The close of the calendar year is a natural time to mull over the past year and plan for the next. Planning, however, can be a challenge when law firms are operating within a fluid economic environment, including shifting economic policies, rising inflation, and increasing pressure around technology adoption.

To prosper in 2026, firms must strike a balance between rigorous fundamentals and adaptive resilience. Taking stock in the following five areas can help you find that balance.

👉 Want to learn more about the benefits of Tabs3Pay? Schedule a demo today!

1. Your business model and processes

Ask yourself: will our business model allow us to adapt rapidly to market changes? Proactively diversifying aspects of your practice can help mitigate risk.

- Practice areas and subspecialties. If your firm serves clients in multiple practice areas, you may be in a better position to shift gears if a practice area contracts. If you specialize in a single area, it may be feasible to add a new subspecialty or adjacent service so you are less dependent on that line of work.

- Types of engagements. Accepting only one type of engagement, like lengthy litigation matters, can lock you into a rigid revenue cycle. Taking stock of opportunities to add other services, like retainer cases, can improve cash flow.

- Fee arrangements. Many firms are using value-based pricing, milestone pricing, and other alternative fee models. Alternative fee agreements can offer more financial certainty for you, and clients may also prefer them. You can leverage historical time data to set fees that accurately reflect the effort you are likely to expend.

Take the time to reinforce the operational fundamentals that create a solid foundation for your firm: policies, procedures, and workflows.

- Time entry. Review your fee entry procedures and workflows for possible improvements. If you have not established guidelines on fee narratives, now may be a good time to do so. In addition to meeting clients’ billing requirements, the fee narrative is a chance to speed up collection by describing the work in a way the client understands and values.

- Invoicing/statements. It is important to send statements on a regular cadence (usually monthly) for all fee structures. Regular invoicing can keep you top of mind for clients and makes collections easier. For alternative fee matters and longer legal processes, monthly statements can reassure clients that their matter is progressing.

- Collections. Cash flow is always critical for small and midsized firms, and that goes double in uncertain times. By doing a bit of collections work each month, instead of a major push once a year, you may collect more rapidly, and even collect more overall. If you frequently struggle with collections, consider implementing evergreen retainers and structuring engagements so you can withdraw if the retainer is not refilled on time. You can also make it more convenient for clients to pay by offering electronic payment options, including Venmo and PayPal Pay Later.

- Trust accounting. Make sure your written procedures and cross-checks are up to date. If you accept electronic payments (which can help you collect more efficiently), make sure you choose a platform that handles the trust and operating accounts appropriately.

- Workflows. The end of the year is a great time to take stock of the workflows that go along with every matter, like intake, conflict checking, and file opening. Getting these everyday processes dialed in prepares you to pivot on other issues.

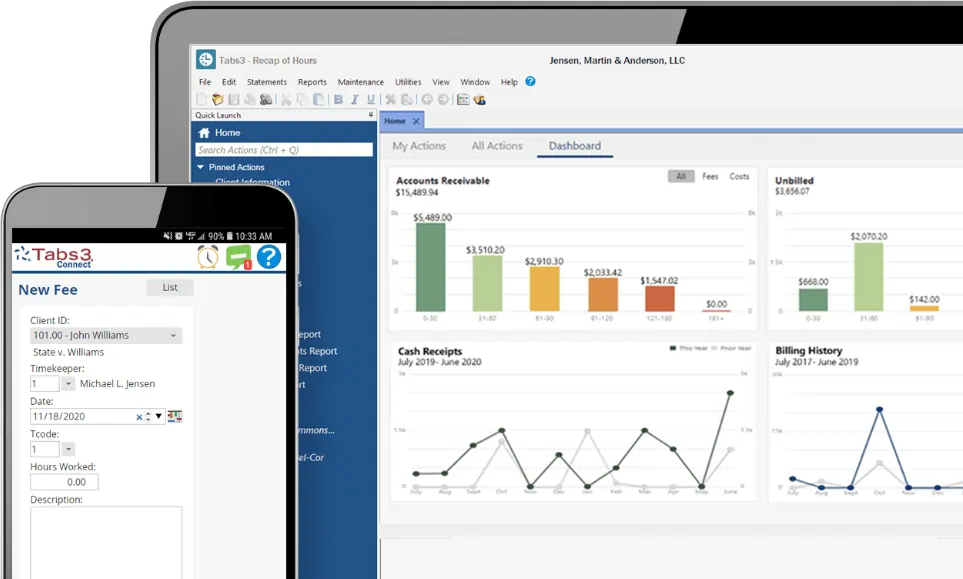

Tabs3 Cloud Tip: The curated library of reports in Tabs3 Billing can help you understand your case mix better and set fees that protect your bottom line. It also makes time entry, statement creation, collections, and trust accounting easier. Tabs3Pay allows you to accept electronic payments and also gives your clients the option to pay in installments, all while maintaining trust compliance and PCI-compliant, bank-grade security.

Ready to transform your law firm’s billing process? Schedule a personalized demo and discover how Tabs3 Cloud can transform your firm in one complete practice management solution.

2. Your business development

Your network helps keep your firm steady in shifting economic winds. Taking stock of your business development practices now can position you to build stronger relationships in 2026.

Business development is about one-on-one relationships, unlike legal marketing, which focuses on reaching a larger audience. With business development, you are not necessarily selling your services explicitly, although you may do some sales pitches. More generally, however, you are nurturing relationships so that your firm naturally comes to mind when a legal need arises.

A few business development avenues to consider for 2026:

- State bar and industry associations. Attending industry events offers double benefits: you stay up-to-date in your practice areas while meeting new people and renewing old connections. If you struggle with small talk, volunteer for a project or a leadership position that allows you to work with others in a more structured way.

- Small, consistent interactions. A regular practice of reaching out to contacts who might hire you or refer work can pay dividends in new work. To get started, set a goal of contacting one person each week.

- Volunteering and pro bono. Finding volunteer work that you enjoy can help you build a stronger, broader community, and help your business by generating future referrals. It can also make your work life feel more meaningful.

Tabs3 Cloud Tip: PracticeMaster’s powerful docket management features can help you fit business development work into your schedule. Tabs3 CRM, a PracticeMaster add-on, can track your business development contacts and information you need to remember about them, like birthdays and anniversaries.

3. Your professional development

Professional development can help you shore up foundational skills and up-skill for greater flexibility. Professional development overlaps with business development work as well; in some cases, you may be able to do both at once.

