When your law firm’s clients cannot pay their bills, everyone loses. Your business is in a bind. The client’s access to legal services is at risk. PayPal Pay Later offers a new solution: instant payment for your firm and manageable monthly payments for your clients. It is available now in Tabs3Pay, part of Tabs3 Billing in Tabs3 Cloud.

👉 Want to learn more about the benefits of Tabs3Pay? Schedule a demo today!

What is Pay Later?

PayPal’s Pay Later is a short-term loan between your client and PayPal: your law firm gets paid immediately, and then the client pays PayPal back over time. Pay Later offers transparent payment terms with no hidden fees. All payment issues are handled by Pay Later.

If your firm already has Tabs3 Billing in Tabs3 Cloud, you can add Pay Later to Tabs3Pay with just a few steps. If you are a new user, you can include Pay Later right from the start.

How does Pay Later benefit my clients?

Legal clients are often caught between the need for legal help and the strain of paying upfront legal fees. At the same time, law firms must collect fees to remain financially viable. Pay Later can help bridge the gap.

Overall, use of buy now, pay later products like Pay Later has expanded rapidly since 2020. Compared to traditional credit cards, these products generally use a soft credit pull (which does not affect the client’s credit score), are easier to get approved for, and may have lower fees. Especially for people with lower credit scores, particularly women and younger people, buy now, pay later offers greater access to credit than was previously available.

By allowing your clients to choose Pay Later, you can improve access to legal services without putting your business at risk. Clients can pay in manageable installments, while your firm gets paid immediately.

Ready to transform your law firm’s billing process? Schedule a personalized demo and discover how Tabs3 Cloud can transform your firm in one complete practice management solution.

How does Pay Later benefit my law firm?

Pay Later can help you serve more clients while reducing your administrative workload and financial risk. That includes:

- Stronger cash flow, because bills are paid faster

- Less time managing accounts receivable

- Better differentiation from competitors that require lump sum payments

- More success in signing up qualified leads

Is Pay Later ethical for law firms?

Pay Later does not raise any new ethical issues. Law firms have been accepting payments from buy now, pay later lenders for years. Buy now, pay later regulatory activity has focused on lenders, not the businesses that accept payments from them.

Of course, law firms have an ethical duty to conduct due diligence before adopting any electronic payment platform, like making sure the tool is PCI compliant and secure, and that it interfaces appropriately with trust and operating accounts. Law firms should also consult local rules, including those related to surcharging, when setting up a payments platform.

Tabs3Pay is a highly secure, PCI compliant electronic payments solution made exclusively for law firms. Trust account compliance is baked into every aspect of the platform. Pay Later functions the same as any other electronic payment method inside the platform. You simply get paid faster, with no manual data entry or cumbersome check processing. The Pay Later difference is on your clients’ end: each person gets to choose how they want to pay.

Promote client choice and cash flow with Pay Later

Tabs3 Billing in Tabs3 Cloud makes it easy to accept electronic payments with Tabs3Pay. It only takes a few minor changes to add Pay Later to the payment choices you offer clients. More choices means more wins, for you and your clients.

Ready to learn more? Demo Tabs3 Cloud today.

Ready to transform your law firm’s billing process? Schedule a personalized demo and discover how Tabs3 Cloud can transform your firm in one complete practice management solution.

The stakes are high: trust account mismanagement is “one of the most frequent causes of [attorney] disciplinary action.” The compliance requirements are voluminous (and sometimes esoteric). With thoughtful planning and attention to detail, however, you can stay compliant.

Note: This article covers general trust accounting principles. The specific rules that apply to your trust accounts may be different, because trust accounting rules are set by states. Make sure to check your state’s rules and consult with ethics counsel as needed.

What is trust accounting?

The guiding principle of trust accounting is simple: Attorneys (and their staff) have a special duty to safeguard their clients’ money because attorneys are fiduciaries for their clients. As fiduciaries, attorneys must act in their clients’ best financial interest. That includes:

- Maintaining separate accounts for clients’ money (the trust account) and the firm’s money (the operational account).

- Making sure that the firm’s money is never commingled with clients’ money.

- Ensuring prompt notification/disbursement when the firm receives money for the client.

- Keeping detailed records of all transactions that involve client money.

- Reconciling trust accounts frequently to detect and correct errors.

The trust account holds clients’ money, like:

- Retainers and advanced fees.

- Escrow deposits for real estate transactions.

- Settlement funds and money awards.

- Other funds received on the client’s behalf.

If an attorney mismanages the trust account, even by accident, the consequences may be serious. Clients might lose trust in the firm. The firm might be liable for damages. Attorneys could face disciplinary action (public reprimand, fines, suspension, and disbarment).

Is a trust account the same as an IOLTA account?

Sometimes people refer to trust accounts as IOLTA (Interest on Lawyer Trust Account) accounts. Not every trust account is an IOLTA account. The type of trust account depends on the interest-earning potential of the client money held.

If the client would earn a minimal amount of interest (because the amount of money is small or it will not be held for long), it is pooled with other client funds in an IOLTA account. The combined funds earn interest, which is used to support legal aid and access to justice.

Larger amounts, or amounts held for a long time, are held in regular interest-bearing accounts (not IOLTA). The interest belongs to the client.

What are the most common trust accounting errors?

The rules for trust accounting are not always intuitive, and it is easy to make mistakes. Common errors include:

- Commingling client and firm funds

- Reconciling the trust account incorrectly or not frequently enough.

- Not tracking all the required information for each transaction

Once a process tied to printers and postal mail, digital tools now enable law firms to implement efficient, cost-effective paperless invoicing. Ready to make the switch? Take the first step toward a more organized and productive invoicing workflow. Download the guide today.

6 principles for getting trust account right

Store client funds separately

This principle is simple, but it can be difficult to apply. Commingling examples include (but are not limited to):

- Using client funds to pay law firm expenses. Never pay firm expenses from the trust account, even if the money has been earned. Move it to the operating account first.

- Moving client money to the operating account before it has been earned. In most cases, retainer funds must be stored in the trust account until they are earned.

- Failing to move earned fees to the operating account regularly. This may seem counter-intuitive, but it is an example of storing the firm’s money in the trust account.

- Handling fixed fees improperly. There is significant variation among states on this issue. Some consider fixed fees to be earned upon receipt; others require lawyers to keep fixed fees in trust until earned.

