When your law firm’s clients cannot pay their bills, everyone loses. Your business is in a bind. The client’s access to legal services is at risk. PayPal Pay Later offers a new solution: instant payment for your firm and manageable monthly payments for your clients. It is available now in Tabs3Pay, part of Tabs3 Billing in Tabs3 Cloud.

👉 Want to learn more about the benefits of Tabs3Pay? Schedule a demo today!

What is Pay Later?

PayPal’s Pay Later is a short-term loan between your client and PayPal: your law firm gets paid immediately, and then the client pays PayPal back over time. Pay Later offers transparent payment terms with no hidden fees. All payment issues are handled by Pay Later.

If your firm already has Tabs3 Billing in Tabs3 Cloud, you can add Pay Later to Tabs3Pay with just a few steps. If you are a new user, you can include Pay Later right from the start.

How does Pay Later benefit my clients?

Legal clients are often caught between the need for legal help and the strain of paying upfront legal fees. At the same time, law firms must collect fees to remain financially viable. Pay Later can help bridge the gap.

Overall, use of buy now, pay later products like Pay Later has expanded rapidly since 2020. Compared to traditional credit cards, these products generally use a soft credit pull (which does not affect the client’s credit score), are easier to get approved for, and may have lower fees. Especially for people with lower credit scores, particularly women and younger people, buy now, pay later offers greater access to credit than was previously available.

By allowing your clients to choose Pay Later, you can improve access to legal services without putting your business at risk. Clients can pay in manageable installments, while your firm gets paid immediately.

Ready to transform your law firm’s billing process? Schedule a personalized demo and discover how Tabs3 Cloud can transform your firm in one complete practice management solution.

How does Pay Later benefit my law firm?

Pay Later can help you serve more clients while reducing your administrative workload and financial risk. That includes:

- Stronger cash flow, because bills are paid faster

- Less time managing accounts receivable

- Better differentiation from competitors that require lump sum payments

- More success in signing up qualified leads

Is Pay Later ethical for law firms?

Pay Later does not raise any new ethical issues. Law firms have been accepting payments from buy now, pay later lenders for years. Buy now, pay later regulatory activity has focused on lenders, not the businesses that accept payments from them.

Of course, law firms have an ethical duty to conduct due diligence before adopting any electronic payment platform, like making sure the tool is PCI compliant and secure, and that it interfaces appropriately with trust and operating accounts. Law firms should also consult local rules, including those related to surcharging, when setting up a payments platform.

Tabs3Pay is a highly secure, PCI compliant electronic payments solution made exclusively for law firms. Trust account compliance is baked into every aspect of the platform. Pay Later functions the same as any other electronic payment method inside the platform. You simply get paid faster, with no manual data entry or cumbersome check processing. The Pay Later difference is on your clients’ end: each person gets to choose how they want to pay.

Promote client choice and cash flow with Pay Later

Tabs3 Billing in Tabs3 Cloud makes it easy to accept electronic payments with Tabs3Pay. It only takes a few minor changes to add Pay Later to the payment choices you offer clients. More choices means more wins, for you and your clients.

Ready to learn more? Demo Tabs3 Cloud today.

Ready to transform your law firm’s billing process? Schedule a personalized demo and discover how Tabs3 Cloud can transform your firm in one complete practice management solution.

In many law firms, December is a mad dash to collect overdue bills and secure compensation. Tabs3 Billing in Tabs3 Cloud can help you finish strong this year. Moreover, it can help you make 2026 even more profitable. Read on to learn how.

👉 Want to learn more about Tabs3 Cloud? Schedule a demo today!

Start by getting 2025’s bills collected

You still have time to maximize revenue for this year, and you can collect more if you think outside the Aging AR report. Below are four tips to boost your collections outcomes.

1. Get invoices out to clients

If your firm does not bill on a regular cadence, now is the time to catch up. You may need to do a second round of invoicing in December to clear the decks before the new year.

Make sure to locate any “lost” billable work that can be added to the end of year invoices. Tabs3 Billing in Tabs3 Cloud includes reports that can help you find hidden billables:

- The Recap of Hours Report helps you find missing timeslips

- The Aged Work-In-Process Report helps you find time that could be invoiced. You can also see aging WIP in the Timekeeper Status Report.

- The Client Budget Report can be helpful for flat fee cases.

2. Follow up on receivables

Next, take action on overdue invoices. Many firms start with a written reminder, but consider making a phone call sooner rather than later if the client is not responding.

Depending on your practice area and the client relationship, it may be helpful to make a plan while on the phone with the client about how and when they will pay. Then you can follow up right away if the payment does not arrive as promised.

Tabs3 Billing in Tabs3 Cloud comes with a variety of helpful collections reports:

- The Detail Accounts Receivable Report shows outstanding receivables for each client broken out by age. The Accounts Receivable by Invoice Report gives you details about each invoice.

- The Summary Collections Report and Detail Collections Report helps you focus your collections efforts by setting criteria for inclusion like number of days past due, total balance due, and more.

- To check on receivables for individual timekeepers, you can use the Timekeeper Status Report to see receivables by age. Tabs3 Cloud and Platinum Edition users can also access the Accounts Receivable by Timekeeper Report.

Finally, make sure that any unallocated payments are correctly applied to outstanding invoices. The Unallocated Payments Report in Tabs3 Billing can help you find them.

Ready to transform your law firm’s billing process? Schedule a personalized demo and discover how Tabs3 Cloud can transform your firm in one complete practice management solution.

3. Be strategic with write-downs and write-offs

It often makes sense to write down time on an invoice to get cash in the door and stanch spending on collections activities. Of course, writing down time for a client can create an expectation of future write-downs. It is a good practice to review your firm’s write-down practices at least annually to pinpoint patterns of excessive write-downs. The Write-Up/Write-Down Report in Tabs3 Billing can help you keep an eye on discounting.

Unlike write-downs, write-offs have tax consequences. The Write-Off Report in Tabs3 Billing helps you track write-off activity.

4. Accept electronic payments

If your firm is not already accepting payments electronically, adding that capacity now could help you collect more (and faster) on your outstanding invoices. For example, instead of a reminder letter, you could send an email invoice with an electronic payment link.

If you are using Tabs3Pay in Tabs3 Billing, you can offer PayPal Pay Later, which gives clients more time to pay while putting revenue to your pocket right away. Clients can also pay by ACH, credit card, debit card, Venmo, or standard PayPal.

Plan for a more profitable 2026

Late payments hurt your cash flow and waste your time. Calling clients about unpaid bills can be stressful. And waiting until the end of the year to handle unpaid bills not only takes over your December schedule, it can reduce the likelihood of getting paid at all.

Below are three ways Tabs3 Billing in Tabs3 Cloud can help you stay on top of collections year-round so you collect more revenue with less work.

1. Send invoices monthly

Getting paid on time starts before you send the bill. Maintaining a regular billing cycle keeps your invoices top of mind for clients and spreads out the work of billing and invoicing.

Best practices include:

- Completing time entry and sending a statement for every matter monthly, even if no money is owed that month

- Writing clear fee entries to show clients the work you are doing on their behalf

- Offering clients the option to get invoices by email and pay electronically.

