Your law firm is taking stock of 2025 accomplishments and preparing for a prosperous 2026. It is the perfect time to reflect on your marketing and intake processes, too. Are they driving the qualified leads and new engagements you need without draining resources needed elsewhere?

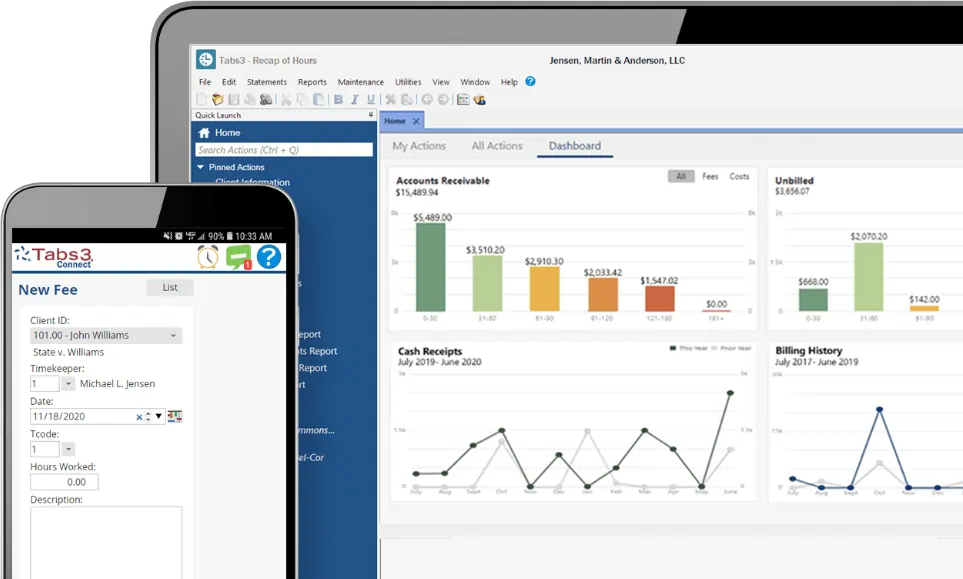

For many small and midsize law firms, marketing and intake can become an overwhelming task for already-overcommitted teams. Tabs3 Websites along with Tabs3 CRM and PracticeMaster in Tabs3 Cloud can reduce that burden. Working together, they can help you land more well-qualified clients and reduce the costs of onboarding them.

👉 Is your current website underperforming? Check out the The Ultimate Website Audit Checklist.

Start here: Take stock of your current approach

Talk with your team about what is going well and identify opportunities for improvement. Here are three prompts to get the conversation started.

1. All digital roads lead to your website. Is it persuading qualified leads to contact you?

Paid ads, search engines, AI search, social media, billboards, word-of-mouth… no matter how you get leads, your website is the front door of your law firm. It should showcase your expertise, convince qualified leads that your firm is the right choice, and make it easy to contact you. When it does, your website becomes a multiplier on your other marketing investments. If it does not, however, your website can actually negate other marketing efforts.

2. How do you move and track each lead through your intake workflow?

If you are not able to qualify leads and complete intake quickly, potential clients will keep shopping and may engage with another firm. Most firms need a visual intake workflow tracker that is accessible to all relevant staff. Automations can speed up the process, too.

3. Once the engagement letter is signed, how long does it take to transfer the client to your practice management system?

Opening a new file can become a practice bottleneck because it takes time to move the new client’s data from your intake systems to your matter management systems. Are you wasting time doing double data entry? Are you losing data you previously collected?

Ready to transform your law firm’s billing process? Schedule a personalized demo and discover how Tabs3 Cloud can transform your firm in one complete practice management solution.

Tabs3 Websites builds high-performing websites

Effective websites can be a challenge to create and maintain. You need to keep pace with technological updates, messaging shifts, practice area changes, and staffing adjustments. It is also important to add fresh content to your website regularly. That ongoing workload can be a serious capacity drain for small or midsize firms.

Tabs3 Websites can take those tasks off your plate. This affordable package includes:

- Sleek, modern design that looks great on mobile or desktop.

- 10 pages of content about your law firm, plus up to 3 FAQ pages for key practice areas. All pages are updated quarterly to keep your content fresh.

- SEO that keeps up with changing search practices.

- Secure hosting: bank-grade SSL security, spam protection, firewalls, and backups.

This product also gives you access to important client management tools.

- Convenient online bill payment that can boost customer satisfaction and reduce the resources you spend collecting invoices.

- Online intake forms that help you qualify and sign leads faster.

- A secure client portal so you can safely share documents like engagement agreements.

Tabs3 CRM integrates with your Tabs3 Website

Tabs3 CRM is a legal client relationship management tool (CRM) you can add on to PracticeMaster in Tabs3 Cloud. It helps you sign more qualified leads by tracking their journey through the intake workflow and storing potential client data centrally, where all intake staff can act on it. It can also speed up your intake process.

- Automatically import data from your Tabs3 Website, like pre-screening forms.

- Text or email custom forms, like intake questionnaires, to new leads automatically. Forms can use logic to adjust on the fly, revealing only relevant questions.

- Text or email completed forms to your intake personnel.

- Send automated texts or emails to leads, like intake appointment reminders.

- Create text or email nurture sequences for different segments of your prospect list.

Tabs3 CRM also feeds data to PracticeMaster

Once the engagement letter is signed, you can share the client’s information from Tabs3 CRM to PracticeMaster as a new matter. There is no need to re-type anything, which can speed up your file-opening workflow.

Level up your legal marketing with Tabs3

Many small and midsize law firms struggle to allocate resources between marketing, intake, and client service. With Tabs3 Websites and the Tabs3 CRM add-on for PracticeMaster in Tabs3 Cloud, you can spend more time on billable work and less time landing and onboarding new clients. Sign up for a free Tabs3 Websites or Tabs3 CRM demo today.

Ready to transform your law firm’s billing process? Schedule a personalized demo and discover how Tabs3 Cloud can transform your firm in one complete practice management solution.

The close of the calendar year is a natural time to mull over the past year and plan for the next. Planning, however, can be a challenge when law firms are operating within a fluid economic environment, including shifting economic policies, rising inflation, and increasing pressure around technology adoption.

To prosper in 2026, firms must strike a balance between rigorous fundamentals and adaptive resilience. Taking stock in the following five areas can help you find that balance.

👉 Want to learn more about the benefits of Tabs3Pay? Schedule a demo today!

1. Your business model and processes

Ask yourself: will our business model allow us to adapt rapidly to market changes? Proactively diversifying aspects of your practice can help mitigate risk.

- Practice areas and subspecialties. If your firm serves clients in multiple practice areas, you may be in a better position to shift gears if a practice area contracts. If you specialize in a single area, it may be feasible to add a new subspecialty or adjacent service so you are less dependent on that line of work.

- Types of engagements. Accepting only one type of engagement, like lengthy litigation matters, can lock you into a rigid revenue cycle. Taking stock of opportunities to add other services, like retainer cases, can improve cash flow.

- Fee arrangements. Many firms are using value-based pricing, milestone pricing, and other alternative fee models. Alternative fee agreements can offer more financial certainty for you, and clients may also prefer them. You can leverage historical time data to set fees that accurately reflect the effort you are likely to expend.

Take the time to reinforce the operational fundamentals that create a solid foundation for your firm: policies, procedures, and workflows.

- Time entry. Review your fee entry procedures and workflows for possible improvements. If you have not established guidelines on fee narratives, now may be a good time to do so. In addition to meeting clients’ billing requirements, the fee narrative is a chance to speed up collection by describing the work in a way the client understands and values.

- Invoicing/statements. It is important to send statements on a regular cadence (usually monthly) for all fee structures. Regular invoicing can keep you top of mind for clients and makes collections easier. For alternative fee matters and longer legal processes, monthly statements can reassure clients that their matter is progressing.