Most states make an exception to the commingling prohibition for banking fees. In general, law firms may deposit their own funds in the trust account to pay for normal banking fees. Keeping a significant amount of firm funds in the trust account, however, may be a violation.

Keep thorough records

Trust accounting requires especially meticulous recordkeeping. The ABA Model Rules on Client Trust Account Records, Rule 1, provides a good overview of what is typically required:

- A journal of deposits and withdrawals from trust accounts

- A ledger for each client trust account

- Copies of retainer and compensation agreements

- Copies of any accountings to clients or third parties

- Copies of bills for legal fees and expenses

- Copies of records showing disbursements on behalf of clients

- Financial institution records like checkbook registers, bank statements, deposit records, cancelled checks, and substitute checks

- Detailed records of electronic transfers

- Copies of trial balances and reconciliations

- Copies of the parts of the client file that relate to trust accounting.

Note that ABA rules are advisory only in most cases, so you should refer to state law.

Communicate clearly

Keeping the client informed about their funds is part of the attorney’s fiduciary duty. It is also a good way to head off client misunderstandings that eat up your time and lead to disputes. Examples trust account communication include:

- The engagement letter or fee agreement, which should clearly state how money will move through the trust account.

- Statements, which should be sent regularly and should include a summary of the client’s trust account ledger. It is a best practice to send a statement whenever you pay earned fees from the trust account, even if no additional money is owed.

- Notifying the client when the attorney receives funds on their behalf. The funds must also be disbursed to the client within a reasonable period of time to avoid commingling.

Reconcile correctly and on time

Trust accounting requires three-way reconciliation. You must compare the bank statement against your trust ledger (two-way reconciliation) and also against each client’s trust ledger. All funds, down to the penny, must be accounted for.

Three-way reconciliations should be done on a regular schedule and frequently enough to catch errors promptly. Trust errors tend to snowball, so finding them early benefits everyone.

Many firms find it works best to reconcile monthly right before billing statement creation.

Write down procedures

Even if your accounting team is small, written procedures are essential for staying on track. Procedures should cover trust accounting workflows, checks and balances, and encourage prompt reporting of problems so any errors can be corrected swiftly. Procedures should be reviewed and updated regularly.

Know your state’s rules

It bears repeating—general trust accounting knowledge is necessary but not sufficient for trust account compliance. Stay up to date on your state’s rules and take advantage of local CLE resources.

👉 Set up a personalized demonstration with our experienced trainers today.

Tabs3 helps you get trust accounting right

Trust accounting is complicated. Tabs3 Financials can lighten your load.

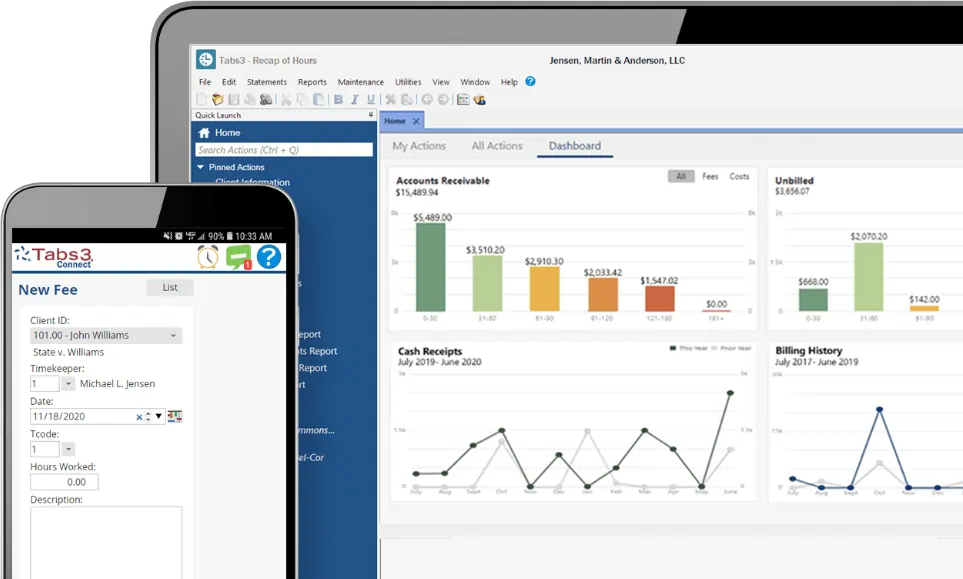

- Instant communication with your bank, easy-to-read trust ledgers, and streamlined three-way reconciliation reports so you can reconcile faster.

- Flexible recordkeeping so you can store all the details needed for compliance.

- Dashboard summaries to help you spot trust problems early.

- Seamless integration with Tabs3 Billing and Tabs3Pay, an electronic payment solution built for lawyer trust account compliance.

Tabs3 Financials is also available through Tabs3Cloud, giving you more control over where and when you work. Schedule your free demo today.

👉 Paperless Invoicing: Why Your Law Firm Should Embrace the Digital Age

Ready to transform your law firm’s billing process? Schedule a personalized demo and discover how Tabs3 Cloud can transform your firm in one complete practice management solution.

Consumers have spoken: they prefer electronic payments by an overwhelming margin. As electronic B2B transactions rise, your business clients likely are not far behind. This month, Tabs3Pay rolls out three new electronic payment options, making it even more convenient for your clients to pay their bills.

Your clients’ needs at the forefront

Tabs3Pay allows you to provide unparalleled client service in the billing function.

Clients can choose email billing with embedded payment links or a secure payment portal, depending on your Tabs3 configuration. For ongoing clients or complex matters, you can simplify the billing burden with scheduled and/or recurring payments. You can even accept payments over the phone.

Your clients choose the payment method they prefer: credit card, debit card, or e-check/ACH. Starting in May 2025, clients can also pay via Venmo, PayPal, and PayPay Pay Later, unless you disable those options.

- PayPal is one of the largest, most popular, and most trusted online payment platforms. Users can send money via credit card, debit card, or bank account. Transactions are safe and encrypted. Paypal has 432 million account holders (2024).

- Venmo is a PayPal product, and works much like PayPal. It was originally optimized for transactions among friends and social sharing, but now supports business transactions. Venmo has 64 million monthly users (2024).

- PayPal Pay Later is a buy now, pay later (BNPL) product. Your firm receives payment immediately, and the client pays PayPal over time (up to 24 months). BNPL use is growing, and is popular among younger people and those with lower credit scores. Accepting BNPL payments can help firms serve clients who are less financially secure, increasing access to legal services, while mitigating financial risk to the firm.