The right billing software makes it easy to bill every month. Tabs3 Billing in Tabs3 Cloud simplifies time entry, offers all-electronic pre-billing workflows, and supports email invoicing.

This article offers a deep dive into billing best practices.

2. Collect consistently

Monitor aging receivables monthly so you can intervene early with unpaid bills. In Tabs3 Billing, you can run the Detail Accounts Receivable Report and the Accounts Receivable by Invoice Report. You can look at individual timekeepers with the Timekeeper Status Report. If you have Tabs3 Cloud or Platinum Edition, the Accounts Receivable by Timekeeper Report is available.

With that data in hand, you can take action. That might include sending reminder messages when a bill is a week late, and making a phone call when bills are 30 days late. You might even update your engagement agreement template to add more clarity about payment policies.

Finally, remove barriers to payment. With Tabs3 Billing in Tabs3 Cloud, you can invoice by email and include a link that allows clients to pay electronically with the method of their choice via Tabs3Pay. Clients can pay faster, so you spend less time collecting bills.

3. Evaluate fee options

If your firm often struggles to collect on invoices, it may be time to reassess your fee structure.

For example, you could experiment with alternative fee arrangements, like flat fees or milestone-based fees. If you are not already using alternative fees, check your local rules for guidance on fees paid in advance to make sure your trust account is in compliance. Tabs3 Billing in Tabs3 Cloud can handle virtually any alternative fee arrangement.

Evergreen retainers are another option. Unlike a one-time retainer, an evergreen retainer is refilled once a set threshold (like dollar amount remaining) is reached. Earned fees are paid from the trust account, rather than by billing the client and waiting for payment. You can typically structure your retainer agreement to pause work or withdraw if the client does not refill the retainer as agreed. Tabs3 Billing makes managing evergreen retainers simple.

Finally, you could allow clients to choose buy now, pay later options on your electronic payment platform. You get paid immediately, and the client pays the lender off in affordable monthly installments. Tabs3Pay in Tabs3 Billing includes PayPal’s Pay Later.

Keep the revenue flowing with Tabs3 Cloud

With Tabs3 Billing, your firm is supported throughout the revenue cycle, from time entry to collections. It integrates seamlessly with Tabs3 Financials, which handles your trust accounting, accounts payable, and general ledger. You can collect more in less time (and with less stress).

Ready to learn more? Demo Tabs3 Cloud today.

Ready to transform your law firm’s billing process? Schedule a personalized demo and discover how Tabs3 Cloud can transform your firm in one complete practice management solution.

When your invoicing system is working against you, every month is spooky season. Struggling with the billing function and the impact on profitability can be downright chilling. Too many firms are caught in a web of scary billing problems, but you can break free by avoiding these seven mistakes.

1. Late time entry

Why it is scary: Time capture is one of the legal industry’s biggest challenges. Legal professionals understand its importance, but every minute spent composing a fee entry is time away from client matters.

Being pulled in both directions takes a toll. Time gets lost because it is not entered contemporaneously. When the bills absolutely must go out, everyone scrambles to enter time and approve draft invoices. Bills may go out late as a result, extending the time it takes to get paid. Workflow and cash flow suffer.

Late time entry is usually caused by:

- Difficult and/or labor-intensive time entry process.

- Workflows and processes that do not support contemporaneous time tracking.

- Law firm culture relating to the importance of time entry.

How to vanquish it: Clear policies about time entry, with strong support from leadership, are crucial. Those policies should be backed up with easy-to-use, mobile-friendly time entry software, so that timekeepers can quickly enter time without interrupting their workflows.

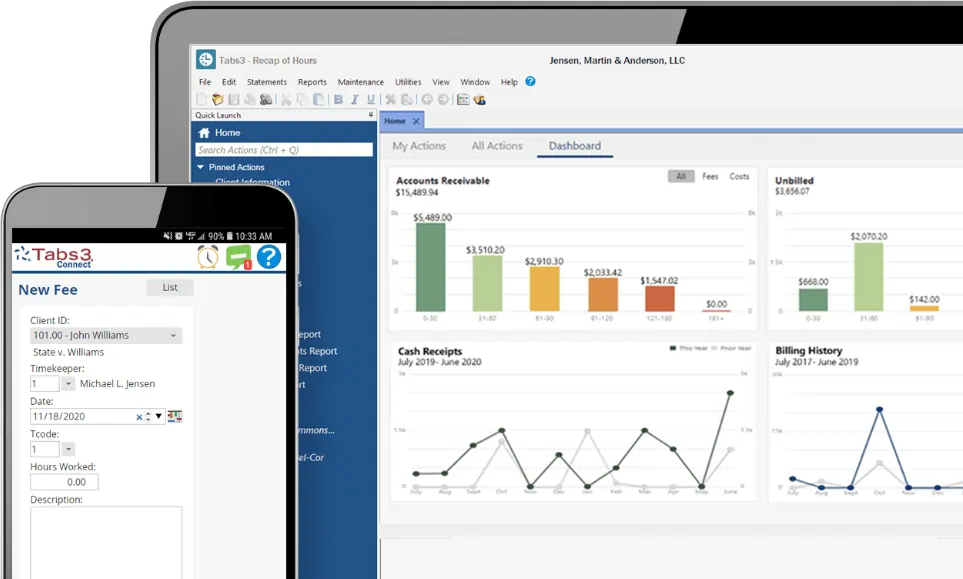

Tabs3 Cloud includes Tabs3 Billing, which allows timekeepers to securely record time in seconds from any browser: smartphone, tablet, laptop, or desktop.

2. Irregular billing cycles

Why it is scary: Ad hoc invoicing can seem like a time-saver, especially for matters with flat fees, retainers, and long timelines. But it creates more problems than it solves, like:

- More work collecting bills because clients are not accustomed to a regular billing cadence and the work you are billing for has faded in the client’s memory.

- More time managing clients because they are not getting regular reminders (in the form of invoices with descriptive fee narratives) about the work you are doing for them.

- More headaches with invoice approval because timekeepers’ memories are no longer fresh.

- Less efficiency in the billing function because of unpredictable spikes in billing and collections work.

- Irregular cash flow and potentially non-compliant trust accounting if client funds are not moved to the operating account timely.

How to vanquish it: The best practice is to invoice monthly. For alternative fee or retainer matters, your invoice is an opportunity to remind the client that you are working on their matter and that finances are settled monthly. For hourly work, monthly invoices keep clients’ financial obligations top of mind, keep cash flowing, and promote efficient billing.

Tabs3 Billing makes monthly invoicing easy. It can accommodate virtually any fee agreement and remembers your settings so invoices are automatically filled in with the correct information, including time entries. You can even complete your internal statement approval process (pre-billing) electronically.

Ready to transform your law firm’s billing process? Schedule a personalized demo and discover how Tabs3 Cloud can transform your firm in one complete practice management solution.

3. Vague or unclear fee narratives

Why it is scary: Ambiguous, fragmentary, or unclear fee entries make bills harder to collect and clients harder to manage. That is true even in flat fee cases where you do not provide a full hourly breakdown. Consider that:

- Many business clients will outright reject block billing or items with inadequate fee narratives.

- Individuals are less likely to pay promptly and remain engaged in their cases when they do not understand what is happening.