- Collections. Cash flow is always critical for small and midsized firms, and that goes double in uncertain times. By doing a bit of collections work each month, instead of a major push once a year, you may collect more rapidly, and even collect more overall. If you frequently struggle with collections, consider implementing evergreen retainers and structuring engagements so you can withdraw if the retainer is not refilled on time. You can also make it more convenient for clients to pay by offering electronic payment options, including Venmo and PayPal Pay Later.

- Trust accounting. Make sure your written procedures and cross-checks are up to date. If you accept electronic payments (which can help you collect more efficiently), make sure you choose a platform that handles the trust and operating accounts appropriately.

- Workflows. The end of the year is a great time to take stock of the workflows that go along with every matter, like intake, conflict checking, and file opening. Getting these everyday processes dialed in prepares you to pivot on other issues.

Tabs3 Cloud Tip: The curated library of reports in Tabs3 Billing can help you understand your case mix better and set fees that protect your bottom line. It also makes time entry, statement creation, collections, and trust accounting easier. Tabs3Pay allows you to accept electronic payments and also gives your clients the option to pay in installments, all while maintaining trust compliance and PCI-compliant, bank-grade security.

Ready to transform your law firm’s billing process? Schedule a personalized demo and discover how Tabs3 Cloud can transform your firm in one complete practice management solution.

2. Your business development

Your network helps keep your firm steady in shifting economic winds. Taking stock of your business development practices now can position you to build stronger relationships in 2026.

Business development is about one-on-one relationships, unlike legal marketing, which focuses on reaching a larger audience. With business development, you are not necessarily selling your services explicitly, although you may do some sales pitches. More generally, however, you are nurturing relationships so that your firm naturally comes to mind when a legal need arises.

A few business development avenues to consider for 2026:

- State bar and industry associations. Attending industry events offers double benefits: you stay up-to-date in your practice areas while meeting new people and renewing old connections. If you struggle with small talk, volunteer for a project or a leadership position that allows you to work with others in a more structured way.

- Small, consistent interactions. A regular practice of reaching out to contacts who might hire you or refer work can pay dividends in new work. To get started, set a goal of contacting one person each week.

- Volunteering and pro bono. Finding volunteer work that you enjoy can help you build a stronger, broader community, and help your business by generating future referrals. It can also make your work life feel more meaningful.

Tabs3 Cloud Tip: PracticeMaster’s powerful docket management features can help you fit business development work into your schedule. Tabs3 CRM, a PracticeMaster add-on, can track your business development contacts and information you need to remember about them, like birthdays and anniversaries.

3. Your professional development

Professional development can help you shore up foundational skills and up-skill for greater flexibility. Professional development overlaps with business development work as well; in some cases, you may be able to do both at once.

- Required CLE and legal events. By choosing events and CLE strategically, you can refresh on foundations like collection techniques, explore new practice areas, and keep up to date on technology changes. Further, when you attend in person, you create an opportunity for low-pressure networking and business development.

- Non-legal conferences and events. While these may not offer CLE credit, they can deepen your industry knowledge. That could help you diversify your matter mix, and the new connections you make can bolster business development efforts.

- Teaching and speaking. Preparing for a speech or workshop requires you to engage with your areas of expertise in new ways. You can grow your expertise while raising your profile in the industry.

Tabs3 Cloud tip: PracticeMaster’s docket management features are helpful in this area too. You can track expenses the firm reimburses in Tabs3 Financials so you are ready for tax time.

4. Your digital presence

It is a good idea to update your LinkedIn profile, your website, your bio, and other social media profiles at least annually. As you meet new people throughout the year, you want your web presence to reflect your current services and positioning.

- Awards, rankings, and publications. Start by reviewing the awards, rankings, and publications currently listed. If your list is long, you may want to select a smaller grouping closely related to your current matter mix. Then add new, relevant honors not yet listed.

- Matter examples. If your firm shares blurbs about matter resolutions on its website, prune existing examples and add new ones at least annually. You may also want to check for any updates to your state bar’s advertising rules.

- Social proof. If appropriate to your practice area and depending on your state’s ethical rules, you might add testimonials to your website and/or social media. Make sure to review public comments on Yelp or similar sites regularly.

Tabs3 Tips: Tabs3 Websites updates your website quarterly to keep content fresh.

5. Your law firm’s technology

Is your firm’s technology working for you? A solid, scalable tech stack can set you up for success when the landscape shifts. Reflecting on how things are going and scan for new tools that might benefit you.

- Marketing. Tracking performance of your marketing tactics is critical, and year-end can be a good time to look at the larger picture. Tech tools can help you implement your marketing strategy in less time and track performance more easily.

- Time entry and billing. Your technology should make it simpler for timekeepers to enter time contemporaneously and meet all time entry deadlines. If that is not happening, look for problems with your current tech in addition to workflow issues.

- Trust accounting and financials. Managing trust accounting without appropriate technology creates unnecessary ethical risks. Check in with the accounting function to identify areas for improvement.

- Practice management. Does your technology ease the workflow, or does it add more steps? Practice management software can automate repetitive tasks and centralize matter information so everyone is on the same page.

Tabs3 Cloud Tip: Tabs3 Cloud has solutions for every aspect of law practice management. Tabs3 Websites can make your marketing efforts more effective. Tabs3 Billing and Tabs3 Financials can simplify time entry, billing, trust accounting, accounts payable, and general ledger. PracticeMaster and its add-on, Tabs3 CRM, can streamline your client journey from first contact to file closure.

Prosper In Every Economic Climate with Tabs3 Cloud

With a full suite of law practice management products, Tabs3 Cloud creates a strong foundation for your law firm and makes quick pivots possible. As you take stock for 2026, consider Tabs3 Cloud as a partner in achieving your firm’s goals. Schedule a free demo today.

Ready to transform your law firm’s billing process? Schedule a personalized demo and discover how Tabs3 Cloud can transform your firm in one complete practice management solution.

When your law firm’s clients cannot pay their bills, everyone loses. Your business is in a bind. The client’s access to legal services is at risk. PayPal Pay Later offers a new solution: instant payment for your firm and manageable monthly payments for your clients. It is available now in Tabs3Pay, part of Tabs3 Billing in Tabs3 Cloud.

👉 Want to learn more about the benefits of Tabs3Pay? Schedule a demo today!

What is Pay Later?

PayPal’s Pay Later is a short-term loan between your client and PayPal: your law firm gets paid immediately, and then the client pays PayPal back over time. Pay Later offers transparent payment terms with no hidden fees. All payment issues are handled by Pay Later.

If your firm already has Tabs3 Billing in Tabs3 Cloud, you can add Pay Later to Tabs3Pay with just a few steps. If you are a new user, you can include Pay Later right from the start.

How does Pay Later benefit my clients?

Legal clients are often caught between the need for legal help and the strain of paying upfront legal fees. At the same time, law firms must collect fees to remain financially viable. Pay Later can help bridge the gap.

Overall, use of buy now, pay later products like Pay Later has expanded rapidly since 2020. Compared to traditional credit cards, these products generally use a soft credit pull (which does not affect the client’s credit score), are easier to get approved for, and may have lower fees. Especially for people with lower credit scores, particularly women and younger people, buy now, pay later offers greater access to credit than was previously available.

By allowing your clients to choose Pay Later, you can improve access to legal services without putting your business at risk. Clients can pay in manageable installments, while your firm gets paid immediately.

Ready to transform your law firm’s billing process? Schedule a personalized demo and discover how Tabs3 Cloud can transform your firm in one complete practice management solution.

How does Pay Later benefit my law firm?