A trusted platform built for attorneys and legal professionals

Professional staff, attorneys, and firm managers also reap rewards from Tabs3Pay:

- Professional staff: Electronic payment systems make it easy to accept payments, reducing repetitive, error-prone manual processes. Further, Tabs3Pay is the only payment platform that is fully integrated with your existing Tabs3 software, so you can complete all billing and accounting work in a single system.

- Partners: By reducing friction at the point of payment, firms can get paid sooner, spend less time making collections calls, and reduce write-offs. That can add up to larger bonuses and more compensation.

- Managing partners: Law firm owners have special ethical obligations, and Tabs3Pay was created to meet them. All deposits go into your trust account, while debits (like fees) are only applied to operations accounts. The secure, PCI compliant payment system also reduces the risks of lost checks and check fraud while keeping your clients’ data safe.

Tabs3Pay: Your partner in exceptional client service

You spend your days working tirelessly for your clients. Tabs3Pay can lighten the load. With simple, transparent pricing, quick setup, and expert U.S.-based tech support, Tabs3Pay helps you delight every client.

Ready to learn more? Set up a demo with our payments team today.

Providing a seamless, secure, and convenient payment experience for your clients is crucial in today’s fast-paced world. Clients increasingly expect digital solutions that are not only efficient but also user-friendly and secure.

This digital-first approach also promotes transparency, which can build trust and reduce potential misunderstandings. Automated reminders also help avoid late payments while maintaining a professional relationship with clients.

Incorporating Tabs3Pay into your legal practice could be a game-changer for your firm and clients. The ability to securely accept online payments adds a level of convenience that today’s clients appreciate. All in all, your clients will love the efficiency, flexibility, and ease of use that Tabs3Pay provides, making the entire payment experience smoother and more transparent for them.

The role of payment convenience in client satisfaction

In today’s on-demand world, convenience is a top priority. Clients are no longer satisfied with outdated payment methods that require them to physically visit your office or mail a check. They want a hassle-free way to pay their bills quickly and efficiently.

Secure online payments

With a legal credit card processing solution, your clients can pay their bills anytime, anywhere. This is particularly beneficial for clients who are unable to visit your office in person. With a few clicks, they can settle their accounts from the comfort of their home or on the go from any mobile device.

Online payments are not just about convenience; they also provide a critical layer of security. Clients can rest assured that their sensitive financial information is protected by top-tier security measures to reduce the risk of fraud or theft. Tabs3Pay offers secure online payments that are compliant with the Payment Card Industry Data Security Standard (PCI DSS), which offers an exceptional level of security and safeguards credit card information against fraud and data breaches.

Optimized for mobile devices

The ability to pay for goods and services by phone or tablet is expected by today’s consumers. Tabs3Pay is mobile-optimized, providing a seamless and user-friendly experience on all devices.

Your clients can easily view their bills, make payments, and receive instant confirmation of their transactions, all from their mobile devices. This feature is particularly beneficial for tech-savvy clients who prefer to manage their finances digitally.

With the ability to pay with Apple Pay or Google Pay using a digital wallet, your clients will appreciate the convenience of not having to enter card information each time they need to make a payment.

Building client trust through payment transparency

Trust is key for any attorney-client relationship. Clients entrust you with their sensitive information, and in return, they expect honesty, integrity, and transparency. This extends to all aspects of your services, including the payment process.

Surcharging

One of the standout features of Tabs3Pay is surcharging. This optional service allows your firm to pass on the expense of credit card processing fees to the cardholder. While this might seem like a minor detail, it plays a significant role in promoting transparency. With surcharging, clients can see exactly what they are being charged for. Everything is laid out clearly, which can enhance trust and satisfaction.

Automated payment options

Another feature that promotes transparency is scheduling automated payments with your clients. With Tabs3Pay, you can schedule payments to automatically process on a specified day of the month or on a one-time basis. Setting up a payment schedule is both convenient for your clients and your firm.

Scheduled payments also provide a clear record of payment and amounts, which can be helpful for clients who like to keep track of their finances. By keeping your clients informed and up to date, you show them that you respect their time and financial obligations, bolstering their trust in your firm.

Enhance client experience

Legal-specific software solutions are designed to streamline your practice and enhance your clients’ overall experience with your firm. Look for the tool that can do the most for your clients. Tabs3Pay isn’t just a payment processor; it’s a solution that offers a range of convenient features that can help you meet your clients needs.

Trust account support

For clients who have funds in trust with your firm, the proper handling of these funds is a matter of significant concern. Tabs3Pay is designed with trust accounting in mind, offering an easy way for clients to deposit trust funds into their account separately from the way they pay for billed work. It’s another way that Tabs3Pay promotes transparency and builds trust between your firm and your clients.

Securely emailed payment link

These days, law firms can offer clients the option to pay their bill safely and securely via a link included with their emailed statement. The Tabs3 Payment Link feature makes it easy for clients to settle their accounts, reducing the potential for confusion or misunderstandings about billing. This seamless integration saves time for your firm and ensures that your clients’ payments are processed and recorded accurately.

Seamless integration

Tabs3Pay’s strength is attributed to its seamless integration with other Tabs3 products, providing a unified, efficient experience for both law firms and clients. Consolidate your tech stack with Tabs3 Cloud, which includes:

Tabs3Pay integrated with Tabs3 Billing and Trust Accounting to provide a comprehensive solution for managing law firm finances and payments, enhancing the client experience with a smooth, easy-to-use payment solution.

Improve client satisfaction with Tabs3Pay

In the increasingly competitive legal field, providing an exceptional client experience is a necessity. By adopting Tabs3Pay, you’re not just improving your payment process but also enhancing your clients’ overall experience with your firm.

Show your clients that you understand their needs and are committed to meeting them. In doing so, you build stronger, more trusting relationships that can lead to increased client satisfaction, loyalty, and ultimately, greater success for your firm. Ready to see how Tabs3Pay can increase client satisfaction? Schedule a demo today and see the difference it can make.

As many as 18% of Americans don’t use credit cards at all. Others may not want to use credit for large invoices. But even if your client doesn’t want to use their credit card, they may still prefer the convenience of online payment compared to paying their bills by cash or sending checks in the mail.

