead costs so you can account for them when setting and reviewing rates.

Tabs3 Billing lets you decide how to handle cost recovery. You can include it in the bill, add a monthly fee, or simply track costs for internal firm use. The platform includes a suite of reports that can help you understand how costs impact profitability so you can set appropriate rates.

5. Missing or duplicated items

Why it is scary: Accidentally billing the same fee or cost twice, or billing fees/costs that look the same, can erode client trust in your firm. Failing to bill fees or costs timely may force you to “catch up” with a bill that is larger than a client expects. If clients complain, you may be under pressure to write down or write off bills that you would otherwise have been able to collect in full.

How to vanquish it: To avoid duplicated or similar charges, review your statement approval process and your firm policies about fee and cost entry narratives. Narratives should allow the client to distinguish between entries. You can catch missing or misattributed time and costs by reviewing reports regularly.

You can do both things with Tabs3 Billing. For example, you can lock down all time entries included on a draft statement to make sure no unexpected changes are made before the bill is issued. Flexible reports make it simple to generate and deliver reports, including aging WIP, at the timekeeper, practice, and firm level.

👉 Want to learn more about Tabs3 Cloud? Schedule a demo today!

6. All-paper billing process

Why it is scary: Too many firms still handle pre-billing on paper. Paper-based processes limit where and when approvers can work, and they reduce visibility into the status of approvals.

Handwritten statement revisions create additional problems. The billing function wastes time puzzling out handwriting and re-entering data, while the timekeeper worries about being misinterpreted.

How to vanquish it: Shift to paperless pre-billing. With modern software, approvers can review pre-bills on desktop, laptop, or mobile devices, directly revising errors and making notes for billing clerks. The billing clerk can quickly finalize and send the bill, speeding up your cash flow.

Tabs3 Billing users can choose between paper-based pre-billing and electronic pre-bills. The electronic process is flexible, so you can find the approach that is best for your firm.

7. Limited bill delivery options

Why it is scary: Many clients prefer to receive invoices via email. Firms that do not offer a digital option may be wasting time, paper, and postage, in addition to client goodwill.

You may also be slowing down your revenue cycle. Consider the time it takes to open a letter, read an invoice, track down the checkbook, write a check, find a stamp, and put the payment in the mail, versus opening an email with an electronic payment link.

How to vanquish it: Most firms can benefit from offering email invoices as an option, and you may discover digital should be the default for your client base. Make sure to include electronic payment options so clients can opt to pay faster.

Tabs3 Billing makes emailing invoices simple and comes with a growing suite of electronic payment options for clients who choose digital payments.

Tabs3 Cloud: Turn tricky billing into a monthly treat

Halloween levity aside, you can make your billing process easier and more effective with all the Tabs3 Billing features found in Tabs3 Cloud. It includes powerful financial management tools:

- Invoice and collect payments faster

- Accept electronic payments securely

- Manage your trust account, accounts payable, and general ledger

- Access Tabs3 from your desktop, laptop, tablet, or smartphone

Next month, we will talk about how to improve your collections so you can keep the revenue cycle spinning.

Ready to learn more? Demo Tabs3 Cloud today.

Ready to transform your law firm’s billing process? Schedule a personalized demo and discover how Tabs3 Cloud can transform your firm in one complete practice management solution.