Pay Later can help you serve more clients while reducing your administrative workload and financial risk. That includes:

- Stronger cash flow, because bills are paid faster

- Less time managing accounts receivable

- Better differentiation from competitors that require lump sum payments

- More success in signing up qualified leads

Is Pay Later ethical for law firms?

Pay Later does not raise any new ethical issues. Law firms have been accepting payments from buy now, pay later lenders for years. Buy now, pay later regulatory activity has focused on lenders, not the businesses that accept payments from them.

Of course, law firms have an ethical duty to conduct due diligence before adopting any electronic payment platform, like making sure the tool is PCI compliant and secure, and that it interfaces appropriately with trust and operating accounts. Law firms should also consult local rules, including those related to surcharging, when setting up a payments platform.

Tabs3Pay is a highly secure, PCI compliant electronic payments solution made exclusively for law firms. Trust account compliance is baked into every aspect of the platform. Pay Later functions the same as any other electronic payment method inside the platform. You simply get paid faster, with no manual data entry or cumbersome check processing. The Pay Later difference is on your clients’ end: each person gets to choose how they want to pay.

Promote client choice and cash flow with Pay Later

Tabs3 Billing in Tabs3 Cloud makes it easy to accept electronic payments with Tabs3Pay. It only takes a few minor changes to add Pay Later to the payment choices you offer clients. More choices means more wins, for you and your clients.

Ready to learn more? Demo Tabs3 Cloud today.

Ready to transform your law firm’s billing process? Schedule a personalized demo and discover how Tabs3 Cloud can transform your firm in one complete practice management solution.

In many law firms, December is a mad dash to collect overdue bills and secure compensation. Tabs3 Billing in Tabs3 Cloud can help you finish strong this year. Moreover, it can help you make 2026 even more profitable. Read on to learn how.

👉 Want to learn more about Tabs3 Cloud? Schedule a demo today!

Start by getting 2025’s bills collected

You still have time to maximize revenue for this year, and you can collect more if you think outside the Aging AR report. Below are four tips to boost your collections outcomes.

1. Get invoices out to clients

If your firm does not bill on a regular cadence, now is the time to catch up. You may need to do a second round of invoicing in December to clear the decks before the new year.

Make sure to locate any “lost” billable work that can be added to the end of year invoices. Tabs3 Billing in Tabs3 Cloud includes reports that can help you find hidden billables:

- The Recap of Hours Report helps you find missing timeslips

- The Aged Work-In-Process Report helps you find time that could be invoiced. You can also see aging WIP in the Timekeeper Status Report.

- The Client Budget Report can be helpful for flat fee cases.

2. Follow up on receivables

Next, take action on overdue invoices. Many firms start with a written reminder, but consider making a phone call sooner rather than later if the client is not responding.

Depending on your practice area and the client relationship, it may be helpful to make a plan while on the phone with the client about how and when they will pay. Then you can follow up right away if the payment does not arrive as promised.

Tabs3 Billing in Tabs3 Cloud comes with a variety of helpful collections reports:

- The Detail Accounts Receivable Report shows outstanding receivables for each client broken out by age. The Accounts Receivable by Invoice Report gives you details about each invoice.

- The Summary Collections Report and Detail Collections Report helps you focus your collections efforts by setting criteria for inclusion like number of days past due, total balance due, and more.

- To check on receivables for individual timekeepers, you can use the Timekeeper Status Report to see receivables by age. Tabs3 Cloud and Platinum Edition users can also access the Accounts Receivable by Timekeeper Report.

Finally, make sure that any unallocated payments are correctly applied to outstanding invoices. The Unallocated Payments Report in Tabs3 Billing can help you find them.

Ready to transform your law firm’s billing process? Schedule a personalized demo and discover how Tabs3 Cloud can transform your firm in one complete practice management solution.

3. Be strategic with write-downs and write-offs

It often makes sense to write down time on an invoice to get cash in the door and stanch spending on collections activities. Of course, writing down time for a client can create an expectation of future write-downs. It is a good practice to review your firm’s write-down practices at least annually to pinpoint patterns of excessive write-downs. The Write-Up/Write-Down Report in Tabs3 Billing can help you keep an eye on discounting.

Unlike write-downs, write-offs have tax consequences. The Write-Off Report in Tabs3 Billing helps you track write-off activity.

4. Accept electronic payments

If your firm is not already accepting payments electronically, adding that capacity now could help you collect more (and faster) on your outstanding invoices. For example, instead of a reminder letter, you could send an email invoice with an electronic payment link.

If you are using Tabs3Pay in Tabs3 Billing, you can offer PayPal Pay Later, which gives clients more time to pay while putting revenue to your pocket right away. Clients can also pay by ACH, credit card, debit card, Venmo, or standard PayPal.

Plan for a more profitable 2026

Late payments hurt your cash flow and waste your time. Calling clients about unpaid bills can be stressful. And waiting until the end of the year to handle unpaid bills not only takes over your December schedule, it can reduce the likelihood of getting paid at all.

Below are three ways Tabs3 Billing in Tabs3 Cloud can help you stay on top of collections year-round so you collect more revenue with less work.

1. Send invoices monthly

Getting paid on time starts before you send the bill. Maintaining a regular billing cycle keeps your invoices top of mind for clients and spreads out the work of billing and invoicing.

Best practices include:

- Completing time entry and sending a statement for every matter monthly, even if no money is owed that month

- Writing clear fee entries to show clients the work you are doing on their behalf

- Offering clients the option to get invoices by email and pay electronically.

The right billing software makes it easy to bill every month. Tabs3 Billing in Tabs3 Cloud simplifies time entry, offers all-electronic pre-billing workflows, and supports email invoicing.

This article offers a deep dive into billing best practices.

2. Collect consistently

Monitor aging receivables monthly so you can intervene early with unpaid bills. In Tabs3 Billing, you can run the Detail Accounts Receivable Report and the Accounts Receivable by Invoice Report. You can look at individual timekeepers with the Timekeeper Status Report. If you have Tabs3 Cloud or Platinum Edition, the Accounts Receivable by Timekeeper Report is available.

With that data in hand, you can take action. That might include sending reminder messages when a bill is a week late, and making a phone call when bills are 30 days late. You might even update your engagement agreement template to add more clarity about payment policies.

Finally, remove barriers to payment. With Tabs3 Billing in Tabs3 Cloud, you can invoice by email and include a link that allows clients to pay electronically with the method of their choice via Tabs3Pay. Clients can pay faster, so you spend less time collecting bills.

3. Evaluate fee options

If your firm often struggles to collect on invoices, it may be time to reassess your fee structure.

For example, you could experiment with alternative fee arrangements, like flat fees or milestone-based fees. If you are not already using alternative fees, check your local rules for guidance on fees paid in advance to make sure your trust account is in compliance. Tabs3 Billing in Tabs3 Cloud can handle virtually any alternative fee arrangement.

Evergreen retainers are another option. Unlike a one-time retainer, an evergreen retainer is refilled once a set threshold (like dollar amount remaining) is reached. Earned fees are paid from the trust account, rather than by billing the client and waiting for payment. You can typically structure your retainer agreement to pause work or withdraw if the client does not refill the retainer as agreed. Tabs3 Billing makes managing evergreen retainers simple.

Finally, you could allow clients to choose buy now, pay later options on your electronic payment platform. You get paid immediately, and the client pays the lender off in affordable monthly installments. Tabs3Pay in Tabs3 Billing includes PayPal’s Pay Later.

Keep the revenue flowing with Tabs3 Cloud

With Tabs3 Billing, your firm is supported throughout the revenue cycle, from time entry to collections. It integrates seamlessly with Tabs3 Financials, which handles your trust accounting, accounts payable, and general ledger. You can collect more in less time (and with less stress).

Ready to learn more? Demo Tabs3 Cloud today.