For today’s law firms, modern payment solutions have to offer clients flexibility. Thankfully, there are solutions that can accommodate this need for flexibility while providing significant benefits to both the client and your law firm. One particularly effective option is ACH payments.

What are ACH payments?

ACH, which stands for “automated clearing house,” is a type of electronic payment in which a transfer is made directly from a bank or credit union.

ACH payments allow law firms to:

- Accept payments online

- Automate your billing system

- Provide an alternative payment system to credit cards or checks

ACH payments are becoming increasingly common in today’s payment landscape, even if we don’t always realize it. Examples of ACH payments include your employer depositing your paycheck via direct deposit, and when you set up an automatic bill payment directly from your bank account.

What are the benefits of accepting ACH payments?

From convenience to cost, incorporating ACH payments into your list of payment options can benefit both the client and the law firm. Consider these factors when weighing whether to add ACH to the list of your law firm’s payment methods.

How ACH payments benefit your law firm’s clients

For clients, ACH payments offer a convenient alternative to credit card payments.

If your clients are among the 18% of Americans who don’t use credit cards, then ACH payments provide an avenue for them to take advantage of online bill payments, which are typically faster and easier than payment by cash or check.

ACH payments are also:

- Safe and secure, with a more predictable arrival time compared to snail mail

- An easy form of contactless payment

- A reliable way to reduce paper usage for both environmental and cost purposes

- Convenient for clients who do not want to add to their credit card debt

Finally, unlike credit card payments, ACH payments do not require a surcharge. For clients who have a fixed budget or need to manage their costs, this can be an appealing benefit.

How ACH payments benefit your law firm

Similar to online payments via credit cards, ACH payments provide fast and easy payment options for your law firm, saving you both time and money.

- ACH payments save time: Facilitating online payments with an alternative to credit cards can encourage clients to pay online who might previously have relied on check or cash payments. This reduces the number of administrative tasks to complete every month, freeing up time for more important tasks.

- ACH payments save money: When clients have a payment option that fits their needs and constraints, they are more able to pay on time, in full. This leads to more on-time payments and fewer collection calls.

Are there any drawbacks to ACH payments?

ACH payments are growing in popularity thanks to their numerous benefits to law firms and clients. But what about the drawbacks?

All financial transactions carry some risk

No financial transaction is completely, 100% risk-free, but ACH payments are a low-risk payment option. There are numerous internal controls protecting ACH transactions (even most U.S. federal government payments are made via ACH).

For any business, there is always some risk of phishing by bad actors. If you have clients who are not used to the online payment process, it may be helpful to provide step-by-step documentation on how to submit their ACH, as well as how to identify red flags for phishing scams, i.e., “We will only ever email you via _____.”

It’s important for your law firm to complete due diligence on any financial transaction platform. Tabs3Pay, for example, ensures PCI compliant and secure transactions, as well as additional security features such as restricted user access to client data.

How can law firms accept ACH payments?

Adding a new payment method can feel like an intimidating process. Thankfully, there are ways to streamline the process for quick and easy adoption:

- Choose your ACH provider, preferably one that specializes in law firm payment processing to ensure compliance. If you are already using Tabs3Pay, then you’re all set. Tabs3Pay offers ACH payments as an “eCheck” payment method for clients, alongside online credit card payments and trust accounting.

- Communicate this payment option with your clients. For new clients, this can be easily integrated into the onboarding process with notice regarding their payment options. For veteran clients, this can be an opportunity to let them know about ACH payments and answer any questions about the options.

- For clients who preferred writing checks in the past, this may not change moving forward. Some clients have well-established preferences. However, others may just be nervous about trying something new. Make sure to provide clear explanations and have resources on hand if they’re curious and want to learn more about the process.

- When you send out your monthly invoice, add a note alerting clients that they can now pay by ACH for fast, easy, and secure payment processing.

The verdict on ACH payments for law firms

ACH payments are an easy alternative to credit cards for firms that want to provide added flexibility for their clients. They are a streamlined, simple, and secure payment method.

For law firms looking to provide ACH payments, the best option is to work with an integrated legal billing system that offers both online credit card payments and ACH payments in one convenient place for your clients.

Tabs3Pay enables law firms to provide a simple and easy billing process for their clients, with options for credit card payments, ACH, and trust accounting. Tabs3Pay is part of the Tabs3 suite of fully integrated billing, accounting, and practice management tools designed to help law firms increase productivity and profitability.

Start your free trial or schedule a demo and explore how Tabs3Pay’s client- and law firm-friendly payment tools can benefit your practice.

The legal profession, known for its adherence to tradition and precision, is experiencing a significant shift in how financial transactions are handled. Gone are the days when clients were content to pay by cash or check, waiting for banks to process these payments at a leisurely pace. Today, the demand for immediacy and convenience in all aspects of service, including payment, is undeniable. This transformation is driving law firms to adopt modern payment solutions, with law firm credit card processing emerging as a critical component in maintaining competitive edge and operational efficiency.

Modern clients are accustomed to the ease and security of digital transactions seen in other service sectors, and they now expect the same from legal service providers. This shift represents more than just a change in payment methods—it’s a fundamental evolution in the client-service provider relationship. The ability to pay instantly for services via credit card not only meets the growing client expectations but also streamlines the transaction process, reducing administrative burdens and enhancing the overall client experience.

The transition to digital payment solutions like credit card processing is facilitated by advancements in technology that ensure secure and efficient transactions. As law firms navigate this new landscape, selecting the right tools and partners for implementing these systems is essential. Law firm credit card processing platforms, such as Tabs3Pay, are specifically designed to meet the unique needs of the legal industry, ensuring compliance, security, and client satisfaction. This move towards integrated payment solutions is not just about keeping up with technology—it’s about taking proactive steps to future-proof law practices in a digital world.

Why credit card processing is essential for law firms

Law firm credit card processing offers many benefits that can directly impact your bottom line and client satisfaction. In an era where convenience and speed are paramount, providing a seamless payment experience is crucial. Here are a few key benefits of implementing credit card processing at your law firm.

Enhanced cash flow and reduced administrative tasks

For many law firms, managing cash flow efficiently remains a challenge. Traditional payment methods often lead to delays and increased administrative burdens. Implementing law firm credit card processing with solutions like Tabs3Pay can significantly enhance cash flow—studies show 30 to 40% improvements —and reduce the time spent on financial administration. Funds from credit card transactions typically settle quickly, meaning your firm can access earnings sooner than it would with check deposits.