- Flat fee clients are more likely to question the reasonableness of your fee when they do not receive regular descriptions of the work you are doing on their behalf.

How to vanquish it: Firms should prohibit block billing and adopt general standards for fee narratives, as well as tracking any client- or matter-specific narrative requirements. Take advantage of any tools available in your software to reduce the time it takes to enter and revise narratives.

In Tabs3 Billing, you can set up macros to spell out common terms or phrases, so you can enter a fee with fewer keystrokes. And by handling pre-billing electronically, you can avoid mistakes caused by misinterpretation of handwritten narratives.

4. Leaving costs unbilled

Why it is scary: Too many firms absorb costs that should be billed to the client or integrated into rates. This cuts into profitability, especially in times where costs are rising. Costs include advanced costs like deposition costs, travel, medical records, and filing fees, as well as overhead expenses like making copies and legal research tool fees.

How to vanquish it: The way you approach this problem depends on your practice, your clients, and most importantly on your fee agreements. Options to consider include:

- Billing for every cost including the portion of overhead expenses. This approach requires careful recordkeeping, so it can increase timekeeper and accounting workloads. Some clients may perceive it as “nickel-and-diming.” Others expect itemized costs.

- Charging a flat monthly file maintenance fee. (Larger advanced costs would need to be billed separately.) This method might reduce recordkeeping burden, and some clients may appreciate knowing what the costs would be. Other clients may be sensitive to paying a set amount even in a month when costs are comparatively low.

- Including overhead costs in rates and billing for larger advanced costs. This works for hourly or flat rates, may reduce recordkeeping burden somewhat, and does not create a line item on the bill. It is still important, however, to track overhead costs so you can account for them when setting and reviewing rates.

Tabs3 Billing lets you decide how to handle cost recovery. You can include it in the bill, add a monthly fee, or simply track costs for internal firm use. The platform includes a suite of reports that can help you understand how costs impact profitability so you can set appropriate rates.

5. Missing or duplicated items

Why it is scary: Accidentally billing the same fee or cost twice, or billing fees/costs that look the same, can erode client trust in your firm. Failing to bill fees or costs timely may force you to “catch up” with a bill that is larger than a client expects. If clients complain, you may be under pressure to write down or write off bills that you would otherwise have been able to collect in full.

How to vanquish it: To avoid duplicated or similar charges, review your statement approval process and your firm policies about fee and cost entry narratives. Narratives should allow the client to distinguish between entries. You can catch missing or misattributed time and costs by reviewing reports regularly.

You can do both things with Tabs3 Billing. For example, you can lock down all time entries included on a draft statement to make sure no unexpected changes are made before the bill is issued. Flexible reports make it simple to generate and deliver reports, including aging WIP, at the timekeeper, practice, and firm level.

👉 Want to learn more about Tabs3 Cloud? Schedule a demo today!

6. All-paper billing process

Why it is scary: Too many firms still handle pre-billing on paper. Paper-based processes limit where and when approvers can work, and they reduce visibility into the status of approvals.

Handwritten statement revisions create additional problems. The billing function wastes time puzzling out handwriting and re-entering data, while the timekeeper worries about being misinterpreted.

How to vanquish it: Shift to paperless pre-billing. With modern software, approvers can review pre-bills on desktop, laptop, or mobile devices, directly revising errors and making notes for billing clerks. The billing clerk can quickly finalize and send the bill, speeding up your cash flow.

Tabs3 Billing users can choose between paper-based pre-billing and electronic pre-bills. The electronic process is flexible, so you can find the approach that is best for your firm.

7. Limited bill delivery options

Why it is scary: Many clients prefer to receive invoices via email. Firms that do not offer a digital option may be wasting time, paper, and postage, in addition to client goodwill.

You may also be slowing down your revenue cycle. Consider the time it takes to open a letter, read an invoice, track down the checkbook, write a check, find a stamp, and put the payment in the mail, versus opening an email with an electronic payment link.

How to vanquish it: Most firms can benefit from offering email invoices as an option, and you may discover digital should be the default for your client base. Make sure to include electronic payment options so clients can opt to pay faster.

Tabs3 Billing makes emailing invoices simple and comes with a growing suite of electronic payment options for clients who choose digital payments.

Tabs3 Cloud: Turn tricky billing into a monthly treat

Halloween levity aside, you can make your billing process easier and more effective with all the Tabs3 Billing features found in Tabs3 Cloud. It includes powerful financial management tools:

- Invoice and collect payments faster

- Accept electronic payments securely

- Manage your trust account, accounts payable, and general ledger

- Access Tabs3 from your desktop, laptop, tablet, or smartphone

Next month, we will talk about how to improve your collections so you can keep the revenue cycle spinning.

Ready to learn more? Demo Tabs3 Cloud today.

Ready to transform your law firm’s billing process? Schedule a personalized demo and discover how Tabs3 Cloud can transform your firm in one complete practice management solution.

With Q4 just around the corner, law firms are poised to dive into budgeting and planning work. Tabs3 Billing Reports empower you to make smart, data-driven decisions for a more prosperous 2026. There are benefits for stakeholders throughout the firm:

- Firm leadership can see how the current strategy is playing out.

- Accounting staff can spot areas for collections and trust compliance improvement.

- Partners can find collections problems early enough to boost compensation.

You get flexible, powerful reports right out of the box when you choose Tabs3 Billing, part of Tabs3 Cloud.

👉 Want to learn more about Tabs3 Cloud? Schedule a demo today!

Understand time and billing trends

Most firms monitor time and billing data monthly. In Q4, you can assess year-to-date data and look for broader implications.

How are individual timekeepers performing overall?

This question is especially relevant in Q4 if your firm has annual performance goals and/or determines bonuses based on timekeeper productivity. The earlier you check the reports, the more time you will have to course-correct before year-end. You can use these reports to inform strategic planning for 2026, too. For example, you can see what matters each timekeeper spends the most time on. You might also study performance by task code to identify work that could be done more efficiently.

Reports to consider:

- Allocated Payments Report

- Client Realization Report

- Detailed AR Report (Platinum users can sort by timekeeper)

- Productivity Report by Category for Each Timekeeper

- Productivity Report by Tcode for Each Timekeeper

- Timekeeper Analysis Report

- Timekeeper Status Report

- Write-Up/Write-Down Report

- Write-Off Report

How much work time do timekeepers spend on billables vs. non-billables?

To maximize billables, you need to understand where the time is going. With these reports, you can drill down on individual timekeepers, clients, and practice areas to find places to improve.

Reports to consider:

- Client Analysis Report

- Client Productivity Report

- Recap of Hours Report

- Timekeeper Productivity Report

- Transaction File List

- Task Code Billing Report

Which of our practice areas are the largest, and how profitable are they?

By looking at these numbers, the firm can make better decisions about how to allocate resources and where to seek new business. There is a report for this specific purpose (Category Productivity Report), and you may find reports that sort by client useful if each client is a meaningful proxy for a practice area. For example, if your small business clients only engage you for commercial leasing, client-based reports could be helpful.

Reports to consider:

- Category Productivity Report

- Client Productivity Report

- Client Realization Report

- Top Client Report

What unbilled work has been “lost” and could be invoiced this year?