Ready to transform your law firm’s billing process? Schedule a personalized demo and discover how Tabs3 Cloud can transform your firm in one complete practice management solution.

When your invoicing system is working against you, every month is spooky season. Struggling with the billing function and the impact on profitability can be downright chilling. Too many firms are caught in a web of scary billing problems, but you can break free by avoiding these seven mistakes.

1. Late time entry

Why it is scary: Time capture is one of the legal industry’s biggest challenges. Legal professionals understand its importance, but every minute spent composing a fee entry is time away from client matters.

Being pulled in both directions takes a toll. Time gets lost because it is not entered contemporaneously. When the bills absolutely must go out, everyone scrambles to enter time and approve draft invoices. Bills may go out late as a result, extending the time it takes to get paid. Workflow and cash flow suffer.

Late time entry is usually caused by:

- Difficult and/or labor-intensive time entry process.

- Workflows and processes that do not support contemporaneous time tracking.

- Law firm culture relating to the importance of time entry.

How to vanquish it: Clear policies about time entry, with strong support from leadership, are crucial. Those policies should be backed up with easy-to-use, mobile-friendly time entry software, so that timekeepers can quickly enter time without interrupting their workflows.

Tabs3 Cloud includes Tabs3 Billing, which allows timekeepers to securely record time in seconds from any browser: smartphone, tablet, laptop, or desktop.

2. Irregular billing cycles

Why it is scary: Ad hoc invoicing can seem like a time-saver, especially for matters with flat fees, retainers, and long timelines. But it creates more problems than it solves, like:

- More work collecting bills because clients are not accustomed to a regular billing cadence and the work you are billing for has faded in the client’s memory.

- More time managing clients because they are not getting regular reminders (in the form of invoices with descriptive fee narratives) about the work you are doing for them.

- More headaches with invoice approval because timekeepers’ memories are no longer fresh.

- Less efficiency in the billing function because of unpredictable spikes in billing and collections work.

- Irregular cash flow and potentially non-compliant trust accounting if client funds are not moved to the operating account timely.

How to vanquish it: The best practice is to invoice monthly. For alternative fee or retainer matters, your invoice is an opportunity to remind the client that you are working on their matter and that finances are settled monthly. For hourly work, monthly invoices keep clients’ financial obligations top of mind, keep cash flowing, and promote efficient billing.

Tabs3 Billing makes monthly invoicing easy. It can accommodate virtually any fee agreement and remembers your settings so invoices are automatically filled in with the correct information, including time entries. You can even complete your internal statement approval process (pre-billing) electronically.

Ready to transform your law firm’s billing process? Schedule a personalized demo and discover how Tabs3 Cloud can transform your firm in one complete practice management solution.

3. Vague or unclear fee narratives

Why it is scary: Ambiguous, fragmentary, or unclear fee entries make bills harder to collect and clients harder to manage. That is true even in flat fee cases where you do not provide a full hourly breakdown. Consider that:

- Many business clients will outright reject block billing or items with inadequate fee narratives.

- Individuals are less likely to pay promptly and remain engaged in their cases when they do not understand what is happening.

- Flat fee clients are more likely to question the reasonableness of your fee when they do not receive regular descriptions of the work you are doing on their behalf.

How to vanquish it: Firms should prohibit block billing and adopt general standards for fee narratives, as well as tracking any client- or matter-specific narrative requirements. Take advantage of any tools available in your software to reduce the time it takes to enter and revise narratives.

In Tabs3 Billing, you can set up macros to spell out common terms or phrases, so you can enter a fee with fewer keystrokes. And by handling pre-billing electronically, you can avoid mistakes caused by misinterpretation of handwritten narratives.

4. Leaving costs unbilled

Why it is scary: Too many firms absorb costs that should be billed to the client or integrated into rates. This cuts into profitability, especially in times where costs are rising. Costs include advanced costs like deposition costs, travel, medical records, and filing fees, as well as overhead expenses like making copies and legal research tool fees.

How to vanquish it: The way you approach this problem depends on your practice, your clients, and most importantly on your fee agreements. Options to consider include:

- Billing for every cost including the portion of overhead expenses. This approach requires careful recordkeeping, so it can increase timekeeper and accounting workloads. Some clients may perceive it as “nickel-and-diming.” Others expect itemized costs.

- Charging a flat monthly file maintenance fee. (Larger advanced costs would need to be billed separately.) This method might reduce recordkeeping burden, and some clients may appreciate knowing what the costs would be. Other clients may be sensitive to paying a set amount even in a month when costs are comparatively low.

- Including overhead costs in rates and billing for larger advanced costs. This works for hourly or flat rates, may reduce recordkeeping burden somewhat, and does not create a line item on the bill. It is still important, however, to track overhead costs so you can account for them when setting and reviewing rates.

Tabs3 Billing lets you decide how to handle cost recovery. You can include it in the bill, add a monthly fee, or simply track costs for internal firm use. The platform includes a suite of reports that can help you understand how costs impact profitability so you can set appropriate rates.

5. Missing or duplicated items

Why it is scary: Accidentally billing the same fee or cost twice, or billing fees/costs that look the same, can erode client trust in your firm. Failing to bill fees or costs timely may force you to “catch up” with a bill that is larger than a client expects. If clients complain, you may be under pressure to write down or write off bills that you would otherwise have been able to collect in full.

How to vanquish it: To avoid duplicated or similar charges, review your statement approval process and your firm policies about fee and cost entry narratives. Narratives should allow the client to distinguish between entries. You can catch missing or misattributed time and costs by reviewing reports regularly.

You can do both things with Tabs3 Billing. For example, you can lock down all time entries included on a draft statement to make sure no unexpected changes are made before the bill is issued. Flexible reports make it simple to generate and deliver reports, including aging WIP, at the timekeeper, practice, and firm level.

👉 Want to learn more about Tabs3 Cloud? Schedule a demo today!

6. All-paper billing process

Why it is scary: Too many firms still handle pre-billing on paper. Paper-based processes limit where and when approvers can work, and they reduce visibility into the status of approvals.

Handwritten statement revisions create additional problems. The billing function wastes time puzzling out handwriting and re-entering data, while the timekeeper worries about being misinterpreted.

How to vanquish it: Shift to paperless pre-billing. With modern software, approvers can review pre-bills on desktop, laptop, or mobile devices, directly revising errors and making notes for billing clerks. The billing clerk can quickly finalize and send the bill, speeding up your cash flow.

Tabs3 Billing users can choose between paper-based pre-billing and electronic pre-bills. The electronic process is flexible, so you can find the approach that is best for your firm.

7. Limited bill delivery options

Why it is scary: Many clients prefer to receive invoices via email. Firms that do not offer a digital option may be wasting time, paper, and postage, in addition to client goodwill.

You may also be slowing down your revenue cycle. Consider the time it takes to open a letter, read an invoice, track down the checkbook, write a check, find a stamp, and put the payment in the mail, versus opening an email with an electronic payment link.

How to vanquish it: Most firms can benefit from offering email invoices as an option, and you may discover digital should be the default for your client base. Make sure to include electronic payment options so clients can opt to pay faster.

Tabs3 Billing makes emailing invoices simple and comes with a growing suite of electronic payment options for clients who choose digital payments.

Tabs3 Cloud: Turn tricky billing into a monthly treat

Halloween levity aside, you can make your billing process easier and more effective with all the Tabs3 Billing features found in Tabs3 Cloud. It includes powerful financial management tools:

- Invoice and collect payments faster

- Accept electronic payments securely

- Manage your trust account, accounts payable, and general ledger

- Access Tabs3 from your desktop, laptop, tablet, or smartphone

Next month, we will talk about how to improve your collections so you can keep the revenue cycle spinning.

Ready to learn more? Demo Tabs3 Cloud today.