- Required CLE and legal events. By choosing events and CLE strategically, you can refresh on foundations like collection techniques, explore new practice areas, and keep up to date on technology changes. Further, when you attend in person, you create an opportunity for low-pressure networking and business development.

- Non-legal conferences and events. While these may not offer CLE credit, they can deepen your industry knowledge. That could help you diversify your matter mix, and the new connections you make can bolster business development efforts.

- Teaching and speaking. Preparing for a speech or workshop requires you to engage with your areas of expertise in new ways. You can grow your expertise while raising your profile in the industry.

Tabs3 Cloud tip: PracticeMaster’s docket management features are helpful in this area too. You can track expenses the firm reimburses in Tabs3 Financials so you are ready for tax time.

4. Your digital presence

It is a good idea to update your LinkedIn profile, your website, your bio, and other social media profiles at least annually. As you meet new people throughout the year, you want your web presence to reflect your current services and positioning.

- Awards, rankings, and publications. Start by reviewing the awards, rankings, and publications currently listed. If your list is long, you may want to select a smaller grouping closely related to your current matter mix. Then add new, relevant honors not yet listed.

- Matter examples. If your firm shares blurbs about matter resolutions on its website, prune existing examples and add new ones at least annually. You may also want to check for any updates to your state bar’s advertising rules.

- Social proof. If appropriate to your practice area and depending on your state’s ethical rules, you might add testimonials to your website and/or social media. Make sure to review public comments on Yelp or similar sites regularly.

Tabs3 Tips: Tabs3 Websites updates your website quarterly to keep content fresh.

5. Your law firm’s technology

Is your firm’s technology working for you? A solid, scalable tech stack can set you up for success when the landscape shifts. Reflecting on how things are going and scan for new tools that might benefit you.

- Marketing. Tracking performance of your marketing tactics is critical, and year-end can be a good time to look at the larger picture. Tech tools can help you implement your marketing strategy in less time and track performance more easily.

- Time entry and billing. Your technology should make it simpler for timekeepers to enter time contemporaneously and meet all time entry deadlines. If that is not happening, look for problems with your current tech in addition to workflow issues.

- Trust accounting and financials. Managing trust accounting without appropriate technology creates unnecessary ethical risks. Check in with the accounting function to identify areas for improvement.

- Practice management. Does your technology ease the workflow, or does it add more steps? Practice management software can automate repetitive tasks and centralize matter information so everyone is on the same page.

Tabs3 Cloud Tip: Tabs3 Cloud has solutions for every aspect of law practice management. Tabs3 Websites can make your marketing efforts more effective. Tabs3 Billing and Tabs3 Financials can simplify time entry, billing, trust accounting, accounts payable, and general ledger. PracticeMaster and its add-on, Tabs3 CRM, can streamline your client journey from first contact to file closure.

Prosper In Every Economic Climate with Tabs3 Cloud

With a full suite of law practice management products, Tabs3 Cloud creates a strong foundation for your law firm and makes quick pivots possible. As you take stock for 2026, consider Tabs3 Cloud as a partner in achieving your firm’s goals. Schedule a free demo today.

Ready to transform your law firm’s billing process? Schedule a personalized demo and discover how Tabs3 Cloud can transform your firm in one complete practice management solution.

When your law firm’s clients cannot pay their bills, everyone loses. Your business is in a bind. The client’s access to legal services is at risk. PayPal Pay Later offers a new solution: instant payment for your firm and manageable monthly payments for your clients. It is available now in Tabs3Pay, part of Tabs3 Billing in Tabs3 Cloud.

👉 Want to learn more about the benefits of Tabs3Pay? Schedule a demo today!

What is Pay Later?

PayPal’s Pay Later is a short-term loan between your client and PayPal: your law firm gets paid immediately, and then the client pays PayPal back over time. Pay Later offers transparent payment terms with no hidden fees. All payment issues are handled by Pay Later.

If your firm already has Tabs3 Billing in Tabs3 Cloud, you can add Pay Later to Tabs3Pay with just a few steps. If you are a new user, you can include Pay Later right from the start.

How does Pay Later benefit my clients?

Legal clients are often caught between the need for legal help and the strain of paying upfront legal fees. At the same time, law firms must collect fees to remain financially viable. Pay Later can help bridge the gap.

Overall, use of buy now, pay later products like Pay Later has expanded rapidly since 2020. Compared to traditional credit cards, these products generally use a soft credit pull (which does not affect the client’s credit score), are easier to get approved for, and may have lower fees. Especially for people with lower credit scores, particularly women and younger people, buy now, pay later offers greater access to credit than was previously available.

By allowing your clients to choose Pay Later, you can improve access to legal services without putting your business at risk. Clients can pay in manageable installments, while your firm gets paid immediately.

Ready to transform your law firm’s billing process? Schedule a personalized demo and discover how Tabs3 Cloud can transform your firm in one complete practice management solution.

How does Pay Later benefit my law firm?

Pay Later can help you serve more clients while reducing your administrative workload and financial risk. That includes:

- Stronger cash flow, because bills are paid faster

- Less time managing accounts receivable

- Better differentiation from competitors that require lump sum payments

- More success in signing up qualified leads

Is Pay Later ethical for law firms?

Pay Later does not raise any new ethical issues. Law firms have been accepting payments from buy now, pay later lenders for years. Buy now, pay later regulatory activity has focused on lenders, not the businesses that accept payments from them.

Of course, law firms have an ethical duty to conduct due diligence before adopting any electronic payment platform, like making sure the tool is PCI compliant and secure, and that it interfaces appropriately with trust and operating accounts. Law firms should also consult local rules, including those related to surcharging, when setting up a payments platform.

Tabs3Pay is a highly secure, PCI compliant electronic payments solution made exclusively for law firms. Trust account compliance is baked into every aspect of the platform. Pay Later functions the same as any other electronic payment method inside the platform. You simply get paid faster, with no manual data entry or cumbersome check processing. The Pay Later difference is on your clients’ end: each person gets to choose how they want to pay.

Promote client choice and cash flow with Pay Later

Tabs3 Billing in Tabs3 Cloud makes it easy to accept electronic payments with Tabs3Pay. It only takes a few minor changes to add Pay Later to the payment choices you offer clients. More choices means more wins, for you and your clients.

Ready to learn more? Demo Tabs3 Cloud today.

Ready to transform your law firm’s billing process? Schedule a personalized demo and discover how Tabs3 Cloud can transform your firm in one complete practice management solution.