Both individual partners and firm leadership have an interest in identifying revenue problems. Individual partner compensation may be based on revenue brought in, and the firm itself needs to keep cash flowing. Early in Q4 is a good time to search out “lost” time if you do not already have a system in place.

Reports to consider:

- Aged Work-In-Process Report

- Client Budget Report

- Client Productivity Report

- Detail Work-In-Process Report

- Summary Work-In-Process Report

- Task Code Budget Report

- Timekeeper Status Report

Ready to transform your law firm’s billing process? Schedule a personalized demo and discover how Tabs3 Cloud can transform your firm in one complete practice management solution.

See how invoices turn into revenue (or not)

Your firm can only realize time and billing improvements if invoices are paid. Now is the time to assess your accounts receivable process and plan for improved collections in 2026.

What could still be collected/allocated this year?

The Q4 collections push is proverbial. Finding and applying unallocated payments can also boost your revenue. You can use reports to look at firm progress overall, as well as studying individual timekeeper collections results so you know where to focus collections efforts.

Reports to consider:

- Accounts Receivable by Invoice

- Accounts Receivable by Timekeeper (Tabs3 Cloud and Platinum Edition only)

- Client Funds report

- Collections Report

- Detail Accounts Receivable

- Pre-Bill Tracking Report

- Recap of Hours Report

- Summary Accounts Receivable

- Timekeeper Realization Report

- Timekeeper Status Report

- Unallocated Payments Report

Where are we collecting efficiently (or not)?

Examining your 2025 collections trends can help you spot areas for improvement in 2026. For example, you might ask which timekeepers are most efficient in collections to help you determine what factors drive their success. You can also assess collections by client to aid decisions about ongoing representation and/or client management adjustments.

Reports to consider:

- Client Realization Report

- Collections Report

- Receipt Allocation Report

- Timekeeper Analysis

- Timekeeper Productivity Report

- Top Client Report

How much are we collecting in fees versus other categories?

It may be useful to understand how revenue breaks out across multiple categories. For example, excessive finance charges could indicate a problem upstream in the collections workflow. Tracking the growth of fees, as well as costs, can offer insight into overhead trends and business growth.

Reports to consider:

- Client Realization Report

- Receipt Allocation Report

Track invoice adjustment patterns

Analyzing statement adjustment practices can reveal opportunities for improvement, too. You can use reports to track write-ups, write-downs, courtesy discounts, and write-offs.

Is courtesy discounting negatively impacting the firm’s revenue?

Offering a timely discount is an important client management and collections tool. It is difficult, however, for individual decision makers to spot problematic trends in the moment. In Q4, there is ample year-to-date data available and time to change practices for next year. You may also think through how discounting should impact next year’s rates.

Reports to consider:

- Client Analysis Report

- Client Rate Report (to see current timekeeper rates)

- Receipt Allocation Report

Are attorneys writing down time (or writing up time) excessively?

Actively controlling write-downs (and write-offs) is key to long-term profitability. Excessive write-downs can not only reduce profits, but also point to performance problems and/or client management problems. A rise in write-ups could indicate problems with timekeeping. To keep bill adjustments under control, keep your eye on the big picture.

Reports to consider:

- Client Analysis Report

- Client Productivity Report

- Collections Report

- Timekeeper Productivity Report

- Write-Up/Write-Down Report

Finally, be on the lookout for “silent write-downs,” where attorneys do not enter time. Often, there is an appropriate reason (like correcting a junior’s work), but big shifts in time billed could point to timekeeping problems.

Is the firm writing off debt excessively?

Write-downs and write-offs are distinct in terms of accounting procedures and tax implications. Too many write-offs can trigger accounting and/or tax concerns, so write-offs and write-downs should be tracked and assessed separately.

Reports to consider:

- Client Analysis Report

- Client Productivity Report

- Collections Report

- Timekeeper Productivity Report

- Top Client Report

- Write Off Report

Stay in-the-know on other success indicators

Should we raise our rates and/or flat fees?

Rate increases are often announced at the beginning of the calendar year, so Q4 is the right time to assess whether your current rates are aligned with your goals. You can evaluate trends throughout the past year to inform your predictions about the 2026 market.

Reports to consider:

- Client Budget Report

- Client Productivity Report

- Client Rate Report

- Client Realization Report

- Fee Compensation Rules

- Top Client Report

Is task-based billing going smoothly?

If your firm uses task-based billing, checking relevant reports annually can help you spot any issues that might be missed in day-to-day billing management.

Reports to consider:

- Task Code Billing Report

- Task Code Budget Report

Client reports for task-based billing clients can also be a helpful source of information.

Are we in compliance with our trust accounting obligations?

The reports listed below are in addition to normal accounting reports, required recordkeeping, and regular three-way reconciliations.

Reports to consider:

- Client Funds Report

- Collections Report

The reports you need right now, right out of the box

Tabs3 Billing comes with all the reports you need to prepare for a more prosperous 2026. Our extensive knowledge base includes a helpful Report Finder and a comprehensive guide to each and every report. Demo Tabs3 Billing in Tabs3 Cloud today.

Ready to transform your law firm’s billing process? Schedule a personalized demo and discover how Tabs3 Cloud can transform your firm in one complete practice management solution.

In Billing 101: Introduction to Billing Methods (Part 1), we discussed the terminology and structure behind hourly, contingency, and flat rate billing. But now that you have the invoice total, how do you plan to bill for it?

👉 Note: While this guide is software-agnostic, Tabs3 Billing users can get how-to information about each of these methods in the Billing Methods Guide.

There are multiple ways to bill for any fee structure

The fee structures above are about what the client owes the firm. The fee agreement also lays out when the client must pay and/or receive statements.

Billing/statement cadences vary

One-time billing is the simplest billing scenario. The client owes one all-inclusive fee, plus costs, minus discounts. The bill might be sent at the outset, at the end of the matter, or at another time.

Recurring periodic billing/statements can be used for any fee structure, including:

- A strictly hourly matter where all fees and costs are billed monthly.

- A flat fee paid in more than two or more installments.

- An ongoing flat fee engagement where the flat fee renews every month.

- Monthly information-only statements for a contingency case.

Threshold billing is waiting to bill until fees or costs reach a target amount. Instead of billing every month, you only bill when there is enough work-in-progress or expenses to meet the threshold. Your firm might also send information-only statements during cycles where the threshold is not reached.

Some bills are paid from a retainer

Sometimes you will send a bill to the client and wait for payment. Often, however, you can bill against a retainer.

A retainer is a lump sum payment to a firm.

- A security retainer is an advance payment on the client’s fees. It does not belong to the firm until the firm earns it, so it is held in the trust account. The client may need to replenish the retainer as fees are earned, or pay a recurring retainer.

- Clients can also pay a general retainer to reserve capacity at the law firm. It is considered earned right away, so it does not go into the trust account. The client must pay for the actual services separately.

The details of each retainer are set out in the fee agreement. There are ethical rules that govern how law firms handle retainers, so it is important to understand the exact terms of each retainer.

In the billing function, you might interact with retainers in several ways:

- Billing monthly for services completed, but paying the bill from the retainer instead of waiting for the client to send payment. The firm transfers money from the trust account into the operating account, and sends the client an informational statement.