Client satisfaction and growing expectations

The legal industry is no exception to the growing customer expectation for convenience in making payments, including for business transactions. Providing the ability to make payments by credit card helps meet that demand while also creating a simple payment experience that can be completed from any device.

Overall, accepting credit cards offers greater predictability and stability, opening up opportunities to proactively plan for your firm’s future based on more accurate financial projections.

Increased efficiency and reduced administrative burden

Processing payments via checks or cash can be cumbersome. It involves manual handling, trips to the bank, entry into accounting systems, and reconciliation processes—all of which consume valuable time that could otherwise be spent on billable legal work. Credit card processing automates much of this process. By integrating with legal billing and accounting software, like Tabs3Pay does, transactions are recorded and reconciled in real time. This automation significantly reduces the administrative burden and minimizes the risk of errors, allowing staff to focus on more critical tasks that directly contribute to their firm’s success.

Predictability and financial planning

Accepting credit cards provides a more predictable stream of income, a crucial factor for any law firm’s financial planning. With traditional payment methods, predicting when payments will be received can be challenging, complicating budgeting and financial planning. Credit card processing offers a more consistent and reliable timeline for receiving payments, facilitating better cash flow management and financial stability. This predictability enables law firms to plan with greater confidence, allocate resources more efficiently, and make strategic decisions based on reliable financial data.

How to choose the right credit card processing solution

Not all credit card processors are suitable for the unique needs of law firms. It’s crucial to select a service that understands and aligns with the legal industry’s standards. Here are a few key things to look for when selecting a credit card processing service.

Choose a service that is designed for law firms

General business credit card processors often do not cater to the unique needs of the legal industry, particularly around the management of Interest on Lawyers Trust Accounts (IOLTA) and compliance with the American Bar Association’s rules. Law firm credit card processing solutions must ensure that client funds are properly handled to avoid any impropriety or even the appearance of impropriety. For instance, transaction fees should not be deducted from trust accounts but from the firm’s operating account.

Data security and PCI compliance

Data security is paramount in any industry, but the legal sector faces particularly high expectations due to the sensitivity of the information they handle. Law firms must ensure that the credit card processing solution they choose is Payment Card Industry Data Security Standard (PCI DSS) compliant. This standard helps protect sensitive cardholder data from theft and misuse. Moreover, law firms should inquire about additional security measures, such as end-to-end encryption and tokenization, which can further protect client data from breaches.

Trust account management

Properly handling client funds is paramount in legal practice. Most general business credit card processors deposit funds and deduct fees from the same account, which can complicate trust account management. However, legal-specific solutions like Tabs3Pay are designed to deposit funds directly into the trust account while withdrawing fees from the operating account. This setup prevents the mismanagement of client funds, which is crucial for compliance and trust in legal practice.

Tabs3Pay: A credit card processing solution tailored for law firms

Tabs3Pay stands out in the crowded field of payment processing solutions by being specifically designed to meet the unique needs of law firms. This specialized focus translates into a host of benefits that directly address the operational, compliance, and financial challenges faced by legal professionals today. Here’s how Tabs3Pay offers a superior solution for law firm credit card processing.

Seamless integration with practice management software

One of Tabs3Pay’s most significant advantages is its seamless integration with Tabs3’s legal practice management software. This integration is critical for law firms as it allows for the synchronization of financial data across billing, accounting, and case management modules without any manual intervention. When a client makes a payment via Tabs3Pay, the transaction details are automatically updated in real time across all relevant systems. This saves time and reduces the potential for human error in data entry, ensuring accuracy in financial reporting and client billing.

Designed with legal compliance in mind

Tabs3Pay is built with a deep understanding of the legal industry’s regulatory environment. It ensures that all transactions comply with the American Bar Association’s rules and local jurisdictional requirements for handling client funds. Specifically, Tabs3Pay addresses the critical aspect of trust accounting. Unlike general business processors, Tabs3Pay automatically directs fees to be taken from the operating account while depositing client funds directly into trust accounts. This feature is vital for maintaining ethical compliance and safeguarding client monies, a cornerstone requirement in legal practice.

Enhanced client experience

Tabs3Pay enhances the client experience by offering a convenient and secure way to pay legal fees. Clients can pay from anywhere, at any time, using their preferred payment method, whether it’s credit card, debit card, or even ACH transfers. This flexibility improves client satisfaction as it aligns with the modern consumer’s expectations for quick and easy transactions. Additionally, the system supports mobile payments, which are increasingly becoming the norm in all transactions.

Learn more about Tabs3Pay

Tabs3Pay is part of Tabs3 Software, which means that if you want to sidestep double data entry by having your accounting seamlessly update with new payments, you can. With flat rate options and more, you can find an approach that works for your firm.

Learn more about the benefits of Tabs3Pay.To see firsthand how Tabs3Pay can benefit your law firm, request a free trial or schedule a walkthrough demo today.

In the legal profession, managing client trust funds is not only a matter of sound financial practice—it’s a matter of compliance and ethical duty. Unfortunately, many firms still rely on outdated or generic accounting systems that don’t meet the specific requirements of legal trust accounting.

If that sounds familiar, you’re not alone—and there’s a better way. Modern trust accounting software for lawyers is purpose-built to meet bar association rules, reduce manual work, and improve accuracy.

Need a proven legal trust accounting solution?

Explore Tabs3 Trust Accounting Software

What Is Legal Trust Accounting and Why Does It Matter?

Legal trust accounting refers to the process of tracking and managing client funds held in trust, separate from a law firm’s operating account. These funds may include retainers, settlements, or other payments made in advance of legal services.

The American Bar Association (ABA) and all state bar associations require attorneys to manage these funds according to strict regulations. The most basic rule? Never commingle trust funds with firm operating funds.

In addition to ethical requirements, trust funds are subject to different tax laws and must be documented thoroughly to protect both the client and the firm.

For that reason, it’s vital for law firms to use tools that:

-

Keep trust records separate and secure

-

Track detailed transactions

-

Generate audit-ready reports

-

Ensure state bar compliance

Why Law Firms Should Use Trust Accounting Software

Even experienced attorneys can struggle with the complexity of managing multiple client trust accounts manually. That’s where software makes a major difference.