Consumers have spoken: they prefer electronic payments by an overwhelming margin. As electronic B2B transactions rise, your business clients likely are not far behind. This month, Tabs3Pay rolls out three new electronic payment options, making it even more convenient for your clients to pay their bills.

Your clients’ needs at the forefront

Tabs3Pay allows you to provide unparalleled client service in the billing function.

Clients can choose email billing with embedded payment links or a secure payment portal, depending on your Tabs3 configuration. For ongoing clients or complex matters, you can simplify the billing burden with scheduled and/or recurring payments. You can even accept payments over the phone.

Your clients choose the payment method they prefer: credit card, debit card, or e-check/ACH. Starting in May 2025, clients can also pay via Venmo, PayPal, and PayPay Pay Later, unless you disable those options.

- PayPal is one of the largest, most popular, and most trusted online payment platforms. Users can send money via credit card, debit card, or bank account. Transactions are safe and encrypted. Paypal has 432 million account holders (2024).

- Venmo is a PayPal product, and works much like PayPal. It was originally optimized for transactions among friends and social sharing, but now supports business transactions. Venmo has 64 million monthly users (2024).

- PayPal Pay Later is a buy now, pay later (BNPL) product. Your firm receives payment immediately, and the client pays PayPal over time (up to 24 months). BNPL use is growing, and is popular among younger people and those with lower credit scores. Accepting BNPL payments can help firms serve clients who are less financially secure, increasing access to legal services, while mitigating financial risk to the firm.

A trusted platform built for attorneys and legal professionals

Professional staff, attorneys, and firm managers also reap rewards from Tabs3Pay:

- Professional staff: Electronic payment systems make it easy to accept payments, reducing repetitive, error-prone manual processes. Further, Tabs3Pay is the only payment platform that is fully integrated with your existing Tabs3 software, so you can complete all billing and accounting work in a single system.

- Partners: By reducing friction at the point of payment, firms can get paid sooner, spend less time making collections calls, and reduce write-offs. That can add up to larger bonuses and more compensation.

- Managing partners: Law firm owners have special ethical obligations, and Tabs3Pay was created to meet them. All deposits go into your trust account, while debits (like fees) are only applied to operations accounts. The secure, PCI compliant payment system also reduces the risks of lost checks and check fraud while keeping your clients’ data safe.

Tabs3Pay: Your partner in exceptional client service

You spend your days working tirelessly for your clients. Tabs3Pay can lighten the load. With simple, transparent pricing, quick setup, and expert U.S.-based tech support, Tabs3Pay helps you delight every client.

Ready to learn more? Set up a demo with our payments team today.

Providing a seamless, secure, and convenient payment experience for your clients is crucial in today’s fast-paced world. Clients increasingly expect digital solutions that are not only efficient but also user-friendly and secure.

This digital-first approach also promotes transparency, which can build trust and reduce potential misunderstandings. Automated reminders also help avoid late payments while maintaining a professional relationship with clients.

Incorporating Tabs3Pay into your legal practice could be a game-changer for your firm and clients. The ability to securely accept online payments adds a level of convenience that today’s clients appreciate. All in all, your clients will love the efficiency, flexibility, and ease of use that Tabs3Pay provides, making the entire payment experience smoother and more transparent for them.

The role of payment convenience in client satisfaction

In today’s on-demand world, convenience is a top priority. Clients are no longer satisfied with outdated payment methods that require them to physically visit your office or mail a check. They want a hassle-free way to pay their bills quickly and efficiently.

Secure online payments

With a legal credit card processing solution, your clients can pay their bills anytime, anywhere. This is particularly beneficial for clients who are unable to visit your office in person. With a few clicks, they can settle their accounts from the comfort of their home or on the go from any mobile device.

Online payments are not just about convenience; they also provide a critical layer of security. Clients can rest assured that their sensitive financial information is protected by top-tier security measures to reduce the risk of fraud or theft. Tabs3Pay offers secure online payments that are compliant with the Payment Card Industry Data Security Standard (PCI DSS), which offers an exceptional level of security and safeguards credit card information against fraud and data breaches.

Optimized for mobile devices

The ability to pay for goods and services by phone or tablet is expected by today’s consumers. Tabs3Pay is mobile-optimized, providing a seamless and user-friendly experience on all devices.

Your clients can easily view their bills, make payments, and receive instant confirmation of their transactions, all from their mobile devices. This feature is particularly beneficial for tech-savvy clients who prefer to manage their finances digitally.

With the ability to pay with Apple Pay or Google Pay using a digital wallet, your clients will appreciate the convenience of not having to enter card information each time they need to make a payment.

Building client trust through payment transparency

Trust is key for any attorney-client relationship. Clients entrust you with their sensitive information, and in return, they expect honesty, integrity, and transparency. This extends to all aspects of your services, including the payment process.

Surcharging

One of the standout features of Tabs3Pay is surcharging. This optional service allows your firm to pass on the expense of credit card processing fees to the cardholder. While this might seem like a minor detail, it plays a significant role in promoting transparency. With surcharging, clients can see exactly what they are being charged for. Everything is laid out clearly, which can enhance trust and satisfaction.

Automated payment options

Another feature that promotes transparency is scheduling automated payments with your clients. With Tabs3Pay, you can schedule payments to automatically process on a specified day of the month or on a one-time basis. Setting up a payment schedule is both convenient for your clients and your firm.

Scheduled payments also provide a clear record of payment and amounts, which can be helpful for clients who like to keep track of their finances. By keeping your clients informed and up to date, you show them that you respect their time and financial obligations, bolstering their trust in your firm.

Enhance client experience

Legal-specific software solutions are designed to streamline your practice and enhance your clients’ overall experience with your firm. Look for the tool that can do the most for your clients. Tabs3Pay isn’t just a payment processor; it’s a solution that offers a range of convenient features that can help you meet your clients needs.

Trust account support

For clients who have funds in trust with your firm, the proper handling of these funds is a matter of significant concern. Tabs3Pay is designed with trust accounting in mind, offering an easy way for clients to deposit trust funds into their account separately from the way they pay for billed work. It’s another way that Tabs3Pay promotes transparency and builds trust between your firm and your clients.

Securely emailed payment link

These days, law firms can offer clients the option to pay their bill safely and securely via a link included with their emailed statement. The Tabs3 Payment Link feature makes it easy for clients to settle their accounts, reducing the potential for confusion or misunderstandings about billing. This seamless integration saves time for your firm and ensures that your clients’ payments are processed and recorded accurately.