Ready to transform your law firm’s billing process? Schedule a personalized demo and discover how Tabs3 Cloud can transform your firm in one complete practice management solution.

Your IP law firm is poised to grow or striving to get ahead. The technology you choose can give you a leg up, but not every tool is well-suited for an IP practice’s needs. Learn how the right legal practice management platform could propel you forward.

👉 Want to learn more about Tabs3 Cloud? Schedule a demo today!

What is practice management software?

General business management software works for some businesses. But law firms have unique needs, and meeting those needs requires a specialized legal practice management platform. These products typically include:

- Workflow and task management

- Docketing/calendaring

- Conflict checking and contact management

- Client relationship management (CRM)

- Reports, analytics, and dashboards

- Time entry and cost tracking

- Billing and payment processing

- Trust accounting, bookkeeping, and accounts payable

IP law firms need more from practice management platforms

Most law firms need the features listed above. But IP firms need augmented capacity in a few areas:

- Advanced docket management to handle high-volume deadline tracking

- Robust matter management to ensure coverage and map intricate data relationships

- Workflow and document support to speed up extensive documentation requirements

- Financial tools for alternative fee arrangements and complex payment attribution

Tabs3 Cloud has the tools your IP law firm needs to scale. You get powerful financial tools and can add on PracticeMaster to help you work faster and more accurately.

Ready to transform your law firm’s billing process? Schedule a personalized demo and discover how Tabs3 Cloud can transform your firm in one complete practice management solution.

Never miss a deadline

Your firm’s growth is hampered when due dates are stuck in multiple tools. Teams may have little visibility into the firm’s work as a whole, and it can be difficult to match due dates with client files. The sheer volume of deadlines and filings in IP practices creates extra urgency around this issue; even a single missed step could result in permanent loss of a client’s rights.

The right legal practice management platform can make a big difference. PracticeMaster in Tabs3 Cloud helps supervisors track deadlines across the entire firm. Depending on the access rules you choose, users can see deadlines for a single matter, all of a timekeeper’s matters, or all of a group’s matters. Each deadline is associated with the relevant matter, so nothing gets lost.

The docketing feature also integrates with Microsoft Outlook, including real-time synchronization when you make changes in either place.

Keep everyone up to date

Disconnected data storage causes problems beyond lost due dates. When contacts are siloed, it is challenging to conduct accurate conflict checks and ensure client notifications are handled correctly. Paper-based client files make it difficult to keep everyone up to date on each matter, so time is wasted tracking down information.

Tabs3 Cloud with PracticeMaster allows your firm to centralize all matter management activities. Documents, emails, contacts, and all other matter information is available in digital format, so any updates are immediately available to all authorized users. You can access case files securely from desktop, laptop, tablet, or smartphone.

In addition, leadership teams can use the reporting function to track trends and patterns, which can reveal opportunities for workflow efficiencies and profitability levers. A legal CRM and secure document sharing/eSignature are also available.

Standardize and speed up work

To meet your deadlines, you have to draft client correspondence, filings, and other documents. Each attorney may use a slightly different model for each document type, and you may be re-keying data in every draft. Especially when you are assembling complex or lengthy documents, the opportunities for mistakes compound.

PracticeMaster in Tabs3 Cloud helps you create shared templates for frequently-used documents to ensure that firm policies are uniformly applied. Templates also reduce drafting time and errors, because matter information can be automatically pulled into the document. You can even set up automation to generate a whole set of documents in fewer steps.

Keep the revenue cycle moving forward

More and more law firms are using alternative fee arrangements, but manually managing billing for complex fee agreements can take time. If you have large clients with multiple matters, payment attribution can quickly become a major chore. And regardless of fee arrangements or client size, time entry is a perennial issue.

Tabs3 Cloud comes with robust, flexible financial tools. Efficient time entry from any device enables on-time billing. The platform can handle virtually any fee arrangement, and you only need to set up each client’s fee rules once. Splitting payments between multiple matters is simple. You can do trust accounting, general ledger, and accounts payable from Tabs3 Cloud. Finally, you get access to an extensive suite of financial reports and analytics.

Scale your IP firm with Tabs3 Cloud

Tabs3 Cloud has the core functions and extra features, like PracticeMaster, that IP firms need to grow. It can make your daily work simpler and more efficient while revealing insights that can guide your trajectory. Demo Tabs3 Cloud today.

Ready to transform your law firm’s billing process? Schedule a personalized demo and discover how Tabs3 Cloud can transform your firm in one complete practice management solution.

With Q4 just around the corner, law firms are poised to dive into budgeting and planning work. Tabs3 Billing Reports empower you to make smart, data-driven decisions for a more prosperous 2026. There are benefits for stakeholders throughout the firm:

- Firm leadership can see how the current strategy is playing out.

- Accounting staff can spot areas for collections and trust compliance improvement.

- Partners can find collections problems early enough to boost compensation.

You get flexible, powerful reports right out of the box when you choose Tabs3 Billing, part of Tabs3 Cloud.

👉 Want to learn more about Tabs3 Cloud? Schedule a demo today!

Understand time and billing trends

Most firms monitor time and billing data monthly. In Q4, you can assess year-to-date data and look for broader implications.

How are individual timekeepers performing overall?

This question is especially relevant in Q4 if your firm has annual performance goals and/or determines bonuses based on timekeeper productivity. The earlier you check the reports, the more time you will have to course-correct before year-end. You can use these reports to inform strategic planning for 2026, too. For example, you can see what matters each timekeeper spends the most time on. You might also study performance by task code to identify work that could be done more efficiently.

Reports to consider:

- Allocated Payments Report

- Client Realization Report

- Detailed AR Report (Platinum users can sort by timekeeper)

- Productivity Report by Category for Each Timekeeper

- Productivity Report by Tcode for Each Timekeeper

- Timekeeper Analysis Report

- Timekeeper Status Report

- Write-Up/Write-Down Report

- Write-Off Report

How much work time do timekeepers spend on billables vs. non-billables?

To maximize billables, you need to understand where the time is going. With these reports, you can drill down on individual timekeepers, clients, and practice areas to find places to improve.

Reports to consider:

- Client Analysis Report

- Client Productivity Report

- Recap of Hours Report

- Timekeeper Productivity Report

- Transaction File List

- Task Code Billing Report

Which of our practice areas are the largest, and how profitable are they?

By looking at these numbers, the firm can make better decisions about how to allocate resources and where to seek new business. There is a report for this specific purpose (Category Productivity Report), and you may find reports that sort by client useful if each client is a meaningful proxy for a practice area. For example, if your small business clients only engage you for commercial leasing, client-based reports could be helpful.

Reports to consider:

- Category Productivity Report

- Client Productivity Report

- Client Realization Report

- Top Client Report

What unbilled work has been “lost” and could be invoiced this year?

Both individual partners and firm leadership have an interest in identifying revenue problems. Individual partner compensation may be based on revenue brought in, and the firm itself needs to keep cash flowing. Early in Q4 is a good time to search out “lost” time if you do not already have a system in place.

Reports to consider:

- Aged Work-In-Process Report

- Client Budget Report

- Client Productivity Report

- Detail Work-In-Process Report

- Summary Work-In-Process Report

- Task Code Budget Report

- Timekeeper Status Report

Ready to transform your law firm’s billing process? Schedule a personalized demo and discover how Tabs3 Cloud can transform your firm in one complete practice management solution.

See how invoices turn into revenue (or not)

Your firm can only realize time and billing improvements if invoices are paid. Now is the time to assess your accounts receivable process and plan for improved collections in 2026.

What could still be collected/allocated this year?

The Q4 collections push is proverbial. Finding and applying unallocated payments can also boost your revenue. You can use reports to look at firm progress overall, as well as studying individual timekeeper collections results so you know where to focus collections efforts.