- Asking the client to replenish their retainer balance, either periodically or when a certain threshold is reached.

- Refunding unearned retainer money to the client.

- Billing for a general retainer.

Some bills might be split among multiple entities

In some matters, you may need to apportion a bill among several groups. This can come up in transactional cases that involve multiple business units of a single company, or when a lawyer represents multiple clients on the same matter.

The fee agreement will lay out the details of the split. Both fees and costs can be split, and the percentages vary from case to case. You might also need to display nonbillable transactions on multiple invoices, or allocate credits among multiple clients.

Task-based billing uses codes to enable financial tracking

If your firm serves insurance companies or large corporations, you may need to do additional setup when opening a file. Sometimes this function is handled by a specialized e-billing clerk. When you add fee entries for task-based billing clients, you must include certain codes that describe the work done. This allows the client to track the fees and costs at a granular level. The bill is also submitted electronically.

Once a process tied to printers and postal mail, digital tools now enable law firms to implement efficient, cost-effective paperless invoicing. Ready to make the switch? Take the first step toward a more organized and productive invoicing workflow. Download the guide today.

Discounts, write-downs, write-ups, and write-offs impact totals

Reductions or increases in the bill are the last piece of the puzzle. Firms use a variety of words for these concepts, but the concepts themselves are the same across almost every firm.

- A discount means a reduction of the entire bill, usually by a percentage. Discounts can be one-time or recurring.

- A write-down means reducing the amount of time billed for a task, or removing certain time entries completely. Partners typically do this during statement review/pre-billing. It can also happen during collections, in which case you may need to create a revised statement. You may also be asked to run reports about write-downs, because consistent underbilling can undermine cash flow and reduce partner compensation.

- A write-up means increasing the amount billed beyond what is included in the work-in-progress. This might come up in contingency cases, where the firm is entitled to a certain percentage of a settlement even though it exceeds the amount the firm would have billed on an hourly case.

A write-off means forgiving an unpaid bill (or part of it). Write-offs have tax consequences, so deciding to write off debt is a strategic decision.

Questions to answer when setting up a new case

The following questions can help you get prepared to set up a new case. Depending on your firm, you might get this information from the fee agreement, from someone in your department, from the attorney, or some combination of those. You may want to add other questions that reflect your firm’s unique file-opening process.

For all matters. Detailed questions are in the following sections.

- Will the bills go to a single entity, or will they be split?

- Does this matter require task-based billing?

- Will we apply any thresholds for billing in this matter? If so, what are they?

For matters with retainers.

- Is this a security retainer that will be applied to fees and costs as they accrue? (If not, verify that it is a general retainer and should be placed in the operational account.)

- Is the retainer a one-time payment, or will the client need to replenish it? If so, when should the client replenish it?

- Will the client pay a retainer every month (or at some other cadence)? If so, is there a threshold at which we need to collect fees in another way, like hourly billing?

- What happens to the retainer at the conclusion of the matter (i.e., balance refunded or retained as earned fee)?

For matters with split billing.

- How will fees and costs be split?

- How will credits and nonbillables be split?

- How will advance fees or retainers be split?

- For fees, do you want to split the amount due (hours x rate), or split the hours and then apply rates to calculate the amount due?

Tabs3 makes every fee structure and billing methodology easier

If your firm is not using Tabs3 Billing yet, we would love to show you how easy even complex billing can be. The platform offers virtually unlimited billing options, with smart shortcuts to save you time. You can even handle the statement approval process entirely within Tabs3 Billing with our pre-billing feature.

👉 Set up a personalized demonstration with our experienced trainers today.

Ready to transform your law firm’s billing process? Schedule a personalized demo and discover how Tabs3 Billing simplifies invoicing, boosts security, and streamlines payments – all in one seamless platform.

If revenue is the lifeblood of a law firm, the billing function is its beating heart. Whether you specialize in billing or juggle many administrative duties, the questions you ask when opening a new file set the stage for successful billing and collections.

This guide offers a deep dive into definitions and fee structures. It wraps up with a list of questions to help you navigate any billing setup, no matter how complicated. Part 2 of this series will delve into how to bill for various fee structures.

Note: While this guide is software-agnostic, Tabs3 Billing users can get how-to information about each of these methods in the Billing Methods Guide.

An overview of billing terminology

Fee structures are broad categories of legal fees, like hourly, contingency, flat rate, or hybrids.

Fees compensate the firm for its legal work, like appearing in court or preparing a document. The most common fee structure is hourly. For an hourly matter, the fees are the number of hours each timekeeper worked, multiplied by the timekeeper’s rate.

Costs compensate the firm for its expenditures, like copying files or paying court filing fees. Costs are divided into expenses and advances. Expenses represent a portion of the firm’s overhead, like copying files on the firm’s photocopier. Advances are actual payments the firm makes on behalf of a client, like filing fees paid to the court.

Discounts reduce the bill. They can apply to the entire bill, or a partner might write down (not charge for) part of the fee.

Nearly every matter has a written fee agreement, which says how the fee will be calculated, who is responsible for costs, the billing cadence, and other agreements about representation. It may also be called an engagement letter, engagement agreement, fee contract, etc.

Depending on your firm’s size and file-opening process, you may get the actual fee agreement when you are setting up a new matter or only the information related to billing.

Fee structures can be simple or complex

The most common fee structures are hourly, contingency, and flat fee. But there are also hybrids that include any two of those fee structures, or even all three.

Hourly fee structure

Most transactional and defense litigation matters are billed hourly, as are most family law and criminal defense cases. Timekeepers track the number of hours they spend on a matter, and the fee is the number of hours multiplied by the appropriate rate. Clients are usually billed monthly for the fees incurred in the prior month.

For instance, if Attorney A records 5.0 hours at $250 per hour and Paralegal B records 6.0 hours at $150 per hour, the total fees are $2,150 ($265 x 5.0 plus $150 x 6.0).

Tips and tricks for hourly fee structures

- The client is almost always responsible for costs in hourly matters.

- Most discounts are write-downs by the reviewing attorney during the statement review/pre-billing process.

- While the billing rate is set by the fee agreement, you may not have access to the actual fee agreement. Some firms assign multiple rates to a single timekeeper, or set rates based on role/seniority. You may need clarification to choose the correct rate.

- Some matters may have contingency fees or flat fees in addition to hourly fees, so it might make sense to double-check whether an hourly case is purely hourly. For many firms, however, it is rare to see anything other than straightforward hourly billing.

Contingency fee structure

Contingency fee structures are most common in plaintiff-side litigation, like personal injury or civil rights. In a pure contingency case, the firm is only paid if the client recovers money, either through settlement or winning at trial. These cases typically give the attorney a percentage of the recovery, like this:

A schoolteacher experiences sexual harassment at work and engages the firm. The teacher and the firm agree that the firm will initially pay for all costs and will not charge an hourly rate. If the teacher’s claim is successful, the firm will receive 30% of whatever she was awarded and she will reimburse the firm for costs. If she recovers nothing, the firm will not bill her for fees or costs.

After six months of work, the case settles for $100,000. The firm has incurred $5,000 in costs. When the firm receives the settlement check (and it clears), the firm deducts $5,000 for costs plus $30,000 for the contingency fee. The rest, $65,000, goes to the client.