Seamless integration

Tabs3Pay’s strength is attributed to its seamless integration with other Tabs3 products, providing a unified, efficient experience for both law firms and clients. Consolidate your tech stack with Tabs3 Cloud, which includes:

Tabs3Pay integrated with Tabs3 Billing and Trust Accounting to provide a comprehensive solution for managing law firm finances and payments, enhancing the client experience with a smooth, easy-to-use payment solution.

Improve client satisfaction with Tabs3Pay

In the increasingly competitive legal field, providing an exceptional client experience is a necessity. By adopting Tabs3Pay, you’re not just improving your payment process but also enhancing your clients’ overall experience with your firm.

Show your clients that you understand their needs and are committed to meeting them. In doing so, you build stronger, more trusting relationships that can lead to increased client satisfaction, loyalty, and ultimately, greater success for your firm. Ready to see how Tabs3Pay can increase client satisfaction? Schedule a demo today and see the difference it can make.

As many as 18% of Americans don’t use credit cards at all. Others may not want to use credit for large invoices. But even if your client doesn’t want to use their credit card, they may still prefer the convenience of online payment compared to paying their bills by cash or sending checks in the mail.

For today’s law firms, modern payment solutions have to offer clients flexibility. Thankfully, there are solutions that can accommodate this need for flexibility while providing significant benefits to both the client and your law firm. One particularly effective option is ACH payments.

What are ACH payments?

ACH, which stands for “automated clearing house,” is a type of electronic payment in which a transfer is made directly from a bank or credit union.

ACH payments allow law firms to:

- Accept payments online

- Automate your billing system

- Provide an alternative payment system to credit cards or checks

ACH payments are becoming increasingly common in today’s payment landscape, even if we don’t always realize it. Examples of ACH payments include your employer depositing your paycheck via direct deposit, and when you set up an automatic bill payment directly from your bank account.

What are the benefits of accepting ACH payments?

From convenience to cost, incorporating ACH payments into your list of payment options can benefit both the client and the law firm. Consider these factors when weighing whether to add ACH to the list of your law firm’s payment methods.

How ACH payments benefit your law firm’s clients

For clients, ACH payments offer a convenient alternative to credit card payments.

If your clients are among the 18% of Americans who don’t use credit cards, then ACH payments provide an avenue for them to take advantage of online bill payments, which are typically faster and easier than payment by cash or check.

ACH payments are also:

- Safe and secure, with a more predictable arrival time compared to snail mail

- An easy form of contactless payment

- A reliable way to reduce paper usage for both environmental and cost purposes

- Convenient for clients who do not want to add to their credit card debt

Finally, unlike credit card payments, ACH payments do not require a surcharge. For clients who have a fixed budget or need to manage their costs, this can be an appealing benefit.

How ACH payments benefit your law firm

Similar to online payments via credit cards, ACH payments provide fast and easy payment options for your law firm, saving you both time and money.

- ACH payments save time: Facilitating online payments with an alternative to credit cards can encourage clients to pay online who might previously have relied on check or cash payments. This reduces the number of administrative tasks to complete every month, freeing up time for more important tasks.

- ACH payments save money: When clients have a payment option that fits their needs and constraints, they are more able to pay on time, in full. This leads to more on-time payments and fewer collection calls.

Are there any drawbacks to ACH payments?

ACH payments are growing in popularity thanks to their numerous benefits to law firms and clients. But what about the drawbacks?

All financial transactions carry some risk

No financial transaction is completely, 100% risk-free, but ACH payments are a low-risk payment option. There are numerous internal controls protecting ACH transactions (even most U.S. federal government payments are made via ACH).

For any business, there is always some risk of phishing by bad actors. If you have clients who are not used to the online payment process, it may be helpful to provide step-by-step documentation on how to submit their ACH, as well as how to identify red flags for phishing scams, i.e., “We will only ever email you via _____.”

It’s important for your law firm to complete due diligence on any financial transaction platform. Tabs3Pay, for example, ensures PCI compliant and secure transactions, as well as additional security features such as restricted user access to client data.

How can law firms accept ACH payments?

Adding a new payment method can feel like an intimidating process. Thankfully, there are ways to streamline the process for quick and easy adoption:

- Choose your ACH provider, preferably one that specializes in law firm payment processing to ensure compliance. If you are already using Tabs3Pay, then you’re all set. Tabs3Pay offers ACH payments as an “eCheck” payment method for clients, alongside online credit card payments and trust accounting.

- Communicate this payment option with your clients. For new clients, this can be easily integrated into the onboarding process with notice regarding their payment options. For veteran clients, this can be an opportunity to let them know about ACH payments and answer any questions about the options.

- For clients who preferred writing checks in the past, this may not change moving forward. Some clients have well-established preferences. However, others may just be nervous about trying something new. Make sure to provide clear explanations and have resources on hand if they’re curious and want to learn more about the process.

- When you send out your monthly invoice, add a note alerting clients that they can now pay by ACH for fast, easy, and secure payment processing.

The verdict on ACH payments for law firms

ACH payments are an easy alternative to credit cards for firms that want to provide added flexibility for their clients. They are a streamlined, simple, and secure payment method.

For law firms looking to provide ACH payments, the best option is to work with an integrated legal billing system that offers both online credit card payments and ACH payments in one convenient place for your clients.

Tabs3Pay enables law firms to provide a simple and easy billing process for their clients, with options for credit card payments, ACH, and trust accounting. Tabs3Pay is part of the Tabs3 suite of fully integrated billing, accounting, and practice management tools designed to help law firms increase productivity and profitability.

Start your free trial or schedule a demo and explore how Tabs3Pay’s client- and law firm-friendly payment tools can benefit your practice.

The legal profession, known for its adherence to tradition and precision, is experiencing a significant shift in how financial transactions are handled. Gone are the days when clients were content to pay by cash or check, waiting for banks to process these payments at a leisurely pace. Today, the demand for immediacy and convenience in all aspects of service, including payment, is undeniable. This transformation is driving law firms to adopt modern payment solutions, with law firm credit card processing emerging as a critical component in maintaining competitive edge and operational efficiency.

Modern clients are accustomed to the ease and security of digital transactions seen in other service sectors, and they now expect the same from legal service providers. This shift represents more than just a change in payment methods—it’s a fundamental evolution in the client-service provider relationship. The ability to pay instantly for services via credit card not only meets the growing client expectations but also streamlines the transaction process, reducing administrative burdens and enhancing the overall client experience.