Reports to consider:

- Accounts Receivable by Invoice

- Accounts Receivable by Timekeeper (Tabs3 Cloud and Platinum Edition only)

- Client Funds report

- Collections Report

- Detail Accounts Receivable

- Pre-Bill Tracking Report

- Recap of Hours Report

- Summary Accounts Receivable

- Timekeeper Realization Report

- Timekeeper Status Report

- Unallocated Payments Report

Where are we collecting efficiently (or not)?

Examining your 2025 collections trends can help you spot areas for improvement in 2026. For example, you might ask which timekeepers are most efficient in collections to help you determine what factors drive their success. You can also assess collections by client to aid decisions about ongoing representation and/or client management adjustments.

Reports to consider:

- Client Realization Report

- Collections Report

- Receipt Allocation Report

- Timekeeper Analysis

- Timekeeper Productivity Report

- Top Client Report

How much are we collecting in fees versus other categories?

It may be useful to understand how revenue breaks out across multiple categories. For example, excessive finance charges could indicate a problem upstream in the collections workflow. Tracking the growth of fees, as well as costs, can offer insight into overhead trends and business growth.

Reports to consider:

- Client Realization Report

- Receipt Allocation Report

Track invoice adjustment patterns

Analyzing statement adjustment practices can reveal opportunities for improvement, too. You can use reports to track write-ups, write-downs, courtesy discounts, and write-offs.

Is courtesy discounting negatively impacting the firm’s revenue?

Offering a timely discount is an important client management and collections tool. It is difficult, however, for individual decision makers to spot problematic trends in the moment. In Q4, there is ample year-to-date data available and time to change practices for next year. You may also think through how discounting should impact next year’s rates.

Reports to consider:

- Client Analysis Report

- Client Rate Report (to see current timekeeper rates)

- Receipt Allocation Report

Are attorneys writing down time (or writing up time) excessively?

Actively controlling write-downs (and write-offs) is key to long-term profitability. Excessive write-downs can not only reduce profits, but also point to performance problems and/or client management problems. A rise in write-ups could indicate problems with timekeeping. To keep bill adjustments under control, keep your eye on the big picture.

Reports to consider:

- Client Analysis Report

- Client Productivity Report

- Collections Report

- Timekeeper Productivity Report

- Write-Up/Write-Down Report

Finally, be on the lookout for “silent write-downs,” where attorneys do not enter time. Often, there is an appropriate reason (like correcting a junior’s work), but big shifts in time billed could point to timekeeping problems.

Is the firm writing off debt excessively?

Write-downs and write-offs are distinct in terms of accounting procedures and tax implications. Too many write-offs can trigger accounting and/or tax concerns, so write-offs and write-downs should be tracked and assessed separately.

Reports to consider:

- Client Analysis Report

- Client Productivity Report

- Collections Report

- Timekeeper Productivity Report

- Top Client Report

- Write Off Report

Stay in-the-know on other success indicators

Should we raise our rates and/or flat fees?

Rate increases are often announced at the beginning of the calendar year, so Q4 is the right time to assess whether your current rates are aligned with your goals. You can evaluate trends throughout the past year to inform your predictions about the 2026 market.

Reports to consider:

- Client Budget Report

- Client Productivity Report

- Client Rate Report

- Client Realization Report

- Fee Compensation Rules

- Top Client Report

Is task-based billing going smoothly?

If your firm uses task-based billing, checking relevant reports annually can help you spot any issues that might be missed in day-to-day billing management.

Reports to consider:

- Task Code Billing Report

- Task Code Budget Report

Client reports for task-based billing clients can also be a helpful source of information.

Are we in compliance with our trust accounting obligations?

The reports listed below are in addition to normal accounting reports, required recordkeeping, and regular three-way reconciliations.

Reports to consider:

- Client Funds Report

- Collections Report

The reports you need right now, right out of the box

Tabs3 Billing comes with all the reports you need to prepare for a more prosperous 2026. Our extensive knowledge base includes a helpful Report Finder and a comprehensive guide to each and every report. Demo Tabs3 Billing in Tabs3 Cloud today.

Ready to transform your law firm’s billing process? Schedule a personalized demo and discover how Tabs3 Cloud can transform your firm in one complete practice management solution.

Lawyers and other legal professionals know that law firms are tempting targets for cybercriminals. You probably know a friend of a friend who accidentally sent confidential information to opposing counsel. Even so, it is common at many law firms to send sensitive client information via email. In doing so, you may risk ethical complaints, data breach liability, and reputational damage.

At the same time, changing your workflow is challenging, especially when your caseload is growing and staffing is shrinking. LexShare offers an alternative. It combines strong security with products you already use and trust.

👉 Check out the PracticeMaster Integration page to learn more about LexShare

Wait.. why not just add a privilege/confidentiality disclaimer and use regular email?

Tacking on a disclaimer as an email liability shield approach is fast, easy, and familiar, but it might not be secure enough.

Current ABA guidance* recommends a fact-based analysis

In 1999, Formal Opinion 99-413 (1999) stated that lawyers have a reasonable expectation of privacy in standard email. Formal Opinion 477R (2017) changed that guidance.

The 2017 opinion referenced Comment 18 to Model Rule 1.6(c), which states that “factors to be considered in determining the reasonableness of the lawyer’s efforts [to safeguard confidential information when sending information electronically]” include, but are not limited to:

- the sensitivity of the information,

- the likelihood of disclosure if additional safeguards are not employed,

- the cost of employing additional safeguards,

- the difficulty of implementing the safeguards, and

- the extent to which the safeguards adversely affect the lawyer’s ability to represent clients (e.g., by making a device or important piece of software excessively difficult to use).

It also noted that the duty of competence requires attorneys to understand the risks and benefits associated with changing technology (see Model Rule 1.1, Comment 8).

The ABA concluded that sharing client information over the internet is acceptable if the attorney makes “reasonable efforts to prevent inadvertent or unauthorized access,” unless the client requests more security or the fact-specific analysis indicates higher security is required.

*ABA guidance is advisory. Check with your state bar association for local rules.

“Reasonable efforts” require ongoing evaluation of risks and protections

In the eight years since Opinion 477R was published, the list of security risks law firms face has only grown. The tools available to protect communications have changed, too.

Opinion 477R acknowledged the evolving nature of technology. It cited the ABA’s 2016 Ethics 20/20 Commission Report, which declined to recommend specific safety measures, saying that that “technology is changing too rapidly to offer such guidance and … the particular measures lawyers should use will necessarily change as technology evolves and as new risks emerge and new security procedures become available.”

Reputational damage is an independent risk

Clients rely on their attorneys to safeguard their information, and when that trust is breached, the firm can be damaged even if no ethical rules were violated. An email disclaimer will not stop a hacker. When emails are misdirected, it is not always possible to un-ring the bell. Reputational damage can be especially devastating for firms that rely heavily on referrals.

LexShare offers better security without sacrificing ease of use

Lawyers are understandably reluctant to add new technology to their workflows, even when they want the benefits it provides. It takes time to learn a new process. Some tools add too many extra steps, cutting into your already-limited work time. Or they are difficult for clients to use, so your phone is ringing with support requests.

LexShare makes secure sharing easy on you and your clients. You can send or request a document from PracticeMaster with a few clicks:

- You choose the appropriate level of security based on the situation

- You can write the body of the email right in the workflow or get a secure link and add it to your email manually

- You can set up a notification to alert you when the document is accessed or sent

If you choose to add eSignature capability, the process for getting an eSignature is similar.

On your client’s end, the message looks like a normal email; they just click on the link to get the secure document. If you decide to add extra security, the client must answer a challenge question before viewing the document.

Use case: Sending sensitive information to a client

Imagine that you need to share confidential, written information about your client’s matter, and time is limited.