Tips and tricks for contingency fee structures

- Nearly every state prohibits contingency fees in family law and criminal defense matters.

- Some states allow lawyers to create hybrid arrangements that include both contingency and hourly/flat rates. For instance, the client and firm might agree to a discounted hourly rate plus a bonus if there is a good outcome in the case.

- Sometimes the firm covers costs if the client does not recover money, and sometimes the client must pay for costs no matter what the outcome is. If the client is responsible for costs, the attorney might want to bill for costs monthly, once they hit a certain dollar threshold, or at the end of the case.

- If you are billing periodically for costs, the attorney may want to include fees on the statements, even though you will not be asking the client to pay them. Even if you are not billing for costs, the attorney may want to send periodic fee statements. This can reassure clients their case is being worked.

- Even if you do not bill the client for fees, you may need to prepare a fee report for settlement negotiations or when the firm is filing a fee petition. (A fee petition asks a court to make the other side pay the firm’s bill.)

Flat rate or value fee structure

Instead of billing by the hour or retaining part of a settlement, the firm can set an all-inclusive rate for the work. Typically, the client is also responsible for the costs. An example of a simple flat fee engagement:

Jane is forming a corporation. For $2,000, Attorney A agrees to prepare and mail the necessary paperwork with the Secretary of State’s office. Jane must pay $2,000 up front. She will also be billed for copies, postage, and the filing fee at the end of the case (when the costs are known).

Flat fees can also be recurring. For instance, a small business might pay a flat fee every month to have an attorney on call to help with any business problems that arise. Or a large matter might include multiple flat fee payments, with each one due at a certain stage of the project.

Tips and tricks for flat or value fee structures

- Flat fee arrangements can include hourly or contingency fee. For instance, a firm might offer a flat fee on outside general counsel services, but agree that if the client uses more than a certain number of hours per month, the excess time will be billed at an hourly rate. Or a client might agree to pay a flat rate plus a percentage of money recovered in a contingency case.

- Costs might be included in the flat fee, or you might need to bill for them. The attorney may want to bill at the end of the matter, monthly, or when a certain threshold is reached.

- It is usually a best practice to include fee entries when billing costs, even though the client is not paying hourly. This demonstrates the value the client is receiving.

Discounts, write-downs, write-ups, and write-offs impact totals

Reductions or increases in the bill are the last piece of the puzzle. Firms use a variety of words for these concepts, but the concepts themselves are the same across almost every firm.

- A discount means a reduction of the entire bill, usually by a percentage. Discounts can be one-time or recurring.

- A write-down means reducing the amount of time billed for a task, or removing certain time entries completely. Partners typically do this during statement review/pre-billing. It can also happen during collections, in which case you may need to create a revised statement. You may also be asked to run reports about write-downs, because consistent underbilling can undermine cash flow and reduce partner compensation.

- A write-up means increasing the amount billed beyond what is included in the work-in-progress. This might come up in contingency cases, where the firm is entitled to a certain percentage of a settlement even though it exceeds the amount the firm would have billed on an hourly case.

- A write-off means forgiving an unpaid bill (or part of it). Write-offs have tax consequences, so deciding to write off debt is a strategic decision.

Questions to answer when setting up a new case

The following questions can help you get prepared to set up a new case. Depending on your firm, you might get this information from the fee agreement, from someone in your department, from the attorney, or some combination of those. You may want to add other questions that reflect your firm’s unique file-opening process.

For all matters. Detailed questions are in the following sections.

- What is the fee structure for this matter (e.g., hourly, flat rate, contingency, or hybrid)?

For matters with hourly fees.

- What timekeeper rates should be used?

- Do you want to bill monthly, or at a different cadence?

- Should costs be included in every bill? If not, when (e.g., when a threshold is met, at the end of the matter)?

For matters with contingency fees.

- Will costs be billed to the client? If so, when (e.g., when a threshold is met, at the end of the matter)? Should cost invoices include fee entries?

- If we are not sending regular cost invoices, should the client get regular informational statements showing fee entries?

For matters with flat fees.

- Will costs be billed? If so, when (e.g., monthly, when a threshold is met, at the end of the matter)?

- Is there just one flat fee, or multiple flat fees? In either case, when should the flat fee(s) be billed?

- Should we include the unbilled fee entries on the flat fee and/or cost invoices?

Tabs3 makes every fee structure and billing methodology easier

If your firm is not using Tabs3 Billing yet, we would love to show you how easy even complex billing can be. The platform offers virtually unlimited billing options, with smart shortcuts to save you time. You can even handle the statement approval process entirely within Tabs3 Billing with our pre-billing feature. Set up a personalized demonstration with our experienced trainers today.

Ready to learn more? Stay tuned for Part 2 of this series on how to bill for any fee structure.

You need to get final statements out, but the draft statements are piled on the partner’s desk, and the partner is in court. Are the statements approved? Are more revisions needed? And will you spend hours puzzling out handwritten comments?

Getting the bills in the mail (or email) is hard on billing staff and partners alike, especially if you are doing it on paper. As recently as 2019, 71% of law firms were revising statements on paper. That, however, is changing.

Electronic pre-billing in Tabs3 Billing is now more streamlined

As of Version 2025, draft statement review via electronic pre-billing is easier than ever. The improved process works like this:

- You generate a “pre-bill” statement instead of a draft statement or Detail WIP Report.

- Each pre-bill is electronically assigned to the authorized reviewer(s). The review is done inside Tabs3 Billing, so there is no need to print or email documents.

- The reviewer pulls up a digital preview of the statement in Tabs3 Billing. To revise a transaction, they simply click on it and type their changes. They can also add transactions to the pre-bill or leave comments for you.

- The reviewer can put the pre-bill on hold or mark it as “reviewed.”

- You can access a real-time list of reviewed pre-bills that are ready to be sent (pending any changes the reviewers requested via comments).

- You create the final statement as usual.

4 ways pre-billing makes statement approval easier for you

1. Never wonder whose desk the draft statement is on

With electronic pre-billing, you can check the status of any statement without leaving your desk. No more trying to find draft statements on a partner’s desk or resending emails. If you are part of a billing team, supporting one another is easier, because all the information is kept in one place.

2. Block accidental revisions once review starts

Generating a draft statement or a Detail WIP Report does not create a statement record or protect the transactions included. As a result, it is possible to inadvertently make changes after the draft statements are generated, but before the final statement is created, thereby adding unauthorized entries to the bill.

When you use pre-billing, Tabs3 Billing creates a statement record and locks down the transactions included on the pre-bill. By default, only authorized reviewers (including appropriate billing staff) can change transactions or add new transactions. Any revisions must be done inside the pre-bill workflow.

The firm can also choose to allow additional users to add or modify transactions, or to make changes outside the pre-bill workflow.

Once a process tied to printers and postal mail, digital tools now enable law firms to implement efficient, cost-effective paperless invoicing. Ready to make the switch? Take the first step toward a more organized and productive invoicing workflow. Download the guide today.

3. Create an audit trail for statement changes

A digital record is created every time a user changes a transaction in a pre-bill. Any authorized user can view that record. When clients or attorneys have questions about final statements, it is simple to track how changes occurred — without digging through file cabinets or poring over handwritten comments.