The transition to digital payment solutions like credit card processing is facilitated by advancements in technology that ensure secure and efficient transactions. As law firms navigate this new landscape, selecting the right tools and partners for implementing these systems is essential. Law firm credit card processing platforms, such as Tabs3Pay, are specifically designed to meet the unique needs of the legal industry, ensuring compliance, security, and client satisfaction. This move towards integrated payment solutions is not just about keeping up with technology—it’s about taking proactive steps to future-proof law practices in a digital world.

Why credit card processing is essential for law firms

Law firm credit card processing offers many benefits that can directly impact your bottom line and client satisfaction. In an era where convenience and speed are paramount, providing a seamless payment experience is crucial. Here are a few key benefits of implementing credit card processing at your law firm.

Enhanced cash flow and reduced administrative tasks

For many law firms, managing cash flow efficiently remains a challenge. Traditional payment methods often lead to delays and increased administrative burdens. Implementing law firm credit card processing with solutions like Tabs3Pay can significantly enhance cash flow—studies show 30 to 40% improvements —and reduce the time spent on financial administration. Funds from credit card transactions typically settle quickly, meaning your firm can access earnings sooner than it would with check deposits.

Client satisfaction and growing expectations

The legal industry is no exception to the growing customer expectation for convenience in making payments, including for business transactions. Providing the ability to make payments by credit card helps meet that demand while also creating a simple payment experience that can be completed from any device.

Overall, accepting credit cards offers greater predictability and stability, opening up opportunities to proactively plan for your firm’s future based on more accurate financial projections.

Increased efficiency and reduced administrative burden

Processing payments via checks or cash can be cumbersome. It involves manual handling, trips to the bank, entry into accounting systems, and reconciliation processes—all of which consume valuable time that could otherwise be spent on billable legal work. Credit card processing automates much of this process. By integrating with legal billing and accounting software, like Tabs3Pay does, transactions are recorded and reconciled in real time. This automation significantly reduces the administrative burden and minimizes the risk of errors, allowing staff to focus on more critical tasks that directly contribute to their firm’s success.

Predictability and financial planning

Accepting credit cards provides a more predictable stream of income, a crucial factor for any law firm’s financial planning. With traditional payment methods, predicting when payments will be received can be challenging, complicating budgeting and financial planning. Credit card processing offers a more consistent and reliable timeline for receiving payments, facilitating better cash flow management and financial stability. This predictability enables law firms to plan with greater confidence, allocate resources more efficiently, and make strategic decisions based on reliable financial data.

How to choose the right credit card processing solution

Not all credit card processors are suitable for the unique needs of law firms. It’s crucial to select a service that understands and aligns with the legal industry’s standards. Here are a few key things to look for when selecting a credit card processing service.

Choose a service that is designed for law firms

General business credit card processors often do not cater to the unique needs of the legal industry, particularly around the management of Interest on Lawyers Trust Accounts (IOLTA) and compliance with the American Bar Association’s rules. Law firm credit card processing solutions must ensure that client funds are properly handled to avoid any impropriety or even the appearance of impropriety. For instance, transaction fees should not be deducted from trust accounts but from the firm’s operating account.

Data security and PCI compliance

Data security is paramount in any industry, but the legal sector faces particularly high expectations due to the sensitivity of the information they handle. Law firms must ensure that the credit card processing solution they choose is Payment Card Industry Data Security Standard (PCI DSS) compliant. This standard helps protect sensitive cardholder data from theft and misuse. Moreover, law firms should inquire about additional security measures, such as end-to-end encryption and tokenization, which can further protect client data from breaches.

Trust account management

Properly handling client funds is paramount in legal practice. Most general business credit card processors deposit funds and deduct fees from the same account, which can complicate trust account management. However, legal-specific solutions like Tabs3Pay are designed to deposit funds directly into the trust account while withdrawing fees from the operating account. This setup prevents the mismanagement of client funds, which is crucial for compliance and trust in legal practice.

Tabs3Pay: A credit card processing solution tailored for law firms

Tabs3Pay stands out in the crowded field of payment processing solutions by being specifically designed to meet the unique needs of law firms. This specialized focus translates into a host of benefits that directly address the operational, compliance, and financial challenges faced by legal professionals today. Here’s how Tabs3Pay offers a superior solution for law firm credit card processing.

Seamless integration with practice management software

One of Tabs3Pay’s most significant advantages is its seamless integration with Tabs3’s legal practice management software. This integration is critical for law firms as it allows for the synchronization of financial data across billing, accounting, and case management modules without any manual intervention. When a client makes a payment via Tabs3Pay, the transaction details are automatically updated in real time across all relevant systems. This saves time and reduces the potential for human error in data entry, ensuring accuracy in financial reporting and client billing.

Designed with legal compliance in mind

Tabs3Pay is built with a deep understanding of the legal industry’s regulatory environment. It ensures that all transactions comply with the American Bar Association’s rules and local jurisdictional requirements for handling client funds. Specifically, Tabs3Pay addresses the critical aspect of trust accounting. Unlike general business processors, Tabs3Pay automatically directs fees to be taken from the operating account while depositing client funds directly into trust accounts. This feature is vital for maintaining ethical compliance and safeguarding client monies, a cornerstone requirement in legal practice.

Enhanced client experience

Tabs3Pay enhances the client experience by offering a convenient and secure way to pay legal fees. Clients can pay from anywhere, at any time, using their preferred payment method, whether it’s credit card, debit card, or even ACH transfers. This flexibility improves client satisfaction as it aligns with the modern consumer’s expectations for quick and easy transactions. Additionally, the system supports mobile payments, which are increasingly becoming the norm in all transactions.

Learn more about Tabs3Pay

Tabs3Pay is part of Tabs3 Software, which means that if you want to sidestep double data entry by having your accounting seamlessly update with new payments, you can. With flat rate options and more, you can find an approach that works for your firm.

Learn more about the benefits of Tabs3Pay.To see firsthand how Tabs3Pay can benefit your law firm, request a free trial or schedule a walkthrough demo today.

In the competitive legal sector, maintaining and enhancing law firm profitability is crucial. A key aspect of this is ensuring swift payment from clients. Timely payments not only ensure fair compensation for attorneys and staff but also significantly contribute to the overall financial health and growth potential of a law firm.

When fees and invoices go uncollected and realization rates drop, it pumps the breaks on profitability, cash flow, and growth goals. But payment lags aren’t always the fault of the client. Inefficient workflows, poor communication, and inconvenient client processes all contribute to delays in payments. However, there are a number of simple steps law firms can take to get paid faster.

Law firms often wait weeks or even months to be paid after an invoice is sent, but there are ways you can take control over your payment timelines and improve your firm’s profitability. Here’s where you can start.