Trust accounting software for lawyers provides automation, accuracy, and visibility across all trust-related activity. The benefits include:

-

Compliance & Risk Reduction – Built-in safeguards prevent overdrafts and unauthorized access

-

Time Savings – Automated entries, reconciliations, and reporting streamline operations

-

Better Oversight – Dashboards and reports offer a real-time view of trust account status

-

Audit Readiness – Generate detailed reports that meet state and ABA requirements

When designed specifically for law firms, trust accounting software removes the guesswork—and the risk—from trust fund management.

Read more: 6 Ways to Improve Your Firm’s Trust Accounting

Trust Accounting Best Practices for Lawyers

Even with the best tools, following these legal trust accounting best practices is key to avoiding errors:

Maintain Accurate, Segregated Records

Never mix trust and firm funds. Ensure records are updated in real-time and that each transaction is logged with full documentation.

Enforce Strong Security Protocols

Trust accounts are frequent targets for fraud. Use software that limits access, enforces user permissions, and logs all activity.

Monitor Purpose-Specific Use

Trust funds must only be used for their designated legal purpose. Track and document every disbursement carefully.

Prioritize Transparency

Make trust records accessible within your firm and shareable with clients when requested. Transparency builds trust—and helps avoid complaints.

Limit Transactions to Minimize Risk

Fewer transactions = fewer chances for error. Structure payment plans and invoicing to reduce transaction volume where possible.

Read more: Six Trust Accounting Best Practices for Lawyers

Tabs3: Your Versatile Trust Accounting Software Solution

Tabs3 Trust Accounting software is built exclusively for law firms—designed to make trust fund management intuitive, compliant, and efficient.

With key features accessible from a single dashboard, you can reduce time spent on administrative tasks and stay focused on serving your clients.

-

Track multiple client trust accounts

-

Run three-way reconciliations

-

Prevent errors with built-in safeguards

-

Securely process deposits with Tabs3Pay

-

Seamlessly integrate with Tabs3 Billing, General Ledger, and Accounts Payable

Whether your firm is managing one trust or hundreds, Tabs3 simplifies the process and helps keep you compliant.

How Tabs3 Software Integrates Across Your Firm

Tabs3 Trust Accounting works hand-in-hand with the rest of the Tabs3 Financial Software Suite to deliver firm-wide financial visibility:

-

View trust balances within the Matter Manager

-

Include trust info on statements and work-in-process reports

-

Sync activity across Billing, General Ledger, and Accounts Payable

-

Accept credit card deposits with Tabs3Pay

All trust activity is recorded automatically, so your books stay clean—and your team stays audit-ready.

Three-Way Reconciliation & Trust Fund Protection

Tabs3 includes a Three-Way Reconciliation Report, required in many jurisdictions, to confirm that:

-

Bank balances

-

Individual client ledgers

-

Internal trust ledgers are all in sync.

You’ll also be alerted if an account drops below a minimum balance or if any transactions are flagged for review—helping prevent ethical violations and client complaints before they happen.

Additional Features of Tabs3 Trust Accounting

-

Customizable Dashboards – Pin your most-used actions and view recent transactions at a glance

-

Positive Pay Export – Export approved checks to your bank for added fraud protection

-

Role-Based Security – Customize access to sensitive data based on staff roles

-

Cloud and On-Premises Availability – Choose what fits your firm’s infrastructure

Streamline Your Trust Accounting with Tabs3

Experience the difference that Tabs3 Trust Accounting software can make for your firm! All Tabs3 Financials software, including Trust Accounting, General Ledger, and Accounts Payable, are available to access with Tabs3 Cloud and on-premises subscription plans. View our pricing plans for more information and find the solution that best fits your needs.

Schedule your free demo today.

Lawyers spend their days prioritizing and juggling competing demands from clients, deadlines, and an assortment of unavoidable administrative tasks.

With so many critical to-dos on the docket every day, the last thing a lawyer needs is to have to chase down payment after their work is done.

Legal teams are all too familiar with the challenges associated with payments, yet many law firms still rely on traditional payment methods. Manually sending out invoices and then waiting for checks to come in can lead to decreased cash flow and frustration in client relationships. It also requires unnecessarily complicated workflows, adding more time to what should be a simple process of collecting payment.

However, there is a way to create ease, transparency, and rapid payments for client invoices. A legal software solution like Tabs3Pay can help you take credit for all the work you do and get your firm compensated without a hassle.

7 ways Tabs3Pay makes it easy to take credit for your work

In the legal world, time is of the essence. The faster you receive payment for your services, the better you can allocate resources and plan for the future.

With Tabs3Pay, you can easily accept credit card payments from your clients. This accelerates the payment process, eliminates manual errors, minimizes write-offs, and ensures PCI compliance.

In short, Tabs3 gives your firm an advantage at every stage of the billing process.

1. Get paid faster

Because online payments are more convenient, clients are more likely to pay on time and in full when you offer this option.

With Tabs3Pay’s mobile-friendly options, your clients can pay any invoice upon receipt through an emailed link or from the Tabs3 Client Portal, no matter where they are. Clients can easily view their bills, make payments, and receive instant confirmation of their transactions, all from their mobile devices.

For clients on retainer or with other appropriate payment structures, automated payments can take the guesswork out of the client payment process. Schedule payments to process one time or on a specific day every month.

With automated payments, clients don’t have to spend time each month paying off invoices, and you can focus on your client’s case matters instead of their outstanding bills.

Nor will your clients have to run to the post office; you can request trust account replenishments directly from the Tabs3 Matter Manager and send them their secure payment link via email.

Finally, but most crucially, funds sent through Tabs3Pay are available in as little as 24 hours. That means when you “get paid,” you actually get paid.

2. Automate payments to prevent manual error

Say goodbye to manual data entry and hello to a more efficient, error-free financial workflow.

Manual errors in payment processing can be costly and time-consuming. When errors occur, they not only disrupt your financial operations but also damage your firm’s reputation.

Tabs3Pay eliminates these manual errors thanks to a range of automated processes. From batch billing to automatically withdrawing processing fees from operating accounts, you can ensure payments are processed accurately and save your firm time that could be better spent serving clients.

3. Manage collections and reduce write-offs

No one wants to chase down clients to collect outstanding payments. It’s tiresome, strains client relationships, and can lead to avoidable write-offs.