4. Spend less time revising fee entries

With a paper-based process, all changes must be entered twice. The partner hand-writes changes, and then you type the same words again (after you decipher the partner’s handwriting). Allowing reviewers to type changes directly into Tabs3 Billing can save a great deal of time.

Timekeepers and managing partners get major benefits too

Changing processes can be challenging. Change is easier, however, when the value is clear. When your firm adopts pre-billing:

- Partners and other timekeepers can feel confident that their revisions will never be misinterpreted, because they enter changes directly. That can translate into less time spent fielding billing questions from clients and more time for billable work.

- Partners can quickly (and independently) check the status of each pre-bill and statements’ edit history, so any client concerns can be resolved quickly.

- Partners can instantly see the results of write-downs and other changes when reviewing pre-bills, empowering them to make more informed billing decisions.

- By analyzing how transactions are modified at the pre-bill stage, managing partners can gain insight into profitability issues, like excessive write-downs.

Let us show you how easy statement review could be

Our expert trainers can demonstrate the pre-billing process to help your team decide whether to advocate for changes in your firm’s billing process. We can also support your firm throughout the process of shifting to pre-billing. Contact us today to schedule a demo!

Ready to transform your law firm’s billing process? Schedule a personalized demo and discover how Tabs3 Billing simplifies invoicing, boosts security, and streamlines payments – all in one seamless platform.

Consumers have spoken: they prefer electronic payments by an overwhelming margin. As electronic B2B transactions rise, your business clients likely are not far behind. This month, Tabs3Pay rolls out three new electronic payment options, making it even more convenient for your clients to pay their bills.

Your clients’ needs at the forefront

Tabs3Pay allows you to provide unparalleled client service in the billing function.

Clients can choose email billing with embedded payment links or a secure payment portal, depending on your Tabs3 configuration. For ongoing clients or complex matters, you can simplify the billing burden with scheduled and/or recurring payments. You can even accept payments over the phone.

Your clients choose the payment method they prefer: credit card, debit card, or e-check/ACH. Starting in May 2025, clients can also pay via Venmo, PayPal, and PayPay Pay Later, unless you disable those options.

- PayPal is one of the largest, most popular, and most trusted online payment platforms. Users can send money via credit card, debit card, or bank account. Transactions are safe and encrypted. Paypal has 432 million account holders (2024).

- Venmo is a PayPal product, and works much like PayPal. It was originally optimized for transactions among friends and social sharing, but now supports business transactions. Venmo has 64 million monthly users (2024).

- PayPal Pay Later is a buy now, pay later (BNPL) product. Your firm receives payment immediately, and the client pays PayPal over time (up to 24 months). BNPL use is growing, and is popular among younger people and those with lower credit scores. Accepting BNPL payments can help firms serve clients who are less financially secure, increasing access to legal services, while mitigating financial risk to the firm.

A trusted platform built for attorneys and legal professionals

Professional staff, attorneys, and firm managers also reap rewards from Tabs3Pay:

- Professional staff: Electronic payment systems make it easy to accept payments, reducing repetitive, error-prone manual processes. Further, Tabs3Pay is the only payment platform that is fully integrated with your existing Tabs3 software, so you can complete all billing and accounting work in a single system.

- Partners: By reducing friction at the point of payment, firms can get paid sooner, spend less time making collections calls, and reduce write-offs. That can add up to larger bonuses and more compensation.

- Managing partners: Law firm owners have special ethical obligations, and Tabs3Pay was created to meet them. All deposits go into your trust account, while debits (like fees) are only applied to operations accounts. The secure, PCI compliant payment system also reduces the risks of lost checks and check fraud while keeping your clients’ data safe.

Tabs3Pay: Your partner in exceptional client service

You spend your days working tirelessly for your clients. Tabs3Pay can lighten the load. With simple, transparent pricing, quick setup, and expert U.S.-based tech support, Tabs3Pay helps you delight every client.

Ready to learn more? Set up a demo with our payments team today.

For law firms, time is quite literally money. With a finite number of billable hours in a day, the way you structure, track, and plan for time can make a significant difference in areas across your legal practice.

Beyond accurate time management, incorrect timekeeping has far-reaching consequences for:

- Company profits

- ABA compliance

- Staff management

- Client trust

The best way to improve all of the above? Implementing time-tracking software for attorneys.

Six benefits of accurate legal time tracking software

Time tracking is key to accurately staffing and allocating resources for every facet of firm operations. Here are six major benefits of proper time tracking, and how you can step up your system today.

1. Track and plan matter budgets

Because law firms build matter and case plans based on previous experience and knowledge, it can be difficult to scope projects correctly without accurate background information for similar tasks. If your firm chronically under-tracks time, then team members will consistently fall victim to underfunded projects and impossible timelines. Crucially, this can also negatively impact the client experience (and ultimately, client satisfaction).

Under-tracking time doesn’t just impact billable hour projects, either. For non-billable business operations, under-budgeted projects lead to wasted work, inefficient systems, and poor project rollout.

No matter how you frame it, knowing how much associate and partner time is needed for a project will have a significant impact on a matter’s overall success. Otherwise, you may not have the time and resources you need to succeed.

Using an attorney time tracking software like Tabs3 helps your team track time in as little as two clicks. Once you’ve recorded time, you’ll be able to benchmark future projects against that time, so you budget appropriately.

2. Allocate resources accurately

Similar to budget allocation, historical project data is critical to accurately allocating resources for billable and non-billable initiatives in a legal practice. An underestimated project will take up more than the projected time, costing the firm more money and potentially leading to stressful working conditions for attorneys and staff.

On the other hand, if a firm overestimates necessary resources, it can have the opposite problem. Projects can be overstaffed. If staff time isn’t allocated correctly, it can cost associates and partners much-needed billable hours. What’s more, other client work may suffer and profitability can decrease across the board.

Tabs3’s legal time tracking software not only helps you track time, our built-in journal function allows your team to keep detailed notes on each matter. This is vital for budgeting time for future tasks, as notes can inform where the most time was spent and how that can be expedited in the future.

3. Set profitable rates and fee structures

Many firms provide different fee structures to cater to client needs, including flat fees, retainers, fee splitting, and contingency.

If your firm uses flat fees or task-based billing, your profitability depends on accurately pricing your services based on how much time a matter will take to resolve. Without accurate legal time tracking software, you could be severely underselling your services. It’s as simple as that.

4. Maintain compliance with ABA regulations

Beyond your own firm’s needs, time tracking is essential to maintaining compliance with ABA Model Rules of Professional Conduct 1.5, 1.6, and 1.15.

Per the American Bar Association, improper attorney time tracking can lead to serious ethical dilemmas, disciplinary measures, and even disbarment.

It’s important to note that compliance matters for every team member, not just partners. According to Model Rule 1.5, firms can only charge reasonable fees (the definition of which varies based on several factors). If an associate charges a client unreasonable or padded fees, they are accountable for their actions, even if they were directed to do so by a supervising lawyer.

To keep this issue to a minimum, the ABA suggests that legal staff, especially new lawyers, take care to review bills to avoid allegations of padding, especially when logging time for multiple cases at the same time.