Developing and communicating payment policies

To solidify the foundation of your law firm’s profitability, it’s essential to focus on establishing and enforcing robust payment policies. This not only streamlines your billing processes but also sets clear expectations for your clients, contributing to a more predictable and efficient payment cycle. The following steps will guide you through the process of creating transparent payment terms and conditions and the importance of communicating these effectively both within your firm and to your clients. By doing so, you can improve cash flow management and take a significant step toward enhancing your law firm’s profitability.

1. Establish clear payment terms and conditions

It’s a best practice to set clear payment terms and conditions before signing on a client or completing billable hours. Clear payment policies don’t just provide you with legal protection if a client disputes charges. They also establish expectations for how the payment process should unfold and define obligations for you and your client.

These expectations are vital for building trust between you and your client. When clients understand their obligations, they can:

- Budget for legal expenses more effectively

- Understand their payment options

- Inquire about alternate arrangements for fees

- Avoid late fees

- Clear up questions before they become an issue

They can only do this if your payment policies are transparent, though. If your payment policies are long and packed full of legalese, your clients are less likely to follow them.

2. Share payment terms and conditions internally and externally

Once you’ve developed payment terms and conditions, your clients and your staff should be fully aware of them. For clients, this is something that should be addressed during the client intake process, ideally before signing any contracts or agreements. To ensure full transparency, consider including your payment policies on invoices.

Your team should also be looped into payment terms and conditions so they can answer questions confidently. In addition to training staff, it can also be helpful to add this information to any internal knowledge base you may have.

Better invoicing practices

A key element in enhancing law firm profitability lies in optimizing your invoicing practices. Efficient and clear invoicing not only facilitates quicker payments but also reinforces the professionalism and credibility of your firm. The upcoming steps will delve into how you can create user-friendly invoices that promote transparency and ease for your clients. By focusing on timely, detailed, and well-structured invoicing, you can significantly reduce payment delays and misunderstandings, thereby improving your cash flow and overall profitability.

3. Create user-friendly invoices

Invoices are the unsung hero of law firm profitability. They may seem like a simple document that tells what a client owes, but they are much more than that.

A good invoice helps your client render payment with confidence that you have completed legal work in accordance with your contract. When you omit necessary details, however, such as details of work completed or precise due dates, you can damage client trust and increase the risk of compliance violations.

This is where using legal invoicing software can be of great help, providing guardrails that ensure your invoices include critical information like:

- Name and contact information of the lawyer or law firm that is sending the bill

- Client’s name

- Description of the legal services offered

- Date the services were rendered

- Trust account balance (if relevant)

- Date of last payment (if relevant)

- Total cost of services rendered

- Terms of payment (e.g. due upon receipt, net 30, etc.)

- Date the invoice is sent out

- Any sales tax or other fees that are due

- A link to submit electronic payment

Make sure to include your logo, brand fonts, and colors on your invoice. A professionally designed invoice template enhances brand recognition and adds to your law firm’s credibility.

4. Send invoices out on time

When your invoices are sent late or inconsistently, your clients may think that the same rules apply to their payments (even if your payment policies are clear). As a result, they will be less likely to take their payment obligations to your firm seriously.

When you send invoices out in a timely and consistent manner, you give your clients the opportunity to budget for legal services, review their legal fees, and ask questions if necessary. This demonstrates that you’re committed to client service.

Offer client-friendly payment options

Even if you serve limited practice areas, your clients have a range of payment needs. One client may need support with setting up a payment plan, for example, while another client may want to schedule withdrawals. Providing client-friendly payment options can make it easier for clients to settle their invoices and for your practice to maintain a strong cash flow.

Consider the options below:

5. Provide online payment options

Paying with cash or check is becoming less and less common. Clients expect to be able to pay for services with debit and credit cards, no matter the industry. In fact, some younger clients may not even use checkbooks.

However, the legal industry has historically been slow to embrace credit cards. Law firms have been particularly cautious about the implications for trust accounting compliance and credit card usage.

Law firms can mitigate compliance risks while still meeting client expectations by working with a legal-specific payment processor that’s embedded in their practice management system, like Tabs3Pay. Not only does this streamline the billing process (saving you lots of billable hours every month), it can provide clients the choice to pay by:

- Credit card

- Debit card

- ACH bank transfer

- Scheduled payments

Electronic payment options speed payment up for several reasons. To start, they are more convenient for clients. After all, it takes less time to click on a link in an email and pay via credit card than it does to hunt down a checkbook.

Funds also reach your bank account faster. When clients pay via credit card, payment can be accessed in as little as 24 hours, depending on your payment processor.

6. Allow for different types of fee agreements

Fee-based billing is a legal industry stand-by, but it’s not the only option out there. What’s more, it may not necessarily be the best option for your practice. Depending on which practice areas you serve, you may find that clients can pay faster and easier if you implement different fee agreements, such as flat fees, retainers, or contingency fees.

If you determine that a different fee structure is the right fit for your law firm, avoid surprises with your clients. Update your payment policies and communicate changes to your clients immediately to avoid confusion, payment delays, or write-offs.

Improve your law firm’s profitability with Tabs3 Software

Tabs3’s suite of client and law firm-friendly payment tools offers a fully integrated suite of billing, accounting, and practice management tools designed to help law firms run more efficiently and profitably.

Tabs3 Software offers:

- Compliant online credit card payment processing with Tabs3Pay

- Calendars and matter organization tools

- Easy-to-use time-tracking functionalities

- Conflict of interest searches

- Client relationship management tools

- Cloud and mobile access

- And more

To see how Tabs3 can help your law firm implement better billing and accounting practices, schedule a walkthrough demo or sign up for a free trial today.

Lawyers spend their days prioritizing and juggling competing demands from clients, deadlines, and an assortment of unavoidable administrative tasks.

With so many critical to-dos on the docket every day, the last thing a lawyer needs is to have to chase down payment after their work is done.

Legal teams are all too familiar with the challenges associated with payments, yet many law firms still rely on traditional payment methods. Manually sending out invoices and then waiting for checks to come in can lead to decreased cash flow and frustration in client relationships. It also requires unnecessarily complicated workflows, adding more time to what should be a simple process of collecting payment.

However, there is a way to create ease, transparency, and rapid payments for client invoices. A legal software solution like Tabs3Pay can help you take credit for all the work you do and get your firm compensated without a hassle.