With Tabs3Pay, you can:

- Proactively monitor the status of invoices

- Create flexible payment schedules for clients with large outstanding balances

- Send convenient reminders to clients with approaching due dates

- Accept a broad range of credit cards, including Visa®, MasterCard®, Discover®, American Express®, Diner’s Club®, and JCB credit cards, as well as Visa and MasterCard debit cards

4. Reduce processing fees

High or unpredictable processing fees have historically been a barrier to accepting credit card payments for law firms. Tabs3Pay helps mitigate this issue by offering:

- Zero initial setup fees

- Transparent and predictable pass-through fees

- Optional client surcharging

5. Secure and PCI-compliant transactions guaranteed

Security is essential when it comes to handling financial transactions, especially in the legal industry, where client confidentiality is paramount. Tabs3Pay is designed to ensure PCI compliance, meaning that all payment information is handled securely and in accordance with industry standards.

Your clients can trust that their financial data is safe, and you can rest easy knowing that you are in compliance with legal and regulatory requirements.

6. More accurate financial reporting

Running a healthy practice requires comprehensive insight into your firm’s financial data. To achieve that, you need access to robust reporting software.

Tabs3Pay is fully integrated with Tabs3 Billing, providing firms access to customizable financial reports. With Tabs3 Billing’s dashboards, you can use graphs to quickly assess Accounts Receivable, Work-in-Process, Cash Receipts, and Billing History historical data.

Use detailed reports to understand which clients are struggling and which clients consistently pay their invoices on time. This reporting can give your law firm the information it needs to make strategic decisions for profitability and growth.

7. Greater client satisfaction

Using Tabs3Pay benefits law firms, but it can also improve the overall client experience. The flexibility and convenience of credit card payments with a legal-specific payment processor make it easy for you to stay focused on your matters.

Clients appreciate the convenience of credit card payments. By providing a transparent system with built-in consistency and security, Tabs3Pay fosters client trust and a more positive relationship with your firm.

In turn, this benefits your firm’s reputation and can lead to more business in the form of referrals because happy clients are more likely to recommend your services to others.

Improve your payment processing with Tabs3Pay

In the legal industry, every advantage for your law firm can serve as a competitive edge.

Tabs3Pay improves all aspects of the payment process, both for your team and your clients. It lets you streamline non-billable tasks, improve client satisfaction, and take credit for all your work. It also works seamlessly with Tabs3 Billing and PracticeMaster, helping law firms create a customizable system for managing and growing their practices.

Ready to see how Tabs3Pay can transform your billing process and your practice? Schedule a demo or sign up for your free trial today.

Tax season doesn’t have to be a time of stress and last-minute scrambling for law firms and attorneys. With the right preparation (and tools), you can turn this often-dreaded period into a smooth, manageable process.

Whether you’re flying solo or are part of a large legal practice, there are straightforward steps you can take to get your financial house in order well before you need to file taxes for the year.

Let’s review some essential tips to ensure your law firm is ready to meet tax season head-on.

Make tax preparation a year-long process

Tax prep is inevitable. If you chip away at the main tasks and stay organized during the year, you’ll barely register the stress of this notoriously challenging season.

Prepare for tax season throughout the year with efficient record-keeping and billing practices. Keeping documents organized prevents the end-of-year or last-minute scramble to balance accounts and locate information to complete tax forms.

For example, use the advanced reporting features in your legal billing software to keep track of your accounts receivable, expenses, write-offs, and other financial information each month.

Additionally, check in on your general ledger processes early to stay on top of your bank account balances and reconciliation status, and correct coding errors when necessary.

What else can you do to stay on top of your tax-related tasks? Here are five more tips.

1. Manage IRS Form 1099 year-round

Many law firms struggle with IRS Form 1099-MISC and Form 1099-NEC each year, and each form has different requirements to follow. For example, the IRS requires Form 1099-NEC when your law firm pays over $600 in compensation for services to individuals who are non-employees, such as court reporters, expert witnesses, co-counsels, jury consultants, etc.

Who issues Form 1099s?

Typically, the payor of a taxable settlement or judgment payment issues Form 1099-MISC to the payee. However, some law firms might be required to issue a form 1099-MISC if they play a significant role in overseeing and managing the client’s settlement or trust funds.

When do law firms receive 1099s?

In addition to issuing numerous 1099s, your law firm should receive 1099s from clients who pay you $600 or more during the year for legal services or nonlegal services. The 1099s you receive must be included with your law firm’s business tax return.

When should 1099s be issued?

The deadlines range from January 31st to the end of February, depending on the type of form 1099 being issued.

You can avoid headaches with 1099s by tracking payment activity throughout the year. Law firm accounting software helps you record payments and receipts that require 1099s, prepare tax forms, mail recipient copies, and file the forms electronically with taxing authorities.

2. Track deductions and expenses

Many expenses your law firm incurs can be deducted on tax returns. Examples of typical law firm deductions include, but are not limited to:

- Credit card transaction fees

- Travel and mileage

- Office expenses

- Continuing Legal Education (CLE)

- Advertising and marketing

- Insurance premiums

- Professional dues

- Research materials

- Retirement plan contributions for employees

- Fees for professionals

Your tax professional should advise you about the business expenses you can deduct.

However, you need to provide your tax professional with accurate and complete information about law firm expenses for them to determine which expenses can be used as law firm deductions for tax purposes.

Tracking expenses throughout the year and posting the amounts to the correct categories is essential. Legal accounting software can help, especially when it’s time to print a detailed report of the law firm’s expenses for the year.

3. Invest in legal accounting software

If your law firm is manually entering and preparing financial reports or using software not specifically designed for law firms, switching to a law firm accounting software may be the best way to prepare for tax season.

Legal accounting software streamlines your law firm’s accounting process and provides enhanced financial information about your law firm, which decreases the risk of costly errors and mistakes.

When choosing legal accounting software, search for a provider that integrates with your practice management software. Many systems also integrate with other products a law firm might use, such as document management platforms, secure file sharing, payroll services, and tax form preparation and filing.

4. Complete your year-end financial analysis

Attorneys and law firms need to perform a year-end financial analysis for many reasons, including preparing for tax time.

Because you may need to take care of outstanding issues before the end of the year, you benefit from performing these year-end accounting and financial steps in November:

- Identify and collect outstanding accounts receivable. Ensure all billing and time entries are current, prepare an accounts receivable report, and take steps to collect outstanding balances.

- Review the law firm’s accounts payable report to ensure all payments due before the end of the year are paid.

- Ensure all client ledgers are up-to-date and balanced. Reconcile all trust accounts before December 31st.