Your perspective: Instead of sending a letter or making an appointment, you decide to send an email and attach the confidential information. Since the information is sensitive, you use LexShare to send a secure link with a pre-arranged challenge question. You complete the entire process inside PracticeMaster in just a few minutes.

The client’s perspective: Your client receives the email in their regular email inbox. They answer the challenge question accurately and read the information on your secure portal.

By emailing a secure link instead of meeting or mailing a letter, you:

- Get the information to the client quickly so you do not lose momentum on the matter.

- Avoid an extra appointment in your calendar.

- Save on paper and postage.

- Keep sensitive data out of email inboxes and limit the risk of unauthorized access to confidential information.

👉 Check out our LexShare video to learn more about this process

Use Case: Receiving confidential documents from a client

In this scenario, you completed the initial consultation virtually and need additional documentation from the client to decide on next steps, including screenshots of texts from the client’s phone.

Your perspective: This particular information is very sensitive, so you use LexShare to send the client a single-use link that allows them to upload the screenshots or files to your secure portal. You complete the entire process inside PracticeMaster with just a few clicks.

The client’s perspective: The client opens the email on their phone or computer, clicks the link, and uploads the necessary files.

By emailing a secure link for the client to upload, you:

- Get a faster response, because the client can complete the task from their mobile device, so you can take the next step in the matter right away.

- Import the screenshots or files directly into PracticeMaster.

- Keep sensitive data out of email inboxes and limit the risk of unauthorized access to confidential information.

See the document sharing process (starts at 2:31).

Use case: Signing a retainer agreement

After reviewing the client’s documentation, you decide to accept the matter. Now you need to get a signed retainer agreement.

Your perspective: The retainer agreement is sensitive, and your client wants to get moving on the matter right away. You decide to use LexShare to request an eSignature on the document. You go into PracticeMaster, select the document, and click “Request eSignature.” You complete the eSignature request process quickly and efficiently.

Your client’s perspective: The client clicks the link, answers the challenge question, and reads the document. Then they sign the document in a few clicks.

Watch the eSignature process from your perspective and your client’s perspective.

By using the eSignature process, you:

- Secure representation fast so the client does not move on to another firm.

- Meet the client’s expectations for speed.

- Save on paper and postage.

- Keep sensitive data out of email inboxes and limit the risk of unauthorized access to confidential information.

👉 Schedule a demo to learn more about how Tabs3 can benefit your firm

Protect your clients, your good name, and your time

LexShare’s plug-and-play integration with PracticeMaster means you can start sending securely right away. Your clients will also welcome a simpler process for sharing and signing. Demo PracticeMaster with LexShare on Tabs3 Cloud today!

Ready to transform your law firm’s billing process? Schedule a personalized demo and discover how Tabs3 Cloud can transform your firm in one complete practice management solution.

The stakes are high: trust account mismanagement is “one of the most frequent causes of [attorney] disciplinary action.” The compliance requirements are voluminous (and sometimes esoteric). With thoughtful planning and attention to detail, however, you can stay compliant.

Note: This article covers general trust accounting principles. The specific rules that apply to your trust accounts may be different, because trust accounting rules are set by states. Make sure to check your state’s rules and consult with ethics counsel as needed.

What is trust accounting?

The guiding principle of trust accounting is simple: Attorneys (and their staff) have a special duty to safeguard their clients’ money because attorneys are fiduciaries for their clients. As fiduciaries, attorneys must act in their clients’ best financial interest. That includes:

- Maintaining separate accounts for clients’ money (the trust account) and the firm’s money (the operational account).

- Making sure that the firm’s money is never commingled with clients’ money.

- Ensuring prompt notification/disbursement when the firm receives money for the client.

- Keeping detailed records of all transactions that involve client money.

- Reconciling trust accounts frequently to detect and correct errors.

The trust account holds clients’ money, like:

- Retainers and advanced fees.

- Escrow deposits for real estate transactions.

- Settlement funds and money awards.

- Other funds received on the client’s behalf.

If an attorney mismanages the trust account, even by accident, the consequences may be serious. Clients might lose trust in the firm. The firm might be liable for damages. Attorneys could face disciplinary action (public reprimand, fines, suspension, and disbarment).

Is a trust account the same as an IOLTA account?

Sometimes people refer to trust accounts as IOLTA (Interest on Lawyer Trust Account) accounts. Not every trust account is an IOLTA account. The type of trust account depends on the interest-earning potential of the client money held.

If the client would earn a minimal amount of interest (because the amount of money is small or it will not be held for long), it is pooled with other client funds in an IOLTA account. The combined funds earn interest, which is used to support legal aid and access to justice.

Larger amounts, or amounts held for a long time, are held in regular interest-bearing accounts (not IOLTA). The interest belongs to the client.

What are the most common trust accounting errors?

The rules for trust accounting are not always intuitive, and it is easy to make mistakes. Common errors include:

- Commingling client and firm funds

- Reconciling the trust account incorrectly or not frequently enough.

- Not tracking all the required information for each transaction

Once a process tied to printers and postal mail, digital tools now enable law firms to implement efficient, cost-effective paperless invoicing. Ready to make the switch? Take the first step toward a more organized and productive invoicing workflow. Download the guide today.

6 principles for getting trust account right

Store client funds separately

This principle is simple, but it can be difficult to apply. Commingling examples include (but are not limited to):

- Using client funds to pay law firm expenses. Never pay firm expenses from the trust account, even if the money has been earned. Move it to the operating account first.

- Moving client money to the operating account before it has been earned. In most cases, retainer funds must be stored in the trust account until they are earned.

- Failing to move earned fees to the operating account regularly. This may seem counter-intuitive, but it is an example of storing the firm’s money in the trust account.

- Handling fixed fees improperly. There is significant variation among states on this issue. Some consider fixed fees to be earned upon receipt; others require lawyers to keep fixed fees in trust until earned.

Most states make an exception to the commingling prohibition for banking fees. In general, law firms may deposit their own funds in the trust account to pay for normal banking fees. Keeping a significant amount of firm funds in the trust account, however, may be a violation.

Keep thorough records

Trust accounting requires especially meticulous recordkeeping. The ABA Model Rules on Client Trust Account Records, Rule 1, provides a good overview of what is typically required:

- A journal of deposits and withdrawals from trust accounts

- A ledger for each client trust account

- Copies of retainer and compensation agreements

- Copies of any accountings to clients or third parties

- Copies of bills for legal fees and expenses

- Copies of records showing disbursements on behalf of clients

- Financial institution records like checkbook registers, bank statements, deposit records, cancelled checks, and substitute checks

- Detailed records of electronic transfers

- Copies of trial balances and reconciliations

- Copies of the parts of the client file that relate to trust accounting.

Note that ABA rules are advisory only in most cases, so you should refer to state law.

Communicate clearly

Keeping the client informed about their funds is part of the attorney’s fiduciary duty. It is also a good way to head off client misunderstandings that eat up your time and lead to disputes. Examples trust account communication include:

- The engagement letter or fee agreement, which should clearly state how money will move through the trust account.

- Statements, which should be sent regularly and should include a summary of the client’s trust account ledger. It is a best practice to send a statement whenever you pay earned fees from the trust account, even if no additional money is owed.

- Notifying the client when the attorney receives funds on their behalf. The funds must also be disbursed to the client within a reasonable period of time to avoid commingling.

Reconcile correctly and on time

Trust accounting requires three-way reconciliation. You must compare the bank statement against your trust ledger (two-way reconciliation) and also against each client’s trust ledger. All funds, down to the penny, must be accounted for.

Three-way reconciliations should be done on a regular schedule and frequently enough to catch errors promptly. Trust errors tend to snowball, so finding them early benefits everyone.

Many firms find it works best to reconcile monthly right before billing statement creation.