7 ways Tabs3Pay makes it easy to take credit for your work

In the legal world, time is of the essence. The faster you receive payment for your services, the better you can allocate resources and plan for the future.

With Tabs3Pay, you can easily accept credit card payments from your clients. This accelerates the payment process, eliminates manual errors, minimizes write-offs, and ensures PCI compliance.

In short, Tabs3 gives your firm an advantage at every stage of the billing process.

1. Get paid faster

Because online payments are more convenient, clients are more likely to pay on time and in full when you offer this option.

With Tabs3Pay’s mobile-friendly options, your clients can pay any invoice upon receipt through an emailed link or from the Tabs3 Client Portal, no matter where they are. Clients can easily view their bills, make payments, and receive instant confirmation of their transactions, all from their mobile devices.

For clients on retainer or with other appropriate payment structures, automated payments can take the guesswork out of the client payment process. Schedule payments to process one time or on a specific day every month.

With automated payments, clients don’t have to spend time each month paying off invoices, and you can focus on your client’s case matters instead of their outstanding bills.

Nor will your clients have to run to the post office; you can request trust account replenishments directly from the Tabs3 Matter Manager and send them their secure payment link via email.

Finally, but most crucially, funds sent through Tabs3Pay are available in as little as 24 hours. That means when you “get paid,” you actually get paid.

2. Automate payments to prevent manual error

Say goodbye to manual data entry and hello to a more efficient, error-free financial workflow.

Manual errors in payment processing can be costly and time-consuming. When errors occur, they not only disrupt your financial operations but also damage your firm’s reputation.

Tabs3Pay eliminates these manual errors thanks to a range of automated processes. From batch billing to automatically withdrawing processing fees from operating accounts, you can ensure payments are processed accurately and save your firm time that could be better spent serving clients.

3. Manage collections and reduce write-offs

No one wants to chase down clients to collect outstanding payments. It’s tiresome, strains client relationships, and can lead to avoidable write-offs.

With Tabs3Pay, you can:

- Proactively monitor the status of invoices

- Create flexible payment schedules for clients with large outstanding balances

- Send convenient reminders to clients with approaching due dates

- Accept a broad range of credit cards, including Visa®, MasterCard®, Discover®, American Express®, Diner’s Club®, and JCB credit cards, as well as Visa and MasterCard debit cards

4. Reduce processing fees

High or unpredictable processing fees have historically been a barrier to accepting credit card payments for law firms. Tabs3Pay helps mitigate this issue by offering:

- Zero initial setup fees

- Transparent and predictable pass-through fees

- Optional client surcharging

5. Secure and PCI-compliant transactions guaranteed

Security is essential when it comes to handling financial transactions, especially in the legal industry, where client confidentiality is paramount. Tabs3Pay is designed to ensure PCI compliance, meaning that all payment information is handled securely and in accordance with industry standards.

Your clients can trust that their financial data is safe, and you can rest easy knowing that you are in compliance with legal and regulatory requirements.

6. More accurate financial reporting

Running a healthy practice requires comprehensive insight into your firm’s financial data. To achieve that, you need access to robust reporting software.

Tabs3Pay is fully integrated with Tabs3 Billing, providing firms access to customizable financial reports. With Tabs3 Billing’s dashboards, you can use graphs to quickly assess Accounts Receivable, Work-in-Process, Cash Receipts, and Billing History historical data.

Use detailed reports to understand which clients are struggling and which clients consistently pay their invoices on time. This reporting can give your law firm the information it needs to make strategic decisions for profitability and growth.

7. Greater client satisfaction

Using Tabs3Pay benefits law firms, but it can also improve the overall client experience. The flexibility and convenience of credit card payments with a legal-specific payment processor make it easy for you to stay focused on your matters.

Clients appreciate the convenience of credit card payments. By providing a transparent system with built-in consistency and security, Tabs3Pay fosters client trust and a more positive relationship with your firm.

In turn, this benefits your firm’s reputation and can lead to more business in the form of referrals because happy clients are more likely to recommend your services to others.

Improve your payment processing with Tabs3Pay

In the legal industry, every advantage for your law firm can serve as a competitive edge.

Tabs3Pay improves all aspects of the payment process, both for your team and your clients. It lets you streamline non-billable tasks, improve client satisfaction, and take credit for all your work. It also works seamlessly with Tabs3 Billing and PracticeMaster, helping law firms create a customizable system for managing and growing their practices.

Ready to see how Tabs3Pay can transform your billing process and your practice? Schedule a demo or sign up for your free trial today.

As a law firm, you’re not just offering legal services; you’re providing a holistic experience that begins the moment a client walks through your door and continues well beyond the resolution of their case. One crucial aspect of this experience that’s often overlooked is the payment process. In an era in which digital transactions are the norm, clients expect and appreciate the ability to make payments quickly and conveniently. They value transparency in their transactions and trust that their sensitive information will be handled with utmost security. With a legal software solution, you can meet and exceed these expectations, strengthening your client relationships and setting your firm apart in a crowded marketplace. Whether it’s the ease of secure online payments, the flexibility of mobile optimization, or the reassurance of automated payment reminders, Tabs3Pay has a host of benefits that your clients will love.

The role of payment convenience in client satisfaction

In today’s on-demand world, convenience is king. Clients are no longer satisfied with outdated payment methods that require them to physically visit your office or mail a check. They want to settle their bills quickly and efficiently. This is where Tabs3Pay shines.

Secure online payments

With a legal credit card processing solution, your clients can pay their bills anytime, anywhere. This is particularly beneficial for clients who are unable to visit your office in person. With a few clicks, they can settle their accounts from the comfort of their homes, on the road, or anywhere in between. Online payments are not just about convenience; they also provide a critical layer of security. Clients can rest assured that their sensitive financial information is protected by gold-standard security measures to reduce the risk of fraud or theft. Tabs3Pay offers secure online payments that are compliant with the Payment Card Industry Data Security Standard (PCI DSS), which offers an exceptional level of security and safeguards credit card information against fraud and data breaches.

Mobile optimization

The ability to pay for goods and services via a smartphone or tablet is expected in today’s mobile-first culture. Tabs3Pay is mobile-optimized, providing a seamless and user-friendly experience on all devices. Your clients can easily view their bills, make payments, and receive instant confirmation of their transactions, all from their mobile devices. This feature is particularly beneficial for tech-savvy clients who prefer to manage their finances digitally. By offering a payment solution that aligns with your clients’ lifestyles and preferences, you make their lives easier and show that you understand and cater to their needs. This can significantly enhance their overall experience with your firm and foster long-term loyalty. It can also help you build trust, an essential ingredient in great legal service.