- Review your Owner’s Draw account to ensure attorneys are paid all amounts owed to date. If you have unpaid receipts or travel expenses, pay those now before the end of the year.

- Make year-end charitable donations and retirement contributions to reduce taxable income.

Finally, prepare and review the law firm’s financial statements. Financial statements include income statements, balance sheets, and cash flow statements. Your law firm’s financial statements give you an overview of the practice to ensure everything is recorded and reconciled.

5. Know your tax filing deadlines

Various tax filings have different deadlines. Check with your tax professional to verify tax deadlines now so you are not in the position of rushing to complete financial reporting and tax forms at the last minute.

You should also know tax deadlines for filing payroll taxes, quarterly taxes, and other tax obligations for the law firm.

Tabs3 Software simplifies tax season for law firms

Tabs3 provides reliable and trusted service to lawyers and law firms. Our legal accounting software has effective tools to manage all aspects of your law firm’s finances, from trust accounting and billing clients to tracking expenses and preparing for tax season.

To learn more about how Tabs3 can help make tax season less stressful by managing your daily law firm finances, schedule a free demo today!

Every detail matters when you’re running a legal practice. And while generic accounting software may get the job done, it lacks specialized features that have the potential to make or break a law firm’s financial compliance and efficiency.

So, what are you sacrificing by not opting for a legal-specific accounting solution?

Let’s explore the distinct advantages of legal-specific accounting software and why making the switch is necessary for law firms that want to stay at the top in a highly competitive industry.

Understanding the legal industry’s unique accounting needs

The legal industry has specific accounting needs that differ significantly from those of other industries. These requirements stem from the industry’s regulatory environment, trust and IOLTA account management, client expense tracking, and the need for meticulous time tracking and billing.

Regulatory environment

Law firms operate within a strict regulatory framework, with in-depth financial reporting and compliance requirements. Failing to comply with bar association rules can result in sanctions or reputational damage—even disbarment.

Legal-specific billing and accounting software is designed to adhere to these regulations, with baked-in safeguards that reduce the risk of non-compliance.

Trust and IOLTA account management

Trust accounts, also known as IOLTA accounts (Interest on Lawyer Trust Accounts), hold client funds for various transactions.

Because the money in trust is the client’s property until services are performed, billed for, and approved (or disbursed, in the case of settlement awards), lawyers have a fiduciary responsibility to keep it safe.

IOLTA accounts come with complex rules, and failure to comply can lead to severe penalties. Legal-specific accounting software offers features to manage these accounts accurately and efficiently, minimizing the risk of errors.

Client expense tracking

Law firms often incur expenses on behalf of their clients that need to be accurately tracked and billed for. Improper expense tracking can lead to financial losses for a firm or overcharging clients.

Time tracking and billing

Accurate and timely billing is crucial for law firms. Lawyers that bill based on hours accrued put their reputation (and ability to practice) in jeopardy if they pad their hours or overcharge their clients, even unintentionally.

The limitations of general accounting software

While general accounting software, like QuickBooks, is widely used across many industries, it lacks the specialized features needed to handle the unique accounting needs of law firms. Consider the following limitations of general accounting software.

Lack of legal-specific features

General accounting software does not cater to the specific needs of law firms, such as trust accounting, client expense tracking, and legal-specific reporting. Without these features, your law firm may experience inefficiencies and potential errors in your accounting processes.

Inefficiency

Customizing general accounting software to meet the unique needs of a law firm can be a complex and time-consuming process. Even if your generic software offers some level of customization, it may result in less-than-optimal solutions that do not fully meet your firm’s needs.

Risk of errors

Using multiple software solutions for accounting and billing can lead to communication gaps and discrepancies, increasing the risk of errors. Errors at your firm can result in financial losses and erode client trust.

Six benefits of legal-specific accounting software

Legal-specific accounting software is designed to meet the unique accounting needs of law firms. It offers several advantages to enhance your firm’s productivity and accuracy in managing your accounting needs.

1. Reduced compliance risks

Legal-specific accounting software is designed in compliance with the strict regulations of the legal industry. It includes features like trust account management and detailed financial reporting, reducing the risk of non-compliance.

2. Customizable workflows

The best law firm accounting software enables you to tailor the software to meet your firm’s operational needs. This flexibility can significantly improve your firm’s productivity and efficiency, which allows you to focus on higher-level tasks.

3. Effective management of trust funds

The management of trust funds presents a unique set of challenges that require specialized solutions. Legal-specific accounting software is engineered to facilitate the meticulous administration of trust funds, streamlining the process lawyers must use to track, manage, and reconcile accounts.

By incorporating built-in safeguards, the software prevents common errors like overdrawing accounts, ensuring accuracy and compliance in managing trust funds.

4. Efficient routine accounting

Handling routine accounting tasks can be a time-consuming process. Legal-specific accounting software streamlines these tasks, allowing you to focus on client service.

5. Integration with practice management software

Ideally, your law firm accounting software will integrate seamlessly with practice management software, providing a comprehensive solution for your firm’s accounting and operational needs.

Integration offers several benefits, including:

- Cost savings when separate software tools aren’t needed

- Improved efficiency, resulting in time savings

- Reduced risk of errors

Seamless integration between practice management and legal accounting software eliminates the need for duplicate data entry, thereby enhancing operational efficiency and data integrity.

6. Detailed reporting and account management

Legal-specific accounting software enables you to generate detailed financial reports that provide instant insights into your firm’s financial health. It also allows you to manage your chart of accounts efficiently, catering to your firm’s specific needs.

Elevate your firm’s accounting practices with Tabs3 Financials

Choosing a legal-specific accounting software is critical for any law firm committed to operational excellence. Tabs3 Financials offer a comprehensive array of features meticulously designed to meet the distinct requirements of the legal sector.

With Tabs3 Financials, law firms enhance operational efficiency, minimize the likelihood of errors, and ensure steadfast adherence to regulatory mandates.

Unlike generic accounting software, Tabs3 Financials is designed specifically for law firms, offering seamless integration with Tabs3 Billing. From within a single platform, you can manage:

- Law firm operations and workflows

- Trust Accounting

- Accounts Payable

- Chart of accounts

- General Ledger

- Billing and payments

- Tax filing for 1099s

Ready to transform your law firm’s accounting processes with Tabs3 Financials? Get in touch with us today for a free demo.