Write down procedures

Even if your accounting team is small, written procedures are essential for staying on track. Procedures should cover trust accounting workflows, checks and balances, and encourage prompt reporting of problems so any errors can be corrected swiftly. Procedures should be reviewed and updated regularly.

Know your state’s rules

It bears repeating—general trust accounting knowledge is necessary but not sufficient for trust account compliance. Stay up to date on your state’s rules and take advantage of local CLE resources.

👉 Set up a personalized demonstration with our experienced trainers today.

Tabs3 helps you get trust accounting right

Trust accounting is complicated. Tabs3 Financials can lighten your load.

- Instant communication with your bank, easy-to-read trust ledgers, and streamlined three-way reconciliation reports so you can reconcile faster.

- Flexible recordkeeping so you can store all the details needed for compliance.

- Dashboard summaries to help you spot trust problems early.

- Seamless integration with Tabs3 Billing and Tabs3Pay, an electronic payment solution built for lawyer trust account compliance.

Tabs3 Financials is also available through Tabs3Cloud, giving you more control over where and when you work. Schedule your free demo today.

👉 Paperless Invoicing: Why Your Law Firm Should Embrace the Digital Age

Ready to transform your law firm’s billing process? Schedule a personalized demo and discover how Tabs3 Cloud can transform your firm in one complete practice management solution.

A professional law firm website is one of the most effective tools to attract new clients. With virtually unlimited reach as thousands of clients search online for law firms nearby, your website is the best way to instantly showcase your expertise and make a powerful first impression that ends in a signed contract.

More website visitors become clients when six key features are built into your website’s framework. From maximizing your search engine visibility to demonstrating clear social proof with reviews and testimonials, law firm websites with the following elements can help you enhance your site’s performance, increase conversions, and build a stronger client pipeline for long-term firm growth.

👉 Looking for a low-stress website solution? Watch 5 Reasons Law Firms Need Tabs3 Websites now to uncover what makes a turnkey website a competitive advantage for firms of all sizes.

The Benefits of a Professional Legal Website

Too many law firms see their website as a static digital business card. In truth, your website should be a dynamic part of your marketing strategy that is able to consistently attract, capture, and convert clients.

A well-executed law firm website can deliver numerous benefits. With the right site features guiding leads and prospects through the client journey, your firm can expect:

- Enhanced visibility and reach to help ideal clients find your firm and take the next step.

- More consultation requests with clear calls to action (CTAs) driving form fills and calls.

- Free organic traffic and leads from higher positioning in local law firm search results.

- Stronger credibility and trust through professional design and social proof elements.

- Simple, effective marketing that automatically attracts and captures qualified leads.

- Higher conversion rates by optimizing the user experience with clear guidance.

- A powerful first impression that showcases your firm’s services and expertise from the first click.

When 96% of legal clients begin their lawyer search online and 74% of searches end with a phone call, a strong website designed to increase online visibility is a key driver of client acquisition. Simple, optimized features can elevate basic law firm websites to high-performance engines that generate steady growth.

👉 Top-performing legal websites feature specific elements that drive results. Download Essential Elements of a Successful Law Firm Website now to learn what your website needs to reach its full potential.

6 High-Converting Law Firm Website Features That Win Clients

Like any marketing tool, law firm websites should be optimized and improved over time to enhance their lead generation capabilities. Ensuring key features and high-impact site elements are in place can strengthen your digital marketing strategy and enable your firm to drive more consultations, conversions, and long-term growth.

1. Client-Centric Features That Attract and Capture Leads

If your website is filled with legal jargon and focuses more on your credentials than your clients’ needs, it won’t appeal to prospective clients. Your website content should address the real-world challenges and legal questions your clients face on a daily basis. Visitors need to know you understand their situation and have the expertise to guide them before they submit a form or call your firm.

Today’s clients expect more than just information. They want the ability to take action: pay invoices online, check the status of their case, and securely communicate with their attorney. Your firm can support these expectations with seamless integrations with billing and CRM tools for client convenience.

- Post client-focused content that addresses common pain points and legal questions.

- Show visitors you understand their challenges and how you solve their problems.

- Use clear, consistent messaging and pair it with relevant visuals to engage and build trust.

- Offer practical features like online payments, client communication tools, and case updates to turn visitors into clients.

Focus on the outcomes your clients care about, speak their language, and ensure your website delivers more than information to provide real value for clients.

2. Fast, Mobile-Friendly Experience

A website that takes too long to load or fails to display properly on mobile devices is off-putting and challenging for users. As your firm’s digital first impression, your website should be optimized for speed and feature adaptable, mobile-first design.

When over 60% of searches happen on mobile devices and 40% of users leave sites that take more than 3 seconds to load, the importance of a fast-loading website that instantly adapts to fit mobile screens can’t be overstated.

- Conduct website and page load speed tests to understand where improvements are needed.

- Compress images and choose fast hosting to reduce loading time and bounce rates.

- Ensure navigation menus, buttons, and content display properly on various screen sizes.

Take the user experience a step further by ensuring your site is accessible for all users, including those with disabilities. Prioritize a clean, easily navigable design and straightforward information access.

3. Local Search Engine Optimization (SEO)

It’s incredibly difficult to rank in search results for broad, high-competition terms like “family lawyer,” and users searching for terms like those could be located anywhere in the United States. Instead, successful law firm websites use low-competition, location-based keywords to reach the clients searching for attorneys nearby.

Firms that prioritize local SEO are able to connect with high-intent prospective clients using search terms like “personal injury lawyer near me” or “Boca Raton divorce attorney.” Preparing your website with the right keywords and settings will enable you to reach these users early in their attorney search and generate more qualified leads in your area.

- Develop a strong local SEO strategy targeting your geographic area and relevant keywords.

- Identify the neighborhoods and regions you serve and local legal issues people search for.

- Claim and verify your Google Business Profile and other directories to enhance local visibility.

- Target local leads with Tabs3 Google Ads services to increase clicks, calls, and clients with proven ad strategies that position you at the top of local search results.

Potential clients often click the firm they see first in search results. Implementing a strong local search optimization strategy is a powerful way to increase site traffic from high-intent leads who are ready to convert.

4. Clear and Current Contact Information

Is it hard for leads to get in touch with your firm? If visitors can’t easily find your phone number, email, or office location, it’s harder for prospects to reach out. Easily accessible contact information is essential, yet many law firm websites bury details or complicate the process

Is your current website meeting your needs? From your website’s design to user experience and security, there are many factors that go into providing the best digital experience for anyone who visits your site. Running regular website audits is critical to ensure your site is reaching its performance potential.

5. Highlight Client Testimonials and Social Proof

Credibility markers and social proof help law firms win clients. Without testimonials, case results, or reviews displayed prominently on your website, potential clients have little reason to trust you over competitors. Studies show 80% of legal clients seek out online reviews and testimonials before hiring a lawyer. These elements build your reputation and differentiate your firm when leads visit your site.

- Showcase testimonials, reviews, awards, and case studies throughout your website to build trust and demonstrate results.

- Use specialized tools like Feedback Automatic to display positive reviews on your website and keep negative comments internal.

- Create dedicated landing pages for each practice area with relevant testimonials and results to show qualified leads how you can assist with their specific legal needs.

Ensure testimonials feel authentic and specific. Feedback that goes beyond generic praise is most effective. For example, “John helped me get my life back after my accident” resonates with similar clients. Highlight your firm’s success and team expertise with concrete examples to build trust and approachability.

6. Built-In Engagement Tools

High-converting legal websites do more than inform; they engage and prompt users to explore further or take the next step. Many firm websites function as static brochures rather than dynamic lead generation and client relationship tools. Implementing the right features can help you engage visitors consistently to drive more conversions.

- Follow up on form submissions quickly and create multiple touchpoints before clients decide.