Building client trust through payment transparency

Trust is the cornerstone of any attorney-client relationship. Clients entrust you with their sensitive information, and in return, they expect honesty, integrity, and transparency. This extends to all aspects of your services, including the payment process.

Surcharging

One of the standout features of Tabs3Pay is surcharging. This service allows your firm to pass on the expense of credit card processing fees to the cardholder. While this might seem like a minor detail, it plays a significant role in promoting transparency. With surcharging, clients can see exactly what they are being charged for. There are no hidden fees or unexpected charges. Everything is laid out clearly, which can enhance trust and satisfaction. Clients appreciate knowing where their money is going, and this level of transparency can set your firm apart.

Automated payment schedules

Another feature that promotes transparency is scheduling automated payments with your clients. With Tabs3Pay, you can schedule payments to automatically process on a specified day of the month or on a one-time basis. This is not only convenient for your client, but makes it easy for your client to know when their payments will process. Scheduled payments also provide a clear record of payment and amounts, which can be helpful for clients who like to keep track of their finances. By keeping your clients informed and up-to-date, you show them that you respect their time and financial obligations, bolstering their trust in your firm.

Enhance the client experience

Legal-specific software solutions are designed to streamline your practice and enhance your clients’ overall experience with your firm. Look for the tool that can do the most for your clients. Tabs3Pay isn’t just a payment processor; it’s a solution that offers a range of convenient features that can help you meet and exceed your clients’ expectations.

Trust account support

For clients who have funds in trust with your firm, the proper handling of these funds is a matter of significant concern. Tabs3Pay is designed with trust accounting in mind, offering a feature that separates earned and unearned fees to ensure that trusts are handled correctly in accordance with legal and ethical standards. It’s another way that Tabs3Pay promotes transparency and builds trust between your firm and your clients.

Secure payment link

These days, law firms can offer clients the option to pay their bill safely and securely via a link included with their emailed statement. The Tabs3 Payment Link feature makes it easy for clients to settle their accounts, reducing the potential for confusion or misunderstandings about billing. Once a payment is made, you can import it directly into Tabs3 Billing. This seamless integration saves time for your firm and ensures that your clients’ payments are processed and recorded accurately.

Seamless integration

Tabs3Pay’s strength lies in its seamless integration with other Tabs3 products, providing a unified, efficient experience for both law firms and clients. Consolidate your tech stack with:

Tabs3Pay syncs with other Tabs3 products to provide a comprehensive solution for managing law firm finances and payments, enhancing the client experience with a smooth, easy-to-use payment process.

Improve client satisfaction with Tabs3Pay

In the increasingly competitive legal field, providing an exceptional client experience is more than just nice to have. It’s a necessity. By adopting Tabs3Pay, you’re not just improving your payment process but also enhancing your clients’ overall experience with your firm. You’re showing your clients that you understand their needs and are committed to meeting them. And in doing so, you build stronger, more trusting relationships that can lead to increased client satisfaction, loyalty, and ultimately, greater success for your firm. Ready to see how Tabs3Pay can transform your clients’ experience? Schedule a demo or sign up for a free trial today and see the difference it can make.

Law firms want to receive payments on time. Clients want transparency and convenience. The best way to meet both of those needs is to introduce a client portal.

How client portals streamline the payment process

Paying for services online is fast becoming the norm. Clients expect convenient payment options from all of their vendors, and their lawyer is no exception. The easier it is to pay your invoices, the more likely clients are to do it on time.

Online payments are convenient for clients, but they also make a significant impact on a law firm’s billing and collections process. With online payments, law firms can:

- Get paid faster

- Spend less time on past-due collections

- Minimize manual errors, write-offs, and other drains on profitability

- Ensure safe transactions with PCI compliance and other security measures

On the client side, client portals reduce guesswork by storing all client billing information in one place. With client portals, clients can benefit from:

- Convenient access to make payments online

- Viewing full billing history

- Saving credit card information for easier payments

- Clear information regarding any due balances

Client portal best practices for law firms

When implemented right, client portals ease the payment process for law firms and their clients. If you don’t use a well-planned roll-out strategy, even the best systems can fall flat.

Make sure your staff is on the same page

Even if the client portal is easy to implement, you need to ensure that your staff knows how to use the system. Take some time to roll out the product internally before you introduce it to your clients.

Once your team is on board and trained, they can serve as a resource for clients to help them feel comfortable while using the client portal.

When onboarding employees, make sure your firm:

- Creates a launch plan with clear accountability and leaders

- Provides detailed training on the software

- Demonstrates how the program benefits your team, as well as your clients

- Shows specific use cases in employee training

- Provides specific talking points and messaging tips for staff to use when they communicate with clients

Discuss the new features with long-term clients

For long-term clients, it can be a big adjustment (and potentially a negative experience) if you shift from your old payment system to a client portal without clear and frequent communication about the process and the new tool.

Create a set of client communications pieces in advance of the portal rollout, explaining the new system. Emphasize its benefits, including:

- Increased transparency

- Easier online payments

- Quick access to billing history

Once your system launches, follow up with your clients to answer any questions they may have. Consider drafting an FAQ sheet or adjusting your rollout communications as you receive more feedback.

Finally, keep in mind that not all long-term clients will want to switch to a new payment system. Be sure to communicate clearly about all of the payment options that are available.

Communicate with new clients from the very beginning

Client onboarding can feature a lot of documentation and explanations, and the idea of adding even more information may seem overwhelming. However, clear and up-front communication can only make your clients feel more comfortable with your firm.

- Set expectations: discuss your client portal and payment processes early in the onboarding process to prevent any unwanted surprises.

- Explain the benefits: emphasize how client portals can benefit your clients. Portals may seem like an extra step to payment processes, but they’re also much more secure for your client’s continued confidentiality.

- Provide FAQs: every new system will lead to some common questions. How do I change my password? Where can I see my billing history? Make sure you and your staff are prepared to work through these with your clients.

- Don’t use too much technical jargon: lawyers may be in the practice of using complex terminologies and language, but your clients are not. Remember to keep it simple. Not sure if your instructions are clear? Have outside parties review your communications and instructions to see if they can follow your documentation without getting confused or frustrated.

Streamline your payment process with Tabs3’s new client portal

Tabs3 Software’s Platinum edition offers a new client portal that integrates with Tabs3Pay to provide all the tools you need to streamline your payment process.

Learn how Tabs3’s client portal can transform your billing process and schedule a walkthrough demo today.