The ABA’s top tip for compliance? Use a desktop- and mobile-friendly time-tracking tool as part of a larger practice management system for accurate billing practices. With Tabs3, turning a legal timer on and off is so easy that it will become muscle memory.

5. Improve client relationships

As previously noted, padded fees and invoices are a serious breach of ABA regulations. Beyond the risk of disciplinary measures, improperly tracked attorney time can compromise client trust, and trust is the cornerstone of strong client relationships for a law firm. Clients come to law firms to deal with serious and often stressful legal matters. They need someone they can trust to resolve their matters. If your firm loses that trust via padded billing practices or unreasonable fees, it’s nearly impossible to get back.

On the other hand, consistent, transparent time tracking and fee structures promote open and honest communication which will lead to increased client satisfaction stemming from the level of transparency regarding pricing. This level of understanding fosters mutual trust, which is key to a law firm’s long-term growth.

6. Better understand your staff’s performance

Attorney time tracking is an important measure of your firm’s efficiency and productivity, and it tells you how much staff worked on specific projects, or with certain clients. In addition to the financial, ethical, and reputational risks associated with derelict legal time tracking, inaccurate time tracking can hinder your firm’s ability to support staff who may need more help and reward staff who go above and beyond.

All of these factors play into performance reviews, employee recognition, fair compensation, and keeping track of potential high or low performers at your firm.

How to improve your firm’s time-tracking system

The biggest way to improve a firm’s time-tracking system is to implement automated time tracking throughout the day, rather than tracking time at the end of the day or week.

According to the ABA, lawyers who wait until the end of the day can lose 10% of their billable time. For lawyers who wait until the end of the week, that number goes up to a 25% loss of billable time.

We get the pushback: attorneys are busy, and they don’t want to be distracted by turning timers on and off. However, modern legal time tracking software like Tabs3 is incredibly easy to use. It takes just two clicks to start or stop a time, and it can be managed from your computer or phone, meaning your ability to track billable hours isn’t tethered to your desk.

Simplify your time tracking with Tabs3 Software

Nobody wants tedious, menial tasks added on top of day-to-day work. But attorney time tracking doesn’t have to be that way anymore. Today, attorney time tracking software like Tabs3 make time tracking simple and help firms save time later by automatically translating tracked time to bills.

To see how we can help transform your time tracking and firm productivity, schedule a demo today.

Providing a seamless, secure, and convenient payment experience for your clients is crucial in today’s fast-paced world. Clients increasingly expect digital solutions that are not only efficient but also user-friendly and secure.

This digital-first approach also promotes transparency, which can build trust and reduce potential misunderstandings. Automated reminders also help avoid late payments while maintaining a professional relationship with clients.

Incorporating Tabs3Pay into your legal practice could be a game-changer for your firm and clients. The ability to securely accept online payments adds a level of convenience that today’s clients appreciate. All in all, your clients will love the efficiency, flexibility, and ease of use that Tabs3Pay provides, making the entire payment experience smoother and more transparent for them.

The role of payment convenience in client satisfaction

In today’s on-demand world, convenience is a top priority. Clients are no longer satisfied with outdated payment methods that require them to physically visit your office or mail a check. They want a hassle-free way to pay their bills quickly and efficiently.

Secure online payments

With a legal credit card processing solution, your clients can pay their bills anytime, anywhere. This is particularly beneficial for clients who are unable to visit your office in person. With a few clicks, they can settle their accounts from the comfort of their home or on the go from any mobile device.

Online payments are not just about convenience; they also provide a critical layer of security. Clients can rest assured that their sensitive financial information is protected by top-tier security measures to reduce the risk of fraud or theft. Tabs3Pay offers secure online payments that are compliant with the Payment Card Industry Data Security Standard (PCI DSS), which offers an exceptional level of security and safeguards credit card information against fraud and data breaches.

Optimized for mobile devices

The ability to pay for goods and services by phone or tablet is expected by today’s consumers. Tabs3Pay is mobile-optimized, providing a seamless and user-friendly experience on all devices.

Your clients can easily view their bills, make payments, and receive instant confirmation of their transactions, all from their mobile devices. This feature is particularly beneficial for tech-savvy clients who prefer to manage their finances digitally.

With the ability to pay with Apple Pay or Google Pay using a digital wallet, your clients will appreciate the convenience of not having to enter card information each time they need to make a payment.

Building client trust through payment transparency

Trust is key for any attorney-client relationship. Clients entrust you with their sensitive information, and in return, they expect honesty, integrity, and transparency. This extends to all aspects of your services, including the payment process.

Surcharging

One of the standout features of Tabs3Pay is surcharging. This optional service allows your firm to pass on the expense of credit card processing fees to the cardholder. While this might seem like a minor detail, it plays a significant role in promoting transparency. With surcharging, clients can see exactly what they are being charged for. Everything is laid out clearly, which can enhance trust and satisfaction.

Automated payment options

Another feature that promotes transparency is scheduling automated payments with your clients. With Tabs3Pay, you can schedule payments to automatically process on a specified day of the month or on a one-time basis. Setting up a payment schedule is both convenient for your clients and your firm.

Scheduled payments also provide a clear record of payment and amounts, which can be helpful for clients who like to keep track of their finances. By keeping your clients informed and up to date, you show them that you respect their time and financial obligations, bolstering their trust in your firm.

Enhance client experience

Legal-specific software solutions are designed to streamline your practice and enhance your clients’ overall experience with your firm. Look for the tool that can do the most for your clients. Tabs3Pay isn’t just a payment processor; it’s a solution that offers a range of convenient features that can help you meet your clients needs.

Trust account support

For clients who have funds in trust with your firm, the proper handling of these funds is a matter of significant concern. Tabs3Pay is designed with trust accounting in mind, offering an easy way for clients to deposit trust funds into their account separately from the way they pay for billed work. It’s another way that Tabs3Pay promotes transparency and builds trust between your firm and your clients.

Securely emailed payment link

These days, law firms can offer clients the option to pay their bill safely and securely via a link included with their emailed statement. The Tabs3 Payment Link feature makes it easy for clients to settle their accounts, reducing the potential for confusion or misunderstandings about billing. This seamless integration saves time for your firm and ensures that your clients’ payments are processed and recorded accurately.

Seamless integration

Tabs3Pay’s strength is attributed to its seamless integration with other Tabs3 products, providing a unified, efficient experience for both law firms and clients. Consolidate your tech stack with Tabs3 Cloud, which includes:

Tabs3Pay integrated with Tabs3 Billing and Trust Accounting to provide a comprehensive solution for managing law firm finances and payments, enhancing the client experience with a smooth, easy-to-use payment solution.

Improve client satisfaction with Tabs3Pay

In the increasingly competitive legal field, providing an exceptional client experience is a necessity. By adopting Tabs3Pay, you’re not just improving your payment process but also enhancing your clients’ overall experience with your firm.

Show your clients that you understand their needs and are committed to meeting them. In doing so, you build stronger, more trusting relationships that can lead to increased client satisfaction, loyalty, and ultimately, greater success for your firm. Ready to see how Tabs3Pay can increase client satisfaction? Schedule a demo today and see the difference it can make.